AT&T Wireless 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

18

|

AT&T INC.

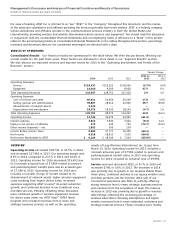

Advertising Solutions

Segment Results

Percent Change

2014 vs. 2013 vs.

2014 2013 2012 2013 2012

Total Segment Operating Revenues $ — $ — $ 1,049 — —

Segment operating expenses

Operations and support — — 773 — —

Depreciation and amortization — — 106 — —

Total Segment Operating Expenses — — 879 — —

Segment Income $ — $ — $ 170 — —

On May 8, 2012, we completed the sale of our Advertising Solutions segment (see Note 5).

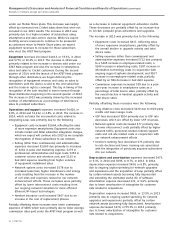

Operations and support expenses increased $833, or

2.0%, in 2014 and $431, or 1.0%, in 2013. Operations and

support expenses consist of costs incurred to provide our

products and services, including costs of operating and

maintaining our networks and personnel costs, such as

compensation and benefits.

The 2014 increase in expenses was primarily due to

increased cost of sales of $621, related to U-verse content

fees; higher nonemployee-related expense of $362 in

conjunction with information technology enhancements,

overall growth of our U-verse services and expenses related

to network enhancements; higher Universal Service Fund

(USF) fees of $157, which are offset by higher USF

revenues; and higher materials and energy costs of $102.

These increases were partially offset by lower employee-

related expense of $396, reflecting ongoing workforce

reduction initiatives.

The 2013 increase was primarily due to increased cost of

sales of $680, primarily related to U-verse related expenses;

higher advertising expenses of $155; and higher contract

services of $125. These increases were partially offset

by lower employee-related expense of $437, reflecting

workforce reduction initiatives, and USF fees of $116,

which are offset by lower USF revenues.

Depreciation and amortization expenses decreased

$584, or 5.4%, in 2014 and $216, or 1.9%, in 2013.

Depreciation decreased $441, or 4.2%, in 2014 primarily

due to extending the estimated useful life of software,

partially offset by ongoing capital spending for network

upgrades and expansion. Amortization expense decreased

$143, or 33.3%, in 2014 primarily due to fully amortized

customer lists associated with acquisitions.

The 2013 decrease was primarily related to lower

amortization of intangibles for customer lists associated

with acquisitions.

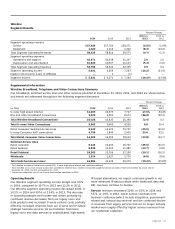

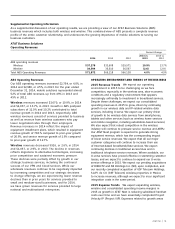

Business

Service revenues from business customers decreased $848,

or 2.5%, in 2014 and $891, or 2.5%, in 2013. Service revenue

declines reflect the fourth-quarter sale of our Connecticut

operations. In 2014 and 2013, the revenue decreases were

due to lower long-distance and voice revenues of $681 and

$721 and declines of $1,229 and $1,012 in traditional data

revenues, which include circuit-based and packet-switched

data services. The decreases were primarily due to lower

demand as customers continue to shift to our most

advanced IP-based offerings, such as Ethernet, VPN, U-verse

high speed Internet access and managed Internet services,

or to other service providers. The lower traditional service

revenues were largely offset by higher demand for our next

generation services. Strategic business service revenues,

which include VPNs, Ethernet, hosting, IP conferencing,

VoIP, Ethernet-access to Managed Internet Service (EaMIS),

security services, and U-verse services provided to business

customers increased $1,220, or 14.4%, in 2014 and $1,105,

or 15.0%, in 2013. In 2014 and in 2013, revenue from VPN

increased $359 and $361, Ethernet increased $338 and

$310, U-verse services increased $173 and $143 and EaMIS

increased $163 and $126.

Consumer

Service revenues from residential customers increased $603,

or 2.7%, in 2014 and $548, or 2.5%, in 2013. The increases

were driven by higher IP data revenue reflecting increased

U-verse penetration, customer additions, and migration

from our legacy voice and DSL services. In 2014 and 2013,

U-verse revenue from consumers increased $1,315 and

$1,289 for high-speed Internet access, $1,024 and $995

for video and $384 and $282 for voice. These increases

were partially offset by decreases of $729 and $616 in DSL

revenue as customers continue to shift to our high-speed

Internet access offerings and $1,418 and $1,379 in

traditional voice revenues.

Equipment revenues decreased $94, or 8.4%, in 2014, and

$188, or 14.4%, in 2013. Our equipment revenues are

mainly attributable to our business customers.