AT&T Wireless 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

68

|

AT&T INC.

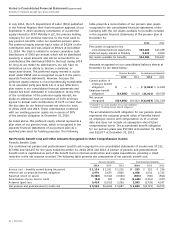

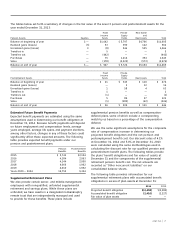

Purchases and sales of securities are recorded as of the

trade date. Realized gains and losses on sales of securities

are determined on the basis of average cost. Interest

income is recognized on the accrual basis. Dividend income

is recognized on the ex-dividend date.

Non-interest bearing cash and overdrafts are valued at

cost, which approximates fair value.

Fair Value Measurements

See Note 10 for a discussion of fair value hierarchy that

prioritizes the inputs to valuation techniques used to

measure fair value.

where such quotes are available, fair value will be

determined based solely upon such quotes provided.

Managers will typically use a pricing matrix for determining

fair value in cases where an approved pricing service

or a broker/dealer is unable to provide a fair valuation

for specific fixed-rate securities such as many private

placements. New fixed-rate securities will be initially valued

at cost at the time of purchase. Thereafter, each bond will

be assigned a spread from a pricing matrix that will be

added to current Treasury rates. The pricing matrix derives

spreads for each bond based on external market data,

including the current credit rating for the bonds, credit

spreads to Treasuries for each credit rating, sector add-ons

or credits, issue specific add-ons or credits as well as call

or other options.

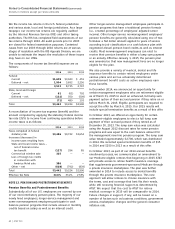

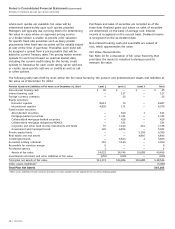

The following table sets forth by level, within the fair value hierarchy, the pension and postretirement assets and liabilities at

fair value as of December 31, 2014:

Pension Assets and Liabilities at Fair Value as of December 31, 2014 Level 1 Level 2 Level 3 Total

Non-interest bearing cash $ 45 $ — $ — $ 45

Interest bearing cash — 127 — 127

Foreign currency contracts — 25 — 25

Equity securities:

Domestic equities 8,613 74 — 8,687

International equities 4,805 171 — 4,976

Fixed income securities:

Asset-backed securities — 610 1 611

Mortgage-backed securities — 1,741 — 1,741

Collateralized mortgage-backed securities — 418 — 418

Collateralized mortgage obligations/REMICS — 531 — 531

Corporate and other fixed income instruments and funds 97 7,210 441 7,748

Government and municipal bonds 145 4,876 — 5,021

Private equity funds — — 5,399 5,399

Real estate and real assets — — 4,845 4,845

Commingled funds — 5,823 2 5,825

Securities lending collateral 310 3,140 — 3,450

Receivable for variation margin 6 — — 6

Purchased options 1 — — 1

Assets at fair value 14,022 24,746 10,688 49,456

Investments sold short and other liabilities at fair value (650) (260) — (910)

Total plan net assets at fair value $13,372 $24,486 $10,688 $ 48,546

Other assets (liabilities)1 (3,383)

Total Plan Net Assets $45,163

1 Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.