AT&T Wireless 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T INC.

|

65

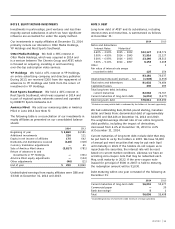

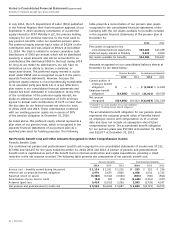

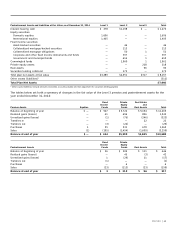

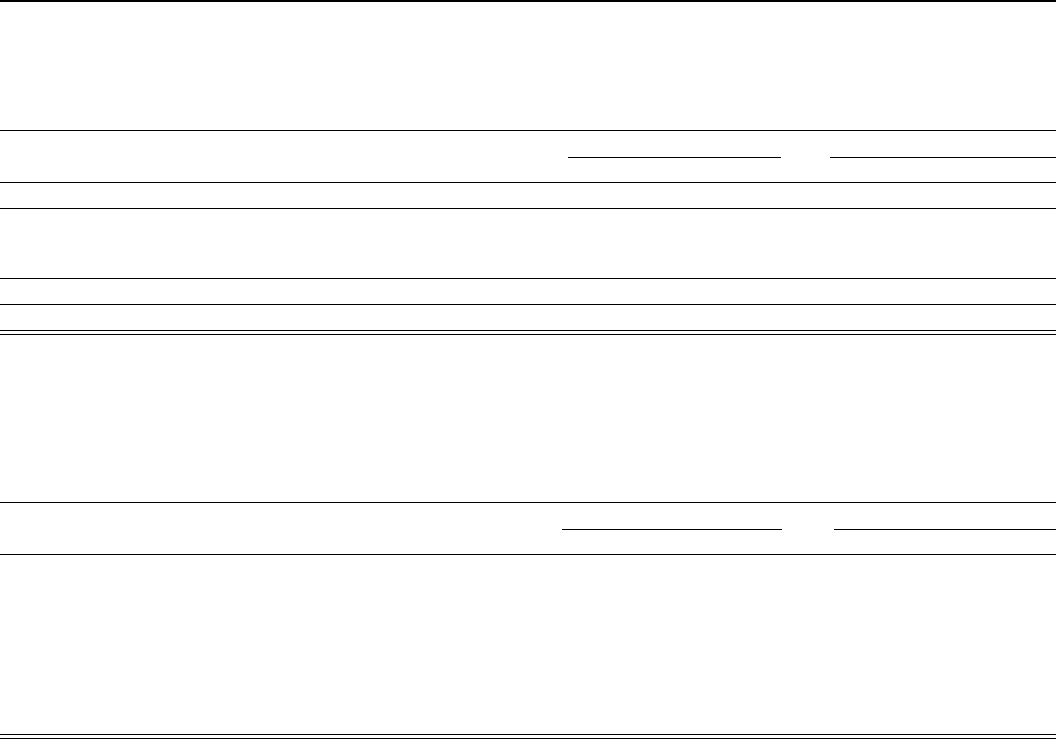

Other Changes in Benefit Obligations Recognized in Other Comprehensive Income

The following table presents the after-tax changes in benefit obligations recognized in OCI and the after-tax prior service

credits that were amortized from OCI into net periodic benefit costs:

Pension Benefits Postretirement Benefits

2014 2013 2012 2014 2013 2012

Balance at beginning of year $583 $641 $ 92 $6,812 $4,766 $3,655

Prior service (cost) credit 45 — 559 383 2,765 1,686

Amortization of prior service credit (58) (58) (10) (898) (719) (575)

Reclassification to income of prior service credit 5 — — (40) — —

Total recognized in other comprehensive (income) loss (8) (58) 549 (555) 2,046 1,111

Balance at end of year $575 $583 $641 $6,257 $6,812 $4,766

The estimated prior service credits that will be amortized from accumulated OCI into net periodic benefit cost over the next

fiscal year is $104 ($64 net of tax) for pension and $1,274 ($790 net of tax) for postretirement benefits.

