AT&T Wireless 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

33

distributions of $560 per annum, which will be distributed

quarterly in equal amounts. We distributed $560 to the

trust in 2014. So long as we make the distributions, the

terms of the preferred equity interest will not impose

any limitations on our ability to declare a dividend, or

repurchase shares. At the time of the contribution of

the preferred equity interest, we made an additional cash

contribution of $175 and have agreed to annual cash

contributions of $175 no later than the due date for our

federal income tax return for each of 2014, 2015 and 2016.

The preferred equity interest is not transferable by the trust

except through its put and call features. After a period of

five years from the contribution or, if earlier, the date upon

which the pension plan trust is fully funded as determined

under U.S. generally accepted accounting principles (GAAP),

AT&T has a right to purchase from the pension plan trust

some or all the preferred equity interest at the greater of

their fair market value or minimum liquidation value plus

any unpaid cumulative dividends. In addition, AT&T will have

the right to purchase the preferred equity interest in the

event AT&T’s ownership of Mobility is less than 50% or

there is a transaction that results in the transfer of 50%

or more of the pension plan trust’s assets to an entity not

under common control with AT&T (collectively, a change

of control). The pension plan trust has the right to require

AT&T to purchase the preferred equity interest at the

greater of their fair market value or minimum liquidation

value plus any unpaid cumulative dividends, and in

installments, as specified in the contribution agreement

upon the occurrence of any of the following: (1) at any time

if the ratio of debt to total capitalization of Mobility exceeds

that of AT&T, (2) the date on which AT&T is rated below

investment grade for two consecutive calendar quarters,

(3) upon a change of control if AT&T does not exercise its

purchase option, or (4) at any time after a seven-year

period from the contribution date. In the event AT&T elects

or is required to purchase the preferred equity interest,

AT&T may elect to settle the purchase price in cash or

shares of AT&T common stock or a combination thereof.

CONTRACTUAL OBLIGATIONS,

COMMITMENTS AND CONTINGENCIES

Current accounting standards require us to disclose our

material obligations and commitments to making future

payments under contracts, such as debt and lease

agreements, and under contingent commitments, such as

debt guarantees. We occasionally enter into third-party

debt guarantees, but they are not, nor are they reasonably

likely to become, material. We disclose our contractual

long-term debt repayment obligations in Note 9 and our

operating lease payments in Note 6. Our contractual

obligations do not include contributions associated with

our voluntary contribution of the Mobility preferred equity

Other

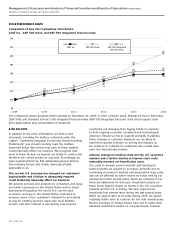

Our total capital consists of debt (long-term debt and debt

maturing within one year) and stockholders’ equity. Our

capital structure does not include debt issued by our equity

method investments. At December 31, 2014, our debt ratio

was 48.6%, compared to 45.0% at December 31, 2013, and

43.0% at December 31, 2012. The debt ratio is affected by

the same factors that affect total capital, and reflects our

recent debt issuances and stock repurchases. Total capital

increased $2,721 in 2014 compared to an increase of

$3,731 in 2013. The 2014 capital increase was primarily

due to increases in debt balances and increases in

accumulated other comprehensive income related to

prior service credits resulting from amendments to our

postretirement benefit plans, partially offset by a

decrease in net income, due to actuarial losses on our

pension and postretirement benefit plans and a charge

for our abandonment of certain network assets; and

additional stock repurchases.

A significant amount of our cash outflows are related

to tax items and benefits paid for current and former

employees. Total taxes incurred, collected and remitted

by AT&T during 2014, 2013, and 2012 were $20,870,

$21,004 and $19,703. These taxes include income,

franchise, property, sales, excise, payroll, gross receipts

and various other taxes and fees. Total health and welfare

benefits provided to certain active and retired employees

and their dependents totaled $5,113 in 2014, with $1,498

paid from plan assets. Of those benefits, $4,168 related to

medical and prescription drug benefits. During 2014, we

paid $6,543 of pension benefits out of plan assets.

During 2014, we also received approximately $10,650 from

monetization of various assets. A majority of that cash was

attributable to the sale of our investment in América Móvil

and the sale of our Connecticut wireline operations (see

Note 5) as well as our sales of certain equipment installment

receivables and real estate holdings. We plan to continue

to explore monetization opportunities in 2015.

In September 2013, we made a voluntary contribution of a

preferred equity interest in AT&T Mobility II LLC (Mobility),

the holding company for our wireless business, to the trust

used to pay pension benefits under our qualified pension

plans. In September 2013, the U.S. Department of Labor

(DOL) published a proposed exemption that authorized

retroactive approval of this voluntary contribution.

In July 2014, the DOL published in the Federal Register

their final retroactive approval of our voluntary contribution.

The preferred equity interest had a value of $9,021 as of

December 31, 2014, and $9,104 on the contribution date,

does not have any voting rights and has a liquidation value

of $8,000. The trust is entitled to receive cumulative cash