AT&T Wireless 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

mobilizing your world

AT&T INC. 2014 Annual Report

Table of contents

-

Page 1

mobilizing your world AT&T INC. 2014 Annual Report -

Page 2

ifc AT&T INC. | 2014 Annual Report Imagine a world where your life id alwayd connected to people, information and experienced - wherever you are, wherever you're going. A place where life id judt plain better. Welcome to your world ... Mobilized Explore that world at att.com/annualreport2014 On ... -

Page 3

...2014 Annual Report 1 Randall Stephenson Chairman, Chief Executive Officer and President To our investors Fast, secure and mobile connectivity to everything on the Internet - everywhere, at every moment and on every device - is what drives us at AT&T. It is why we build wireless and wired networks... -

Page 4

...year in a government auction to acquire a near-nationwide block of high-quality spectrum. Why was this important? Over the last eight years, mobile data trafï¬c on our wireless network increased 100,000 percent - driven by people downloading and sharing videos. Less visible to customers today, but... -

Page 5

... United States, plus 11 Latin American countries. DIRECTV's premier TV service signiï¬cantly improves the economics and expands the geographic reach of our current TV business. The acquisition places us in the best position to provide customers with integrated packages of TV, mobile and high-speed... -

Page 6

... to build a world-class mobile business in a country with a strong economic outlook, a growing middle class and close trade, cultural and geographic ties to the United States. We'll be able to offer customers the ï¬rst-ever North American Mobile Service area - one seamless network that will cover... -

Page 7

... of the entire Internet is at best a solution in search of a problem and at worst a threat to the United States' continued global leadership in technology and innovation. EOY 2015 EXPECTED Consumer Mobility U.S. Video & Broadband International Video & Mobility Regulation that looks forward... -

Page 8

...AT&T. Sincerely, Network of the Future Hear how AT&T is leading the mobile Internet revolution and building the premier network to meet demand for mobile data Visit att.com/AR-premiernetwork for more information Randall Stephenson Chairman, Chief Executive Ofï¬cer and President February 10, 2015 -

Page 9

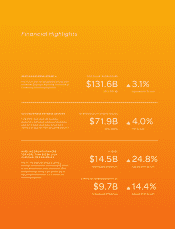

... Total 2014 revenues from business customers, including wireless and wireline, were $71.9 billion and grew 4.0 percent, with fourth-quarter revenues up 5.8 percent BUSINESS SOLUTIONS REVENUES $71.9B 2013: $69.1B 4.0% YOY Growth WIRELINE GROWTH DRIVERS TOP MORE THAN $25 BILLION IN ANNUALIZED... -

Page 10

... it did in 2013 ~45 MILLION TOTAL WORLDWIDE VIDEO SUBSCRIBERS AFTER DIRECTV CLOSES 3 1.04% BEST- EVER WIRELESS POSTPAID CHURN 1.09% 1.06% 1.04% 2014 2012 2013 BUSINESS CUSTOMERS REPRESENTED 54.3% OF OUR TOTAL 2014 REVENUES ( WIRELESS & WIRELINE ) 2012 2013 2014 POSTPAID NET ADDS UP NEARLY 1,438k... -

Page 11

... Financial Statements Notes to Consolidated Financial Statements Report of Management Report of Independent Registered Public Accounting Firm Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting Board of Directors Executive Officers 10 11 42 47 76 77... -

Page 12

... $ 20,302 $ 1.69 $ 18.94 4.57 37.1% 5,913 5,938 5,911 95,536 39,211 16,309 266,590 The number presented represents 100% of AT&T Mobility wireless subscribers. Broadband connections include in-region U-verse high speed Internet access, in-region DSL lines and satellite broadband. 10 | AT&T INC. -

Page 13

...benefit plans and an actuarial gain of $7,584 in 2013. Operating income for 2014 also includes a noncash charge of $2,120 related to an abandonment of network assets, higher wireless equipment costs resulting from higher device sales, increased expenses supporting AT&T U-verse® (U-verse) subscriber... -

Page 14

... 2013. Wireless handset sales and upgrades contributed to higher equipment costs and handset insurance costs in 2014. The increase also reflects higher wireless network costs and wireline costs attributable to U-verse content costs and subscriber growth and employee-related charges. The 2013 expense... -

Page 15

... 2014 total segment income as compared to 26% in 2013. This segment uses our regional, national and global network to provide consumer and business customers with data and voice communications services, U-verse high speed Internet, video and VoIP services and managed networking to business customers... -

