AT&T Wireless 2014 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

19

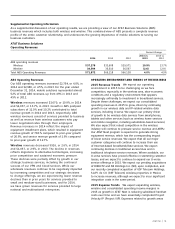

ABS Operating Revenues

Our ABS operating revenues increased $2,754, or 4.0%, in

2014 and $2,980, or 4.5%, in 2013. For the year ended

December 31, 2014, mobile solutions represented almost

52% of total ABS revenues, up from 49% in 2013 and

45% in 2012.

Wireless revenues increased $3,670, or 10.9%, in 2014

and $4,037, or 13.7%, in 2013. Growth in ABS postpaid

subscribers of 11.0% and 10.2% contributed to total

revenue growth in 2014 and 2013, respectively. ABS

wireless revenues consist of services provided to business

as well as revenue from wireless customers who pay

lower negotiated rates through their employers.

Revenue increases in 2014 reflect the impact of

equipment installment plans, which resulted in equipment

revenue growth of 78.1% compared to prior-year growth

of 20.9%, and service revenue growth of 1.9% compared

to prior-year growth of 12.7%.

Wireline revenues decreased $916, or 2.6%, in 2014

and $1,057, or 2.9%, in 2013. The decline in revenues

reflects migrations to alternative technologies, increasing

price competition and sustained economic pressure.

These declines were partially offset by growth in our

strategic business services, including the continued

success of our VPN and Cloud services. While our

wholesale revenues continue to be negatively impacted

by increasing competition and our strategic decisions

to change offerings, we are experiencing lower revenue

declines than in prior years for services provided to

small and medium-sized businesses, and for 2014,

we have grown revenues for services provided to large

national and multinational enterprises.

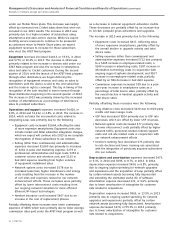

OPERATING ENVIRONMENT AND TRENDS OF THE BUSINESS

2015 Revenue Trends We expect our operating

environment in 2015 to be challenging as we face

competition, especially in the wireless area, slow economic

conditions and a regulatory environment that appears

increasingly unfriendly to investment in broadband services.

Despite these challenges, we expect our consolidated

operating revenues in 2015 to grow, driven by continuing

growth in our wireless data and IP-related wireline data

services, including U-verse. We expect our primary driver

of growth to be wireless data services from smartphones,

tablets and other services (such as wireless home services

and mobile navigation, including automobile-based services).

We also expect that robust competition in the wireless

industry will continue to pressure service revenue and ARPU.

Our AT&T Next program is expected to generate strong

equipment revenue, which has the corresponding impact

of lower service revenues. We expect that all our major

customer categories will continue to increase their use

of Internet-based broadband/data services. We expect

continuing declines in traditional access lines and in

traditional telephone service revenues. Where available, our

U-verse services have proved effective in stemming customer

losses, and we expect to continue to expand our U-verse

service offerings in 2015. We expect our pending acquisitions

of DIRECTV and NII Holdings Inc. (NII), upon completion, and

our recently completed acquisition of GSF Telecom Holdings,

S.A.P.I. de C.V. (GSF Telecom) wireless properties in Mexico

to increase revenues, although we expect to incur significant

integration costs in the same period.

2015 Expense Trends We expect expanding wireless,

wireline and consolidated operating income margins in

2015 as growth in AT&T Next is reducing subsidized handset

costs over time and we have essentially completed Project

Velocity IP (Project VIP). Expenses related to growth areas

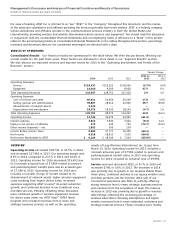

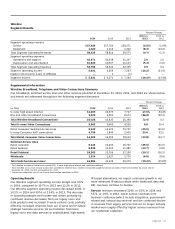

Supplemental Operating Information

As a supplemental discussion of our operating results, we are providing a view of our AT&T Business Solutions (ABS)

business revenues which includes both wireless and wireline. This combined view of ABS presents a complete revenue

profile of the entire customer relationship, and underscores the growing importance of mobile solutions to serving our

business customers.

AT&T Business Solutions

Operating Revenues

Percent Change

2014 vs. 2013 vs.

2014 2013 2012 2013 2012

ABS operating revenues

Wireless $37,278 $33,608 $29,571 10.9% 13.7%

Wireline 34,594 35,510 36,567 (2.6) (2.9)

Total ABS Operating Revenues $71,872 $69,118 $66,138 4.0% 4.5%