AT&T Wireless 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

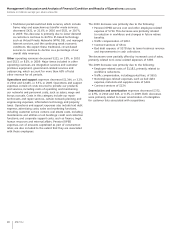

AT&T Inc. 33

decisions for which the individual operating segments are not

being evaluated, including interest cost and expected return on

pension and postretirement benefits assets. In May 2010, we

announced the sale of Sterling, which we closed in August

2010. The Other segment results for all periods shown have

been restated to exclude the results of Sterling, which are now

reflected in discontinued operations (see Note 2).

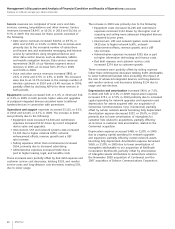

In January 2011, we announced a change in our method of

recognizing actuarial gains and losses for pension and other

postretirement benefits as well as the attribution of those

benefit costs to our segments (see Note 1). Historically, the

total benefit costs were attributed to each segment. As part

of the benefit accounting change, the service cost and the

amortization of prior service costs, which represent the

benefits earned by active employees during the period,

will continue to be attributed to the segment in which the

employee is employed, while interest cost and expected

return on assets will now be recorded in the Other segment

as those financing activities are managed on a corporate

level. Actuarial gains and losses resulting from the

remeasurement of our pension and postretirement benefit

plans, which generally only occurs in the fourth quarter,

will be reflected in AT&T’s consolidated results only.

We have adjusted prior-period segment information to

conform to the current period’s presentation.

Historically, intersegment activity had been reported as

revenue in the billing segment and operating expense in the

purchasing segment. Upon consolidation, the intersegment

revenue and expense were eliminated with the consolidated

results reflecting the cash operating and depreciation expense

of providing the intersegment service. As part of AT&T’s

ongoing initiatives to manage its business from an external

customer perspective, we no longer report intersegment

revenue and report the cash operating and depreciation

expense related to intersegment activity in the purchasing

segment, which provided services to the external customer.

While this change did not affect AT&T’s total consolidated

results, the impact to each operating segment varied. In

particular, the Wireless segment, as a purchaser of network,

IT and other services from the Wireline segment, experienced

a reduction in cash operating expense partially offset by

increased depreciation expense, with the net result being

increased operating margins. This change was effective with

the reporting of operating results for the quarter ended

March 31, 2010. We have applied this change retrospectively,

adjusting prior-period segment information.

The following sections discuss our operating results by

segment. We discuss capital expenditures for each segment

in “Liquidity and Capital Resources.”

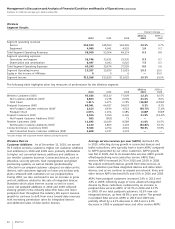

Segment Results

Our segments are strategic business units that offer different

products and services over various technology platforms and

are managed accordingly. Our operating segment results

presented in Note 4 and discussed below for each segment

follow our internal management reporting. We analyze our

various operating segments based on segment income before

income taxes. We make our capital allocations decisions

primarily based on the network (wireless or wireline)

providing services. Actuarial gains and losses from pension

and other postretirement benefits, interest expense and

other income (expense) – net, are managed only on a

total company basis and are, accordingly, reflected only

in consolidated results. Each segment’s percentage of

total segment operating revenue and income calculations

is derived from our segment results table in Note 4.

We have four reportable segments: (1) Wireless,

(2) Wireline, (3) Advertising Solutions and (4) Other.

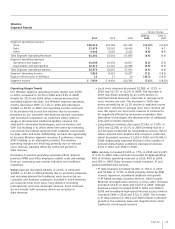

The Wireless segment accounted for approximately 47%

of our 2010 total segment operating revenues as compared

to 44% in 2009 and 67% of our 2010 total segment income as

compared to 63% in 2009. This segment uses our nationwide

network to provide consumer and business customers with

wireless voice and advanced data communications services.

The Wireline segment accounted for approximately 49%

of our 2010 total segment operating revenues as compared

to 52% in 2009 and 34% of our 2010 total segment income

as compared to 38% in 2009. This segment uses our regional,

national and global network to provide consumer and

business customers with landline voice and data

communications services, AT&T U-verse TV, high-speed

broadband and voice services and managed networking to

business customers. Additionally, we receive commissions

on sales of satellite television services offered through our

agency arrangements.

The Advertising Solutions segment accounted for

approximately 3% of our 2010 total segment operating

revenues as compared to 4% in 2009 and 4% of our 2010

total segment income as compared to 6% in 2009. This

segment includes our directory operations, which publish

Yellow and White Pages directories and sell directory

advertising, Internet-based advertising and local search.

The Other segment accounted for approximately 1% of our

2010 and 2009 total segment operating revenues. Since

segment operating expenses exceeded revenue in both

years, a segment loss was incurred in both 2010 and 2009. This

segment includes results from customer information services,

our portion of the results from our international equity

investments and all corporate and other operations. Also

included in the Other segment are impacts of corporate-wide