Page 16

...2013 2012 2014 vs. 2013 2013 vs. 2012 Wireless Subscribers1 Postpaid smartphones Postpaid feature phones and data-centric devices Postpaid Prepaid Reseller Connected devices2 Total Wireless Subscribers Net Additions3 Postpaid Prepaid Reseller Connected devices2 Net Subscriber Additions Mobile Share... -

Page 17

... choose Mobile Share Value pricing, which offers lower prices for having multiple devices (including tablets) sharing services on one billing account, has highlighted the shortcomings of using the traditional metric of ARPU (average revenue per average wireless subscribers) to measure the economic... -

Page 18

...number of subscribers using smartphones and data-centric devices. While we expect monthly service revenues to continue to be pressured as customers move to Mobile Share plans, we expect equipment revenues to increase for those subscribers who elect the AT&T Next program. Equipment revenues increased... -

Page 19

... Change (in 000s) 20143 2013 2012 2014 vs. 2013 2013 vs. 2012 U-verse high speed Internet DSL and Other Broadband Connections Total Wireline Broadband Connections1 Total U-verse Video Connections Retail Consumer Switched Access Lines U-verse Consumer VoIP connections Total Retail Consumer Voice... -

Page 20

... legacy voice and DSL services. In 2014 and 2013, U-verse revenue from consumers increased $1,315 and $1,289 for high-speed Internet access, $1,024 and $995 for video and $384 and $282 for voice. These increases were partially offset by decreases of $729 and $616 in DSL revenue as customers continue... -

Page 21

...to total revenue growth in 2014 and 2013, respectively. ABS wireless revenues consist of services provided to business as well as revenue from wireless customers who pay lower negotiated rates through their employers. Revenue increases in 2014 reflect the impact of equipment installment plans, which... -

Page 22

... Mobility II LLC to the trust used to pay pension benefits. The trust is entitled to receive cumulative annual cash distributions of $560, which will result in a $560 contribution during 2015. In addition, we will contribute $175 no later than the due date for our federal income tax return for 2014... -

Page 23

... provide 4G coverage using another technology (HSPA+), and when combined with our upgraded backhaul network, we are able to enhance our network capabilities and provide superior mobile broadband speeds for data and video services. Our wireless network also relies on other GSM digital transmission... -

Page 24

... our customers to use wireless services without roaming on other companies' networks. We believe this seamless access will prove attractive to customers and provide a significant growth opportunity. U-verse Services During 2014, we continued to expand our offerings of U-verse high speed Internet and... -

Page 25

.... In its decision, the court found the FCC had authority under section 706 of the Act (which directs the FCC and state commissions to promote broadband deployment) to adopt rules designed to preserve the open Internet, but vacated and remanded the antidiscrimination and no-blocking rules on the... -

Page 26

... and use our or competitors' wireless and Internet-based services. In most markets, we compete for customers, often on pricing of bundled services, with large cable companies, such as Comcast Corporation, Cox Communications Inc. and Time Warner Cable Inc., for high-speed Internet, video and voice... -

Page 27

...decrease in the expected long-term rate of return would cause 2015 combined pension and postretirement cost to increase $250, which under our accounting policy would be recognized in the current year as part of our fourth-quarter remeasurement of our retiree benefit plans. In 2014, the actual return... -

Page 28

... traded companies whose services are comparable to those offered by the segment and then calculated a weighted-average of those multiples. Using those weighted averages, we then calculated fair values for each of those segments. In 2014, the calculated fair value of the reporting unit exceeded book... -

Page 29

... is a premier pay TV provider in the United States and Latin America, with a high-quality customer base, the best selection of programming, the best technology for delivering and viewing high-quality video on any device and the best customer satisfaction among major U.S. cable and satellite TV... -

Page 30

... video service at nationwide package prices that do not differ between customers in AT&T's wireline footprint and customers outside our current 21-state wireline footprint. NII Holdings Inc. Acquisition On January 26, 2015, we entered into an agreement with NII to acquire its wireless business... -

Page 31

... on our wireless and wireline networks, our U-verse services and support systems for our communications services. Capital expenditures, excluding interest during construction, increased $255 from 2013. Our Wireless segment represented 53% of our total spending and increased 2% in 2014. The Wireline... -

Page 32

... Cash Used in or Provided by Financing Activities We paid dividends of $9,552 in 2014, $9,696 in 2013, and $10,241 in 2012, primarily reflecting the decline in shares outstanding due to our repurchase activity, partially offset by dividend rate increases. In December 2014, our Board of Directors... -

