AT&T Wireless 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

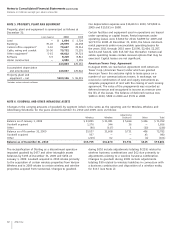

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

68 AT&T Inc.

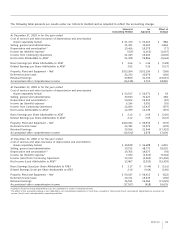

areas across 18 states. The fair value of the acquired net

assets of $1,439 included $368 of property, plant and

equipment, $937 of goodwill, $765 of FCC licenses, and

$224 of customer lists and other intangible assets.

As the value of certain assets and liabilities are preliminary

in nature, they are subject to adjustment as additional

information is obtained about the facts and circumstances

that existed at the acquisition date. When the valuation is

final, any changes to the preliminary valuation of acquired

assets and liabilities could result in adjustments to goodwill.

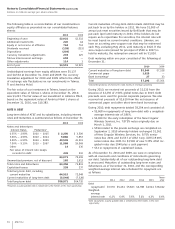

Centennial In December 2010, we completed our acquisition

accounting for Centennial. As of December 31, 2010, the

fair value measurement of Centennial’s net assets acquired

included $1,518 of goodwill, $655 of FCC licenses, and

$449 of customer lists and other intangible assets.

Other Acquisitions In 2010, we acquired $265 of wireless

spectrum from various companies, primarily in support of

our ongoing network enhancement efforts, and a home

monitoring platform developer and other entities for $86

in cash. During 2009, we acquired a provider of mobile

application solutions and a security consulting business

for a combined $50 before closing costs.

During 2008, we acquired Easterbrooke Cellular Corporation,

Windstream Wireless, Wayport Inc., and the remaining 64%

of Edge Wireless for a combined $663, recording $449 in

goodwill. The acquisitions of these companies were designed

to expand our wireless and Wi-Fi coverage area.

Pending Acquisition In December 2010, we agreed to

purchase spectrum licenses in the Lower 700 MHz frequency

band from Qualcomm Incorporated (Qualcomm) for

approximately $1,925 in cash. The spectrum covers more

than 300 million people total nationwide, including 12 MHz

of Lower 700 MHz D and E block spectrum covering more than

70 million people in five of the top 15 metropolitan areas and

6 MHz of Lower 700 MHz D block spectrum covering more

than 230 million people across the rest of the U.S. We plan to

deploy this spectrum as supplemental downlink capacity, using

carrier aggregation technology once compatible handsets and

network equipment are developed. The transaction is subject

to regulatory approvals and other customary closing conditions.

In February 2011, the waiting period under the Hart-Scott-

Rodino Act expired without the Department of Justice (DOJ)

requesting additional information. AT&T and Qualcomm

anticipate closing the purchase in the second half of 2011.

Dispositions

Sale of Sterling Operations In August 2010, we sold our

Sterling Commerce Inc. (Sterling) subsidiary to International

Business Machines Corporation (IBM) for approximately $1,400

in cash. Sterling provides business applications and integration

solutions to approximately 18,000 customers worldwide.

In conjunction with the sale, we divested $649 of goodwill

and other intangible assets. We also entered into a transition

services agreement with IBM related to short-term support

of Sterling’s operations after the sale.

Goodwill, FCC licenses and other indefinite-lived intangible

assets are not amortized but are tested at least annually for

impairment. The testing is performed on the value as of

October 1 each year, and is generally composed of comparing

the book value of the assets to their fair value. Goodwill is

tested by comparing the book value of each reporting unit,

deemed to be our principle operating segments (Wireless,

Wireline and Advertising Solutions), to the fair value of those

reporting units calculated under a market multiple approach

as well as a discounted cash flow approach. FCC licenses

are tested for impairment on an aggregate basis, consistent

with the management of the business on a national scope.

Brand names are tested by comparing the book value to a

fair value calculated using a discounted cash flow approach

on a presumed royalty rate derived from the revenues

related to the brand name.

Intangible assets that have finite useful lives are amortized

over their useful lives, a weighted-average of 7.9 years

(7.9 years for customer lists and relationships and 10.3 years

for other). Customer lists and relationships are amortized using

primarily the sum-of-the-months-digits method of amortization

over the expected period in which those relationships are

expected to contribute to our future cash flows. The remaining

finite-lived intangible assets are generally amortized using the

straight-line method of amortization.

Advertising Costs We expense advertising costs for

advertising products and services or for promoting our

corporate image as we incur them (see Note 14).

Foreign Currency Translation We are exposed to foreign

currency exchange risk through our foreign affiliates and

equity investments in foreign companies. Our foreign

subsidiaries and foreign investments generally report their

earnings in their local currencies. We translate our share of

their foreign assets and liabilities at exchange rates in effect

at the balance sheet dates. We translate our share of their

revenues and expenses using average rates during the year.

The resulting foreign currency translation adjustments are

recorded as a separate component of accumulated OCI in

the accompanying consolidated balance sheets. We do not

hedge foreign currency translation risk in the net assets

and income we report from these sources. However, we do

hedge a large portion of the foreign currency exchange risk

involved in anticipation of highly probable foreign currency-

denominated transactions, which we explain further in our

discussion of our methods of managing our foreign currency

risk (see Note 9).

NOTE 2. ACQUISITIONS, DISPOSITIONS, AND

OTHER ADJUSTMENTS

Acquisitions

Wireless Properties Transactions In June 2010, we

acquired certain wireless properties, including FCC licenses

and network assets, from Verizon Wireless for $2,376 in cash.

The assets primarily represent former Alltel Wireless assets

and served approximately 1.6 million subscribers in 79 service