AT&T Wireless 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

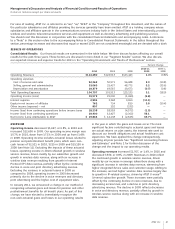

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

40 AT&T Inc.

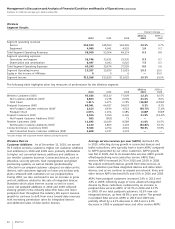

Equity in net income of affiliates increased $34 in 2010,

primarily due to improved results at América Móvil. Equity

in net income of affiliates decreased $86 in 2009, primarily

due to foreign currency translation losses at América Móvil,

Telmex, and TI, partially offset by improved results at

América Móvil. In June 2010, as part of a tender offer

from América Móvil, we exchanged all our shares in TI for

América Móvil L shares at the offered exchange rate of

0.373. The exchange was accounted for at fair value.

In addition, we paid $202 to purchase additional shares

of América Móvil L stock to maintain our ownership

percentage at a pretransaction level.

OPERATING ENVIRONMENT AND TRENDS OF THE BUSINESS

2011 Revenue Trends We expect our operating

environment in 2011 to remain challenging as weak economic

conditions continue and competition remains strong. Despite

these challenges, we expect our operating revenues in 2011

to grow, reflecting continuing growth in our wireless data

and IP-related wireline data services including U-verse and

business services. We expect our primary driver of growth to

be wireless, especially in sales of and increases in data usage

on advanced handsets and emerging devices (such as tablets,

eReaders and mobile navigation devices). We expect that all

our major customer categories will continue to increase their

use of Internet-based broadband/data services. We expect

continuing declines in traditional access lines and in print

directory advertising. Where available, our U-verse services

have proved effective in stemming access line losses, and we

expect to continue to expand our U-verse service offerings

in 2011.

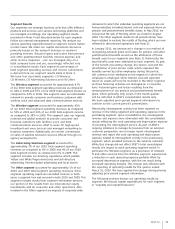

The Other segment includes results from customer information

services, our portion of the results from our international

equity investments and all corporate and other operations.

Also included in the Other segment are impacts of corporate-

wide decisions for which the individual operating segments

are not being evaluated, including the interest cost and

expected return on pension and other postretirement benefit

plan assets.

Operating revenues decreased $128, or 16.6%, in 2010 and

$192, or 19.9%, in 2009. The decrease in 2010 and 2009 is

primarily due to reduced revenues from our operator services.

Operating expenses decreased $652, or 20.8%, in 2010 and

increased $2,000 in 2009. The 2010 change was primarily

due to lower interest costs on our pension and postretirement

benefit obligation and a decrease in operator services

operating expense. The increase in 2009 expense was

primarily due to higher pension and postretirement benefit

plan cost of approximately $2,600 due to a lower-than-

expected return on plan assets caused by investment losses

in 2008, partially offset by workforce reductions in 2008.

Our Other segment also includes our equity investments in

international companies, the income from which we report as

equity in net income of affiliates. Our earnings from foreign

affiliates are sensitive to exchange-rate changes in the value

of the respective local currencies. Our equity in net income

of affiliates by major investment is listed below:

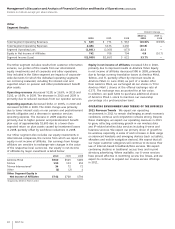

2010 2009 2008

América Móvil $560 $505 $469

Telmex 150 133 252

Telmex Internacional1 34 72 72

Other (2) (2) 1

Other Segment Equity in

Net Income of Affiliates $742 $708 $794

1Acquired by América Móvil in 2010.

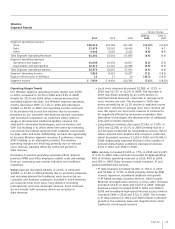

Other

Segment Results

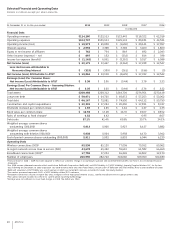

Percent Change

2010 vs. 2009 vs.

2010 2009 2008 2009 2008

Total Segment Operating Revenues $ 643 $ 771 $ 963 (16.6)% (19.9)%

Total Segment Operating Expenses 2,484 3,136 1,136 (20.8) —

Segment Operating Loss (1,841) (2,365) (173) 22.2 —

Equity in Net Income of Affiliates 742 708 794 4.8 (10.7)

Segment Income (Loss) $(1,099) $(1,657) $ 621 33.7% —