AT&T Wireless 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

70

|

AT&T INC.

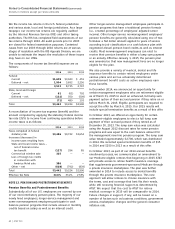

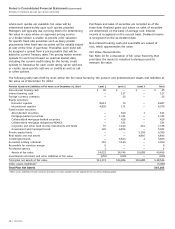

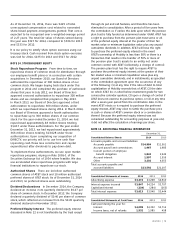

The following tables set forth by level, within the fair value hierarchy, the pension and postretirement assets and liabilities at

fair value as of December 31, 2013:

Pension Assets and Liabilities at Fair Value as of December 31, 2013 Level 1 Level 2 Level 3 Total

Non-interest bearing cash $ 65 $ — $ — $ 65

Interest bearing cash — 324 — 324

Foreign currency contracts — 3 — 3

Equity securities:

Domestic equities 9,841 3 — 9,844

International equities 6,431 7 — 6,438

Fixed income securities:

Asset-backed securities — 553 3 556

Mortgage-backed securities — 2,470 — 2,470

Collateralized mortgage-backed securities — 364 — 364

Collateralized mortgage obligations/REMICS — 514 — 514

Corporate and other fixed income instruments and funds 154 5,147 540 5,841

Government and municipal bonds 15 4,566 — 4,581

Private equity funds — — 5,724 5,724

Real estate and real assets — — 5,194 5,194

Commingled funds — 6,358 4 6,362

Securities lending collateral 390 3,074 — 3,464

Receivable for variation margin 12 — — 12

Assets at fair value 16,908 23,383 11,465 51,756

Investments sold short and other liabilities at fair value (619) (5) — (624)

Total plan net assets at fair value $16,289 $23,378 $11,465 $51,132

Other assets (liabilities)1 (3,894)

Total Plan Net Assets $47,238

1 Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.

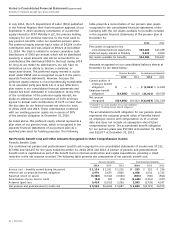

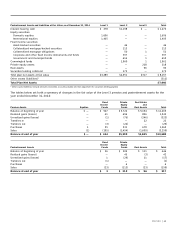

Postretirement Assets and Liabilities at Fair Value as of December 31, 2013 Level 1 Level 2 Level 3 Total

Interest bearing cash $ 405 $ 2,073 $ — $ 2,478

Equity securities:

Domestic equities 1,609 — — 1,609

International equities 1,527 — — 1,527

Fixed income securities:

Asset-backed securities — 35 2 37

Collateralized mortgage-backed securities — 110 — 110

Collateralized mortgage obligations — 53 3 56

Corporate and other fixed income instruments and funds — 367 18 385

Government and municipal bonds — 558 1 559

Commingled funds — 1,899 2 1,901

Private equity assets — — 309 309

Real assets — — 111 111

Securities lending collateral 19 372 — 391

Foreign exchange contracts receivable 3 — — 3

Assets at fair value 3,563 5,467 446 9,476

Foreign exchange contracts payable 3 — — 3

Liabilities at fair value 3 — — 3

Total plan net assets at fair value $ 3,560 $ 5,467 $ 446 $ 9,473

Other assets (liabilities)1 (513)

Total Plan Net Assets $ 8,960

1 Other assets (liabilities) include amounts receivable, accounts payable and net adjustment for securities lending payable.