AT&T Wireless 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

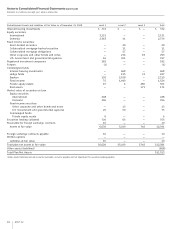

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

94 AT&T Inc.

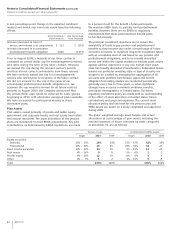

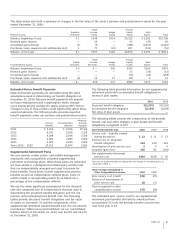

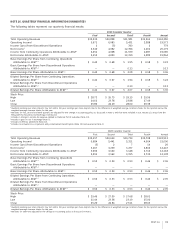

NOTE 14. ADDITIONAL FINANCIAL INFORMATION

December 31,

Consolidated Balance Sheets 2010 2009

Accounts payable and accrued liabilities:

Accounts payable $ 7,437 $ 7,511

Accrued rents and other 2,761 3,333

Accrued payroll and commissions 2,225 2,392

Deferred directory revenue 1,278 1,491

Accrued interest 1,601 1,717

Compensated future absences 538 559

Current portion of employee

benefit obligation 2,394 2,021

Liabilities related to discontinued

operations — 491

Other 1,821 1,745

Total accounts payable and

accrued liabilities $20,055 $21,260

Deferred compensation (included in

Other noncurrent liabilities) $ 1,572 $ 1,538

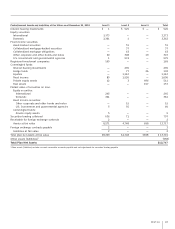

Consolidated Statements of Income 2010 2009 2008

Advertising expense $2,989 $2,787 $3,050

Interest expense incurred $3,766 $4,108 $4,028

Capitalized interest (772) (740) (659)

Total interest expense $2,994 $3,368 $3,369

Consolidated Statements of Cash Flows 2010 2009 2008

Cash paid during the year for:

Interest $3,882 $3,862 $3,705

Income taxes, net of refunds 3,538 4,471 5,307

Consolidated Statements of

Changes in Stockholders’ Equity 2010 2009 2008

Foreign currency translation

adjustment $ (494) $ (765) $(912)

Unrealized gains on

available-for-sale securities 316 324 100

Unrealized gains (losses) on

cash flow hedges (180) 142 (483)

Defined benefit postretirement

plans1 3,070 2,979 878

Other — (2) (1)

Accumulated other comprehensive

income (loss) $2,712 $2,678 $(418)

1

Amounts for 2009 and 2008 are adjusted for the change in accounting policy as

discussed in Note 1.

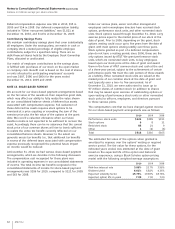

No customer accounted for more than 10% of consolidated

revenues in 2010, 2009 or 2008.

A majority of our employees are represented by labor unions

as of year-end 2010.

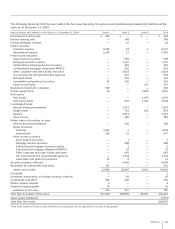

NOTE 15. CONTINGENT LIABILITIES

We are party to numerous lawsuits, regulatory proceedings

and other matters arising in the ordinary course of business.

In accordance with GAAP standards for contingencies, in

evaluating these matters on an ongoing basis, we take into

account amounts already accrued on the balance sheet.

In our opinion, although the outcomes of these proceedings

are uncertain, they should not have a material adverse effect

on our financial position, results of operations or cash flows.

We have contractual obligations to purchase certain goods or

services from various other parties. Our purchase obligations

are expected to be approximately $3,158 in 2011, $4,904 in

total for 2012 and 2013, $1,934 in total for 2014 and 2015

and $607 in total for years thereafter.

See Note 9 for a discussion of collateral and credit-risk

contingencies.