AT&T Wireless 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

54

|

AT&T INC.

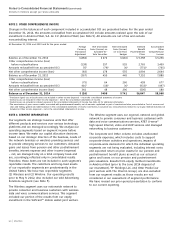

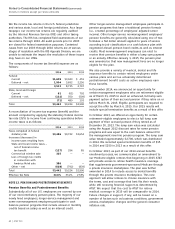

NOTE 7. GOODWILL AND OTHER INTANGIBLE ASSETS

Changes in the carrying amounts of goodwill, by segment (which is the same as the reporting unit for Wireless and Wireline)

were as follows:

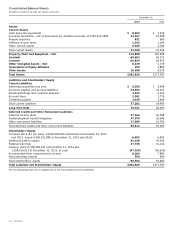

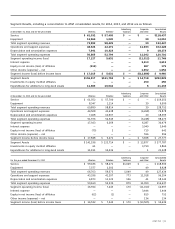

Wireless Wireline Total

Balance as of January 1, 2013 $ 35,803 $ 33,970 $ 69,773

Goodwill acquired 305 — 305

Held for sale — (799) (799)

Other (2) (4) (6)

Balance as of December 31, 2013 36,106 33,167 69,273

Goodwill acquired 367 — 367

Other (4) 56 52

Balance as of December 31, 2014 $36,469 $33,223 $69,692

The majority of our goodwill acquired during 2014 related to our acquisition of Leap (see Note 5). Other changes to

our goodwill during 2014 include adjustments related to closing the sale of our Connecticut operations (see Note 5).

Changes to goodwill during 2013 resulted from the acquisition of ATNI and the held for sale adjustment to goodwill

in conjunction with the sale of our Connecticut operations (see Note 5).

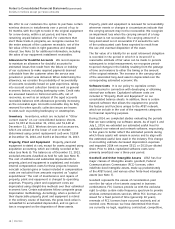

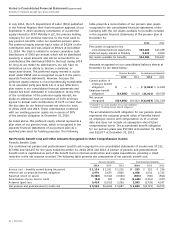

Our other intangible assets are summarized as follows:

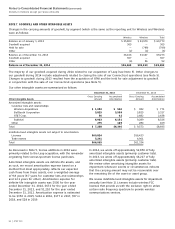

December 31, 2014 December 31, 2013

Gross Carrying Accumulated Gross Carrying Accumulated

Other Intangible Assets Amount Amortization Amount Amortization

Amortized intangible assets:

Customer lists and relationships:

Wireless Acquisitions $ 1,082 $ 550 $ 982 $ 771

BellSouth Corporation 5,825 5,559 5,825 5,317

AT&T Corp. 56 42 2,482 2,438

Subtotal 6,963 6,151 9,289 8,526

Other 275 189 284 169

Total $ 7,238 $6,340 $ 9,573 $8,695

Indefinite-lived intangible assets not subject to amortization:

Licenses $60,824 $56,433

Trade names 5,241 4,901

Total $66,065 $61,334

In 2014, we wrote off approximately $2,850 of fully

amortized intangible assets (primarily customer lists).

In 2013, we wrote off approximately $6,217 of fully

amortized intangible assets (primarily customer lists).

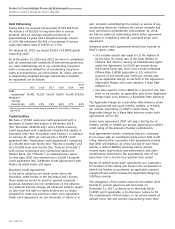

We review other amortizing intangible assets for

impairment whenever events or circumstances indicate

that the carrying amount may not be recoverable over

the remaining life of the asset or asset group.

We review indefinite-lived intangible assets for impairment

annually (see Note 1). Licenses include wireless FCC

licenses that provide us with the exclusive right to utilize

certain radio frequency spectrum to provide wireless

communications services.

As discussed in Note 5, license additions in 2014 were

primarily related to the Leap acquisition, with the remainder

originating from various spectrum license purchases.

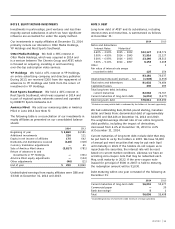

Amortized intangible assets are definite-life assets, and

as such, we record amortization expense based on a

method that most appropriately reflects our expected

cash flows from these assets, over a weighted-average

of 9.8 years (9.7 years for customer lists and relationships

and 12.1 years for other). Amortization expense for

definite-life intangible assets was $500 for the year

ended December 31, 2014, $672 for the year ended

December 31, 2013, and $1,210 for the year ended

December 31, 2012. Amortization expense is estimated

to be $350 in 2015, $244 in 2016, $177 in 2017, $57 in

2018, and $28 in 2019.