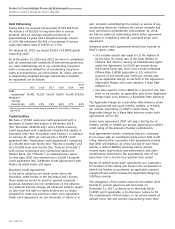

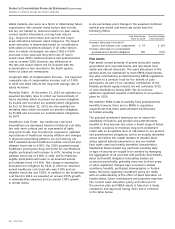

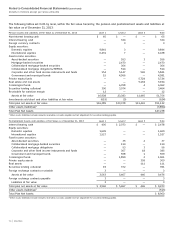

Assumptions

In determining the projected benefit obligation and the net pension and postemployment benefit cost, we used the

following significant weighted-average assumptions:

Pension Benefits Postretirement Benefits

2014 2013 2012 2014 2013 2012

Weighted-average discount rate for determining projected

benefit obligation at December 31 4.30% 5.00% 4.30% 4.20% 5.00% 4.30%

Discount rate in effect for determining net cost1 4.60% 4.30% 5.30% 5.00% 4.30% 5.30%

Long-term rate of return on plan assets 7.75% 7.75% 8.25% 7.75% 7.75% 8.25%

Composite rate of compensation increase for determining

projected benefit obligation 3.00% 3.00% 3.00% 3.00% 3.00% 3.00%

Composite rate of compensation increase for determining

net pension cost (benefit) 3.00% 3.00% 4.00% 3.00% 3.00% 4.00%

1 Weighted-average discount rate of 5.00% in effect from January 1, 2014 through September 30, 2014. Discount rate of 3.50% in effect from October 1, 2014 through

December 31, 2014.

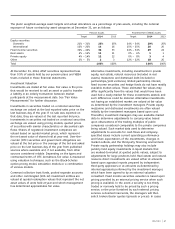

rate by 0.70%, resulting in an increase in our pension

plan benefit obligation of $4,854 and decreased our

postretirement discount rate 0.80%, resulting in an increase

in our postretirement benefit obligation of $2,786. For the

year ended December 31, 2013, we increased our pension

and postretirement discount rates by 0.70%, resulting in

a decrease in our pension plan benefit obligation of

$4,533 and a decrease in our postretirement benefit

obligation of $3,161.

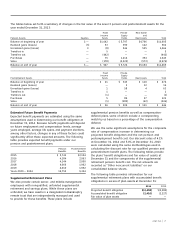

Expected Long-Term Rate of Return Our expected long-

term rate of return on pension plan assets is 7.75% for

2015 and 2014. Our expected long-term rate of return on

postretirement plan assets was adjusted to 5.75% for 2015

from 7.75% for 2014 to reflect changes in the plan asset

mix. Our long-term rates of return reflect the average

rate of earnings expected on the funds invested, or to

be invested, to provide for the benefits included in the

projected benefit obligations. In setting the long-term

assumed rate of return, management considers capital

markets future expectations and the asset mix of the plans’

investments. Actual long-term return can, in relatively

We recognize gains and losses on pension and postretirement

plan assets and obligations immediately in our operating

results. These gains and losses are measured annually as of

December 31 and accordingly will be recorded during the

fourth quarter, unless earlier remeasurements are required.

Discount Rate Our assumed weighted-average discount

rate for pension and postretirement benefits of 4.30% and

4.20% respectively, at December 31, 2014, reflects the

hypothetical rate at which the projected benefit obligation

could be effectively settled or paid out to participants.

We determined our discount rate based on a range of

factors, including a yield curve composed of the rates

of return on several hundred high-quality, fixed income

corporate bonds available at the measurement date and

corresponding to the related expected durations of future

cash outflows. These bonds were all rated at least Aa3 or

AA- by one of the nationally recognized statistical rating

organizations, denominated in U.S. dollars, and neither

callable, convertible nor index linked. For the year ended

December 31, 2014, when compared to the year ended

December 31, 2013, we decreased our pension discount