Page 33

... Board of Directors, the repayment of debt and share repurchases. We plan to fund our financing uses of cash through a combination of cash from operations, debt issuances and asset sales. The timing and mix of debt issuance will be guided by credit market conditions and interest rate trends. Credit... -

Page 34

... above the Federal funds rate, and (c) the ICE Benchmark Administration Limited Settlement Rate applicable to dollars for a period of one month plus 1.00%, plus (2) an applicable margin, as set forth in the 18-Month Credit Agreement (Applicable Margin) (each such Advance, a Base Rate Advance); or... -

Page 35

... the holding company for our wireless business, to the trust used to pay pension benefits under our qualified pension plans. In September 2013, the U.S. Department of Labor (DOL) published a proposed exemption that authorized retroactive approval of this voluntary contribution. In July 2014, the DOL... -

Page 36

... exchange rates. These risks, along with other business risks, impact our cost of capital. It is our policy to manage our debt structure and foreign exchange exposure in order to manage capital costs, control financial risks and maintain financial flexibility over the long term. In managing market... -

Page 37

...) represents the amount we would receive (pay) if we had exited the contracts as of December 31, 2014. Maturity 2015 2016 2017 2018 2019 Thereafter Total Fair Value 12/31/14 Interest Rate Derivatives Interest Rate Swaps: Receive Fixed/Pay Variable Notional Amount Maturing Weighted-Average Variable... -

Page 38

...throughout the world. The current slow economic recovery in the United States continues to pressure some of our customers' demand for and ability to pay for existing services, especially local landline service, and their interest in purchasing new services. Customers are changing their buying habits... -

Page 39

... larger customers' ability to access capital or increase the cost of capital needed to fund business operations. While the global financial markets were generally stable during 2014, a continuing uncertainty surrounding global growth rates has resulted in periodic volatility in the credit, currency... -

Page 40

...and offering attractive services to customers. The wireless industry is undergoing rapid and significant technological changes and a dramatic increase in usage, in particular demand for and usage of data, video and other non-voice services. We must continually invest in our wireless network in order... -

Page 41

...affect our wireline and wireless networks, including telephone switching offices, microwave links, third-party-owned local and long-distance networks on which we rely, our cell sites or other equipment, our customer account support and information systems, or employee and business records could have... -

Page 42

... debt at attractive rates and reduce our ability to respond to competition and adverse economic trends. We have increased the amount of our debt during 2014 and 2015 to fund acquisitions, including spectrum purchases needed to compete in our business. While we believe such decisions were prudent and... -

Page 43

... regulations and conditions relating to spectrum use, licensing, obtaining additional spectrum, technical standards and deployment and usage, including network management rules. • Our ability to manage growth in wireless data services, including network quality and acquisition of adequate spectrum... -

Page 44

... Dollars in millions except per share amounts 2014 2013 2012 Operating Revenues Service Equipment Total operating revenues Operating Expenses Cost of services and sales (exclusive of depreciation and amortization shown separately below) Selling, general and administrative Abandonment of network... -

Page 45

...$16 and $15 Defined benefit postretirement plans: Net actuarial loss from equity method investees arising during period, net of taxes of $0, $0 and $(32) Reclassification adjustment included in net income, net of taxes of $11, $7 and $0 Net prior service credit arising during period, net of taxes of... -

Page 46

... per share amounts December 31, 2014 2013 Assets Current Assets Cash and cash equivalents Accounts receivable - net of allowances for doubtful accounts of $454 and $483 Prepaid expenses Deferred income taxes Other current assets Total current assets Property, Plant and Equipment - Net Goodwill... -

Page 47

... construction Acquisitions, net of cash acquired Dispositions (Purchases) sales of securities, net Return of advances to and investments in equity affiliates Other Net Cash Used in Investing Activities Financing Activities Net change in short-term borrowings with original maturities of three months... -

Page 48

...Amount Shares 2013 Amount Shares 2012 Amount Common Stock Balance at beginning of year Issuance of stock Balance at end of year Additional Paid-In Capital Balance at beginning of year Issuance of treasury stock Share-based payments Share of equity method investee capital transactions Change related... -

Page 49

... of three months or less. The carrying amounts approximate fair value. At December 31, 2014, we held $1,257 in cash and $7,346 in money market funds and other cash equivalents. Revenue Recognition Revenues derived from wireless, local telephone, long distance, data and video services are recognized... -

