AT&T Wireless 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

11

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Dollars in millions except per share amounts

results of Leap Wireless International, Inc. (Leap) from

March 13, 2014. Operating income for 2013 included a

noncash actuarial gain of $7,584 related to pension and

postemployment benefit plans in 2013 and operating

income for 2012 included an actuarial loss of $9,994.

Service revenues decreased $815, or 0.7%, in 2014 and

increased $746, or 0.6%, in 2013. The decrease in 2014

was primarily due to growth in our wireless Mobile Share

Value plans, continued declines in our legacy wireline voice

and data products and the October 2014 sale of our

Connecticut operations (see Note 5), partially offset by

strong revenues from U-verse, strategic business services

and revenues from the acquisition of Leap. The revenue

increase in 2013 was primarily due to growth in wireless

data billings, reflecting the increasing percentage of

wireless subscribers choosing smartphones and higher

wireline revenues from U-verse residential customers and

strategic business services. These increases were mostly

OVERVIEW

Operating income decreased $18,733, or 61.5%, in 2014

and increased $17,482 in 2013. Our operating margin was

8.9% in 2014, compared to 23.7% in 2013 and 10.2% in

2012. Operating income for 2014 decreased $15,453 due

to a noncash actuarial loss of $7,869 related to pension

and postemployment benefit plans and an actuarial gain

of $7,584 in 2013. Operating income for 2014 also

includes a noncash charge of $2,120 related to an

abandonment of network assets, higher wireless equipment

costs resulting from higher device sales, increased

expenses supporting AT&T U-verse® (U-verse) subscriber

growth, and continued declines in our traditional voice

and data services. Partially offsetting these decreases

were continued growth in wireless equipment revenue

for device sales under our AT&T NextSM (AT&T Next)

program and increased revenues from U-verse and

strategic business services, as well as the operating

For ease of reading, AT&T Inc. is referred to as “we,” “AT&T” or the “Company” throughout this document, and the names

of the particular subsidiaries and affiliates providing the services generally have been omitted. AT&T is a holding company

whose subsidiaries and affiliates operate in the communications services industry in both the United States and

internationally, providing wireless and wireline telecommunications services and equipment. You should read this discussion

in conjunction with the consolidated financial statements and accompanying notes. A reference to a “Note” in this section

refers to the accompanying Notes to Consolidated Financial Statements. In the tables throughout this section, percentage

increases and decreases that are not considered meaningful are denoted with a dash.

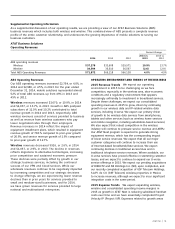

RESULTS OF OPERATIONS

Consolidated Results Our financial results are summarized in the table below. We then discuss factors affecting our

overall results for the past three years. These factors are discussed in more detail in our “Segment Results” section.

We also discuss our expected revenue and expense trends for 2015 in the “Operating Environment and Trends of the

Business” section.

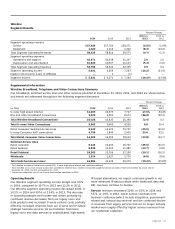

Percent Change

2014 vs. 2013 vs.

2014 2013 2012 2013 2012

Operating Revenues

Service $118,437 $119,252 $118,506 (0.7)% 0.6%

Equipment 14,010 9,500 8,928 47.5 6.4

Total Operating Revenues 132,447 128,752 127,434 2.9 1.0

Operating Expenses

Cost of services and sales 60,611 51,464 55,228 17.8 (6.8)

Selling, general and administrative 39,697 28,414 41,066 39.7 (30.8)

Abandonment of network assets 2,120 — — — —

Depreciation and amortization 18,273 18,395 18,143 (0.7) 1.4

Total Operating Expenses 120,701 98,273 114,437 22.8 (14.1)

Operating Income 11,746 30,479 12,997 (61.5) —

Interest expense 3,613 3,940 3,444 (8.3) 14.4

Equity in net income of affiliates 175 642 752 (72.7) (14.6)

Other income (expense) – net 1,652 596 134 — —

Income Before Income Taxes 9,960 27,777 10,439 (64.1) —

Net Income 6,518 18,553 7,539 (64.9) —

Net Income Attributable to AT&T $ 6,224 $ 18,249 $ 7,264 (65.9)% —