AT&T Wireless 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

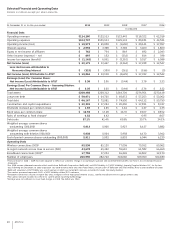

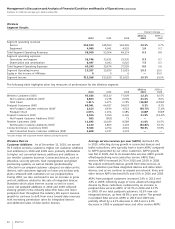

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

36 AT&T Inc.

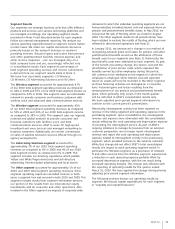

The increase in 2009 was primarily due to the following:

•Equipmentcostsincreased$1,246andcommission

expenses increased $112 driven by the higher cost of

acquiring and selling more advanced integrated devices

compared to prior years.

•Interconnect,USFandnetworksystemcostsincreased

$435 due to higher network traffic, network

enhancement efforts, revenue growth, and a USF

rate increase.

•Administrativeexpensesincreased$291dueinpart

to higher information technology and finance costs.

•Baddebtexpenseandcustomerservicecosts

increased $274 due to customer growth.

These increases were partially offset by selling expense

(other than commissions) decreases totaling $139, attributable

to lower traditional handset sales exceeding the impact of

the sale of advanced integrated devices, and long-distance

and reseller services cost decreases totaling $134 due to

usage and rate declines.

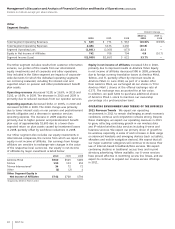

Depreciation and amortization increased $454, or 7.5%,

in 2010 and $18, or 0.3%, in 2009. Depreciation expense

increased $751, or 17.0%, in 2010 primarily due to increased

capital spending for network upgrades and expansion and

depreciation for assets acquired with our acquisition of

Centennial Communications Corp. (Centennial), partially

offset by certain network assets becoming fully depreciated.

Amortization expense decreased $297, or 18.4%, in 2010

primarily due to lower amortization of intangibles for

customer lists related to acquisitions, partially offset by

an increase in customer lists amortization related to the

Centennial acquisition.

Depreciation expense increased $468, or 11.8%, in 2009

due to ongoing capital spending for network upgrades

and expansion, partially offset by certain network assets

becoming fully depreciated. Amortization expense decreased

$450, or 21.8%, in 2009 due to lower amortization of

intangibles attributable to our acquisition of BellSouth

Corporation (BellSouth), partially offset by amortization

of intangible assets attributable to subscribers added in

the November 2009 acquisition of Centennial and the

2007 acquisition of Dobson Communications Corporation.

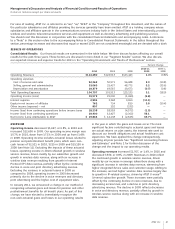

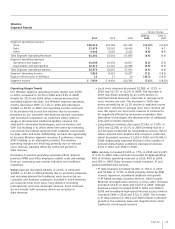

Service revenues are comprised of local voice and data

services, roaming, long-distance and other revenue. Service

revenues increased $4,947, or 10.2%, in 2010 and $4,314, or

9.7%, in 2009. The increases for these periods consisted of

the following:

•Dataservicerevenuesincreased$4,052,or28.7%,in

2010 and $3,539, or 33.4%, in 2009. The increases were

primarily due to the increased number of subscribers

and heavier text and multimedia messaging and Internet

access by subscribers using integrated devices and

other data-centric devices, such as eReaders, tablets,

and mobile navigation devices. Data service revenues

represented 34.0% of our Wireless segment service

revenues in 2010, an increase from 29.1% in 2009,

and 23.9% in 2008.

•Voiceandotherservicerevenuesincreased$895,or

2.6%, in 2010 and $775, or 2.3%, in 2009. The increases

were due to an 11.1% increase in the average number of

wireless customers in 2010 and a 9.4% increase in 2009,

partially offset by declining ARPU for these services in

both periods.

Equipment revenues increased $49, or 1.0%, in 2010 and $16,

or 0.3%, in 2009. In both periods, higher sales and upgrades

of postpaid integrated devices exceeded lower traditional

handset devices in connection with promotions.

Operations and support expenses increased $3,115, or 9.3%,

in 2010 and $2,101, or 6.7%, in 2009. The increase in 2010

was primarily due to the following:

•Equipmentcostsincreased$1,340andcommission

expenses increased $132 driven by record integrated

device sales and upgrades.

•Interconnect,USFandnetworksystemcostsincreased

$1,103 due to higher network traffic, network

enhancement efforts, revenue growth and a USF

rate increase.

•Sellingexpenses(otherthancommissions)increased

$554, primarily due to increased advertising.

•Administrativeexpensesincreased$432duein

part to higher leasing, legal, and benefits costs.

These increases were partially offset by bad debt expense and

customer service cost decreases, totaling $353, and reseller

service costs and long-distance cost decreases, totaling $93,

due to lower usage.