Page 50

... Statements (continued) Dollars in millions except per share amounts We offer to our customers the option to purchase certain wireless devices in installments over a period of up to 30 months, with the right to trade in the original equipment for a new device, within a set period, and have the... -

Page 51

... operating segments (Wireless and Wireline), to the fair value of those reporting units calculated using a discounted cash flow approach as well as a market multiple approach. FCC licenses are tested for impairment on an aggregate basis, consistent with the management of the business on a national... -

Page 52

... mobile wallet joint venture. The Wireline segment uses our regional, national and global network to provide consumer and business customers with data and voice communications services, AT&T U-verse® high speed Internet, video and VoIP services and managed networking to business customers... -

Page 53

... to AT&T consolidated results, for 2014, 2013, and 2012 are as follows: At December 31, 2014 and for the year ended Wireless Wireline Advertising Solutions Corporate and Other Consolidated Results Service Equipment Total segment operating revenues Operations and support expenses Depreciation and... -

Page 54

... is a premier pay TV provider in the United States and Latin America, with a high-quality customer base, the best selection of programming, the best technology for delivering and viewing high-quality video on any device and the best customer satisfaction among major U.S. cable and satellite TV... -

Page 55

...customer demand for our legacy voice and data products and the migration of our networks to next generation technologies, we decided in the fourth quarter of 2014 to abandon in place specific copper network assets classified as cable, wiring and conduit. These abandoned assets had a gross book value... -

Page 56

... per share amounts NOTE 7. GOODWILL AND OTHER INTANGIBLE ASSETS Changes in the carrying amounts of goodwill, by segment (which is the same as the reporting unit for Wireless and Wireline) were as follows: Wireless Wireline Total Balance as of January 1, 2013 Goodwill acquired Held for sale Other... -

Page 57

... rate of our entire long-term debt portfolio, including the impact of derivatives, decreased from 4.4% at December 31, 2013 to 4.2% at December 31, 2014. Current maturities of long-term debt include debt that may be put back to us by the holders in 2015. We have $1,000 of annual put reset securities... -

Page 58

...50% per annum above the Federal funds rate, and (c) the London Interbank Offered Rate (LIBOR) applicable to U.S. dollars for a period of one month plus 1.00% per annum, plus (2) an applicable margin, as set forth in the Agreement (Applicable Margin; each such advance, a Base Rate Advance); or • at... -

Page 59

... above the Federal funds rate, and (c) the ICE Benchmark Administration Limited Settlement Rate applicable to dollars for a period of one month plus 1.00%, plus (2) an applicable margin, as set forth in the 18-Month Credit Agreement (Applicable Margin) (each such Advance, a Base Rate Advance); or... -

Page 60

...) Dollars in millions except per share amounts The Applicable Margin for a Eurodollar Rate Advance under the 18-Month Credit Agreement will equal 0.800%, 0.900% or 1.000% per annum, depending on AT&T's credit rating. The Applicable Margin for a Base Rate Advance under the 18-Month Credit Agreement... -

Page 61

... of the fair values of our available-for-sale securities was estimated based on quoted market prices. Investments in securities not traded on a national securities exchange are valued using pricing models, quoted prices of securities with similar characteristics or discounted cash flows. Realized... -

Page 62

...ended December 31, 2014, and December 31, 2013, no ineffectiveness was measured on cross-currency swaps designated as cash flow hedges. Periodically, we enter into and designate interest rate locks to partially hedge the risk of changes in interest payments attributable to increases in the benchmark... -

Page 63

... 31, 2014 2013 2012 Our valuation allowances at December 31, 2014 and 2013, related primarily to state net operating losses and state credit carryforwards. We recognize the financial statement effects of a tax return position when it is more likely than not, based on the technical merits, that... -

Page 64

...: 2014 2013 2012 Taxes computed at federal statutory rate Increases (decreases) in income taxes resulting from: State and local income taxes - net of federal income tax benefit Connecticut wireline sale Loss of foreign tax credits in connection with América Móvil sale Other - net Total Effective... -

Page 65

... postretirement benefits. This change compared to the previous method resulted in a decrease in the service and interest components for pension cost in the fourth quarter. Historically, we estimated these service and interest cost components utilizing a single weighted-average discount rate derived... -

