AT&T Wireless 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 93

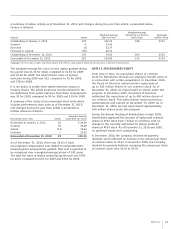

NOTE 13. STOCKHOLDERS’ EQUITY

From time to time, we repurchase shares of common

stock for distribution through our employee benefit plans or

in connection with certain acquisitions. In December 2010,

the Board of Directors authorized the repurchase of

up to 300 million shares of our common stock. As of

December 31, 2010, we repurchased no shares under this

program. In December 2007, the Board of Directors

authorized the repurchase of up to 400 million shares of

our common stock. This authorization replaced previous

authorizations and expired on December 31, 2009. As of

December 31, 2009, we had repurchased approximately

164 million shares under this program.

During the Annual Meeting of Shareholders in April 2009,

shareholders approved the increase of authorized common

shares of AT&T stock from 7 billion to 14 billion, with no

change to the currently authorized 10 million preferred

shares of AT&T stock. As of December 31, 2010 and 2009,

no preferred shares were outstanding.

In December 2010, the Company declared its quarterly

dividend, which reflected an increase in the amount per share

of common stock to $0.43. In December 2009, the Company

declared its quarterly dividend, increasing the amount per share

of common stock from $0.41 to $0.42.

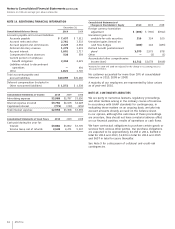

The weighted-average fair value of each option granted during

the period was $1.34 for 2010, compared to $1.84 for 2009

and $5.04 for 2008. The total intrinsic value of options

exercised during 2010 was $13, compared to $5 for 2009,

and $78 for 2008.

It is our policy to satisfy share option exercises using our

treasury shares. The actual excess tax benefit realized for the

tax deductions from option exercises from these arrangements

was $2 for 2010, compared to $0 for 2009 and $10 for 2008.

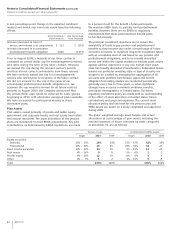

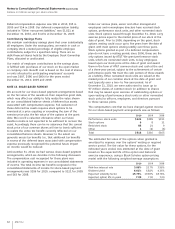

A summary of the status of our nonvested stock units, which

includes performance stock units as of December 31, 2010,

and changes during the year then ended is presented as

follows (shares in millions):

Weighted-Average

Nonvested Stock Units Shares Grant-Date Fair Value

Nonvested at January 1, 2010 26 $ 26.48

Granted 15 25.48

Vested (12) 34.64

Forfeited — 25.92

Nonvested at December 31, 2010 29 $25.30

As of December 31, 2010, there was $414 of total

unrecognized compensation cost related to nonvested share-

based payment arrangements granted. That cost is expected to

be recognized over a weighted-average period of 1.81 years.

The total fair value of shares vested during the year was $396

for 2010, compared to $471 for 2009 and $554 for 2008.

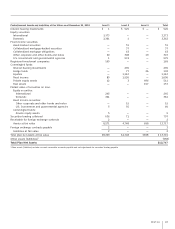

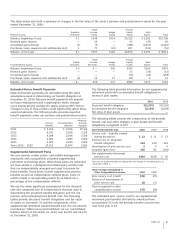

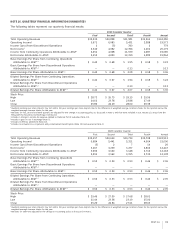

A summary of option activity as of December 31, 2010, and changes during the year then ended, is presented below

(shares in millions):

Weighted-Average

Weighted-Average Remaining Contractual Aggregate

Options Shares Exercise Price Term (Years) Intrinsic Value1

Outstanding at January 1, 2010 178 $36.79 1.86 $115

Granted 4 25.45

Exercised (2) 22.27

Forfeited or expired (50) 42.13

Outstanding at December 31, 2010 130 34.60 1.69 $150

Exercisable at December 31, 2010 125 $34.90 1.43 $134

1Aggregate intrinsic value includes only those options with intrinsic value (options where the exercise price is below the market price).