AT&T Wireless 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

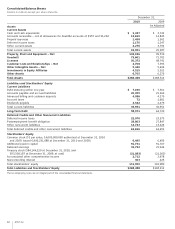

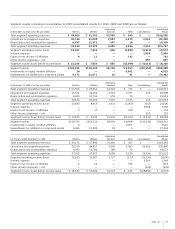

64 AT&T Inc.

Notes to Consolidated Financial Statements

Dollars in millions except per share amounts

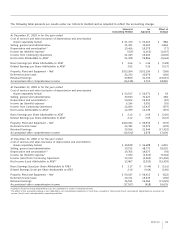

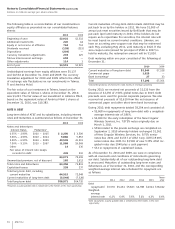

Pension and Other Postretirement Benefits In January 2011,

we announced a change in our method of recognizing actuarial

gains and losses for pension and other postretirement benefits

for all benefit plans. Historically, we have recognized the

actuarial gains and losses as a component of the Stockholders’

Equity on our consolidated balance sheets on an annual basis

and have amortized them into our operating results over the

average future service period of the active employees of these

plans, to the extent such gains and losses were outside of a

corridor. We have elected to immediately recognize actuarial

gains and losses in our operating results, noting that it is

generally preferable to accelerate the recognition of deferred

gains and losses into income rather than to delay such

recognition. This change will improve transparency in our

operating results by more quickly recognizing the effects of

economic and interest rate conditions on plan obligations,

investments and assumptions. These gains and losses are

generally only measured annually as of December 31 and

accordingly will be recorded during the fourth quarter.

Additionally, for purposes of calculating the expected return

on plan assets, we will no longer use a permitted averaging

technique for the market-related value of plan assets but

instead will use actual fair value of plan assets. We have

applied these changes retrospectively, adjusting all prior

periods. The cumulative effect of the change on retained

earnings as of January 1, 2008, was a reduction of $1,533,

with an offset to accumulated other comprehensive income

(OCI). The annual recognition of actuarial gains and losses,

which is reported as “Actuarial loss on pension and

postretirement benefit plans” on our consolidated statement

of cash flows total $2,521 in 2010, $215 in 2009 and $25,150

in 2008. This change did not have a material impact on cash

provided by or used in operations for any period presented.

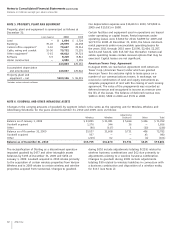

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation Throughout this document, AT&T Inc.

is referred to as “AT&T,” “we” or the “Company.” The consoli-

dated financial statements include the accounts of the

Company and our majority-owned subsidiaries and affiliates.

Our subsidiaries and affiliates operate in the communications

services industry both domestically and internationally,

providing wireless and wireline communications services and

equipment, managed networking, wholesale services, and

advertising solutions.

All significant intercompany transactions are eliminated in

the consolidation process. Investments in partnerships and

less than majority-owned subsidiaries where we have

significant influence are accounted for under the equity

method. Earnings from certain foreign equity investments

accounted for using the equity method are included for

periods ended within up to one month of our year end

(see Note 7).

The preparation of financial statements in conformity with

U.S. generally accepted accounting principles (GAAP) requires

management to make estimates and assumptions that

affect the amounts reported in the financial statements and

accompanying notes, including estimates of probable losses

and expenses. Actual results could differ from those estimates.

We have reclassified certain amounts in prior-period financial

statements to conform to the current period’s presentation.

See Note 2 for a discussion of changes in reporting related

to discontinued operations, and Notes 4 and 11 for a

discussion of our changes in accounting and reporting for

our pension and other postretirement benefit costs and

intersegment activity.