Page 66

... value of benefits based on employee service and compensation as of a certain date and does not include an assumption about future compensation levels. The accumulated benefit obligation for our pension plans was $57,949 at December 31, 2014, and $55,077 at December 31, 2013. Net Periodic Benefit... -

Page 67

... weighted-average assumptions: Pension Benefits 2014 2013 2012 Postretirement Benefits 2014 2013 2012 Weighted-average discount rate for determining projected benefit obligation at December 31 Discount rate in effect for determining net cost1 Long-term rate of return on plan assets Composite rate... -

Page 68

...) Dollars in millions except per share amounts stable markets, also serve as a factor in determining future expectations. We consider many factors that include, but are not limited to, historical returns on plan assets, current market information on long-term returns (e.g., long-term bond rates... -

Page 69

... date, they are valued at the last reported bid price. Investments in securities not traded on a national securities exchange are valued using pricing models, quoted prices of securities with similar characteristics or discounted cash flows. Shares of registered investment companies are valued based... -

Page 70

... based on external market data, including the current credit rating for the bonds, credit spreads to Treasuries for each credit rating, sector add-ons or credits, issue specific add-ons or credits as well as call or other options. Purchases and sales of securities are recorded as of the trade date... -

Page 71

... receivable, accounts payable and net adjustment for securities lending payable. The tables below set forth a summary of changes in the fair value of the Level 3 pension and postretirement assets for the year ended December 31, 2014: Fixed Income Funds Private Equity Funds Real Estate and Real... -

Page 72

... and funds Government and municipal bonds Private equity funds Real estate and real assets Commingled funds Securities lending collateral Receivable for variation margin Assets at fair value Investments sold short and other liabilities at fair value Total plan net assets at fair value Other assets... -

Page 73

... increase in determining our projected benefit obligation and the net pension and postemployment benefit cost. Our discount rates of 4.1% at December 31, 2014 and 5.0% at December 31, 2013 were calculated using the same methodologies used in calculating the discount rate for our qualified pension... -

Page 74

... savings plans is fulfilled with purchases of our stock on the open market or company cash. Benefit cost is based on the cost of shares or units allocated to participating employees' accounts and was $654, $654 and $634 for the years ended December 31, 2014, 2013 and 2012. Performance stock units... -

Page 75

... using our treasury stock. Cash received from stock option exercises was $43 for 2014, $135 for 2013 and $517 for 2012. NOTE 14. STOCKHOLDERS' EQUITY Stock Repurchase Program From time to time, we repurchase shares of common stock for distribution through our employee benefit plans or in connection... -

Page 76

... interest rate risk. NOTE 16. SALES OF EQUIPMENT INSTALLMENT RECEIVABLES We offer our customers the option to purchase certain wireless devices in installments over a period of up to 30 months, with the right to trade in the original equipment for a new device within a set period and have... -

Page 77

... versus the weighted-average common shares for the year. Includes an actuarial loss on pension and postretirement benefit plans (Note 12) and asset abandonment charges (Note 6). 2013 Calendar Quarter First Second Third Fourth2 Annual Total Operating Revenues Operating Income Net Income Net Income... -

Page 78

... by communication programs aimed at ensuring that its policies, standards and managerial authorities are understood throughout the organization. The Audit Committee of the Board of Directors meets periodically with management, the internal auditors and the independent auditors to review the manner... -

Page 79

... Board (United States), the Company's internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) and our report dated... -

Page 80

... sheets of the Company as of December 31, 2014 and 2013, and the related consolidated statements of income, comprehensive income, changes in stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2014 and our report dated February 20, 2015 expressed an... -

Page 81

... Officer Oil States International, Inc. Director since 2013 Background: Public accounting, oil and gas Lead Director Author and Retired President and Chief Executive Officer Girls Incorporated Director since 1998 Southern New England Telecommunications Director 1997-1998 Background: Marketing... -

Page 82

... and Chief Executive Officer, AT&T Mobile and Business Solutions Lori Lee, 49 Senior Executive Vice PresidentHome Solutions Wayne Watts, 61 Senior Executive Vice President and General Counsel Jim Cicconi, 62 Senior Executive Vice PresidentExternal and Legislative Affairs, AT&T Services, Inc... -

Page 83

...at www.att.com/investor.relations Investor Relations Securities analysts and other members of the professional financial community may contact the Investor Relations staff as listed on our website at www.att.com/investor.relations Stock Trading Information AT&T Inc. is listed on the New York Stock... -

Page 84

AT&T Inc. 208 S. Akard St., Dallas, TX 75202 att.com