AT&T Wireless 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

52

|

AT&T INC.

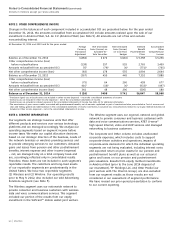

NOTE 5. ACQUISITIONS, DISPOSITIONS AND OTHER ADJUSTMENTS

Acquisitions

Spectrum Acquisitions During 2014, we acquired

$1,263 of wireless spectrum, not including Leap Wireless

International, Inc. (Leap) discussed below. During 2013,

we acquired $895 of wireless spectrum from various

companies, not including the 700 MHz, Atlantic Tele-

Network Inc. (ATNI) and NextWave purchases discussed

below. During 2012, we acquired $855 of wireless

spectrum from various companies.

In January 2015, we submitted winning bids for 251

Advanced Wireless Service (AWS) spectrum in the AWS-3

Auction (FCC Auction 97) for $18,189. We provided the

FCC an initial down payment of $921 in October 2014

and paid the remaining down payment of $2,717 on

February 13, 2015. We will pay the balance of $14,551

on or before March 2, 2015.

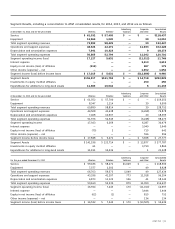

Leap In March 2014, we acquired Leap, a provider of

prepaid wireless service, for $15.00 per outstanding share

of Leap’s common stock, or $1,248 (excluding Leap’s cash

on hand), plus one nontransferable contingent value right

(CVR) per share. The CVR will entitle each Leap stockholder

to a pro rata share of the net proceeds of the future sale

of the Chicago 700 MHz A-band FCC license held by Leap.

The values of assets acquired under the terms of the

agreement were: $3,000 in licenses, $510 in property, plant

and equipment, $520 of customer lists, $340 for trade

names and $248 of goodwill. The estimated fair value of

debt associated with the acquisition of Leap was $3,889,

all of which was redeemed or matured by July 31, 2014.

700 MHz Spectrum In September 2013, we acquired

spectrum in the 700 MHz B band from Verizon Wireless

for $1,900 in cash and an assignment of AWS spectrum

licenses in five markets. The 700 MHz licenses acquired

by AT&T cover 42 million people in 18 states. We recognized

a gain of approximately $293 on this and other spectrum

transactions.

Atlantic Tele-Network In September 2013, we acquired

ATNI’s U.S. retail wireless operations, operated under the

Alltel brand, for $806 in cash, which included closing

adjustments. Under the terms of the agreement, we

acquired wireless properties, with a value of $322 in

licenses and $296 of goodwill.

NextWave In January 2013, we completed the acquisition

of NextWave Wireless Inc. (NextWave), which held wireless

licenses in the Wireless Communication Services and AWS

bands. We acquired all the equity and purchased a portion

of the debt of NextWave for $605. The transaction was

accounted for as an asset acquisition of spectrum.

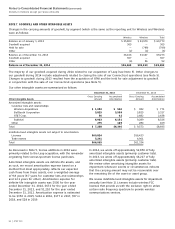

Subsequent and Pending Acquisitions

GSF Telecom On January 16, 2015, we acquired Mexican

wireless company GSF Telecom Holdings, S.A.P.I. de C.V.

(GSF Telecom) for $2,500, less net debt of approximately

$700. GSF Telecom offers service under both the Iusacell

and Unefon brand names in Mexico.

NII Holdings Inc. On January 26, 2015, we entered into

an agreement with NII Holdings Inc. (NII) to acquire its

wireless business in Mexico for $1,875, less any outstanding

net debt held by the business at closing, in a transaction

pursuant to Section 363 of the U.S. Bankruptcy Code.

We will acquire companies, which operate under the name

Nextel Mexico, and approximately 3.0 million subscribers.

DIRECTV In May 2014, we announced a merger agreement

to acquire DIRECTV in a stock-and-cash transaction

for $95.00 per share of DIRECTV’s common stock, or

approximately $48,500 at the date of announcement. As of

December 31, 2014, DIRECTV had approximately $16,177 in

net debt. Each DIRECTV shareholder will receive cash of

$28.50 per share and $66.50 per share in our stock subject

to a collar such that DIRECTV shareholders will receive 1.905

AT&T shares if our average stock price is below $34.90 per

share at closing and 1.724 AT&T shares if our average stock

price is above $38.58 at closing. If our average stock price

(calculated in accordance with the merger agreement with

DIRECTV) is between $34.90 and $38.58 at closing, then

DIRECTV shareholders will receive a number of shares

between 1.724 and 1.905, equal to $66.50 in value.

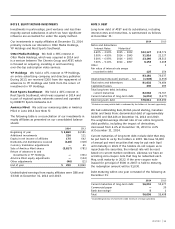

DIRECTV is a premier pay TV provider in the United States

and Latin America, with a high-quality customer base, the

best selection of programming, the best technology for

delivering and viewing high-quality video on any device

and the best customer satisfaction among major U.S.

cable and satellite TV providers.

The merger agreement was adopted by DIRECTV’s

stockholders on September 25, 2014 and remains subject

to review by the FCC and the Department of Justice and

to other closing conditions. It is also a condition that all

necessary consents by certain foreign governmental entities

have been obtained and are in full force and effect.

The transaction is expected to close in the first half of

2015. The merger agreement provides certain mutual

termination rights for us and DIRECTV, including the right

of either party to terminate the agreement if the merger

is not consummated by May 18, 2015, subject to extension

in certain cases to a date no later than November13, 2015.

Either party may also terminate the agreement if an order

permanently restraining, enjoining, or otherwise prohibiting

consummation of the merger becomes final and

nonappealable. In October 2014, DIRECTV and the National

Football League renewed their agreement for the “NFL

Sunday Ticket” service substantially on the terms discussed