AT&T Wireless 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 89

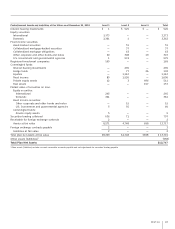

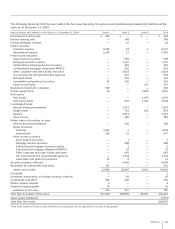

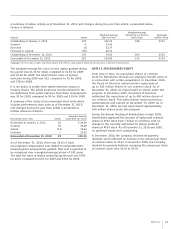

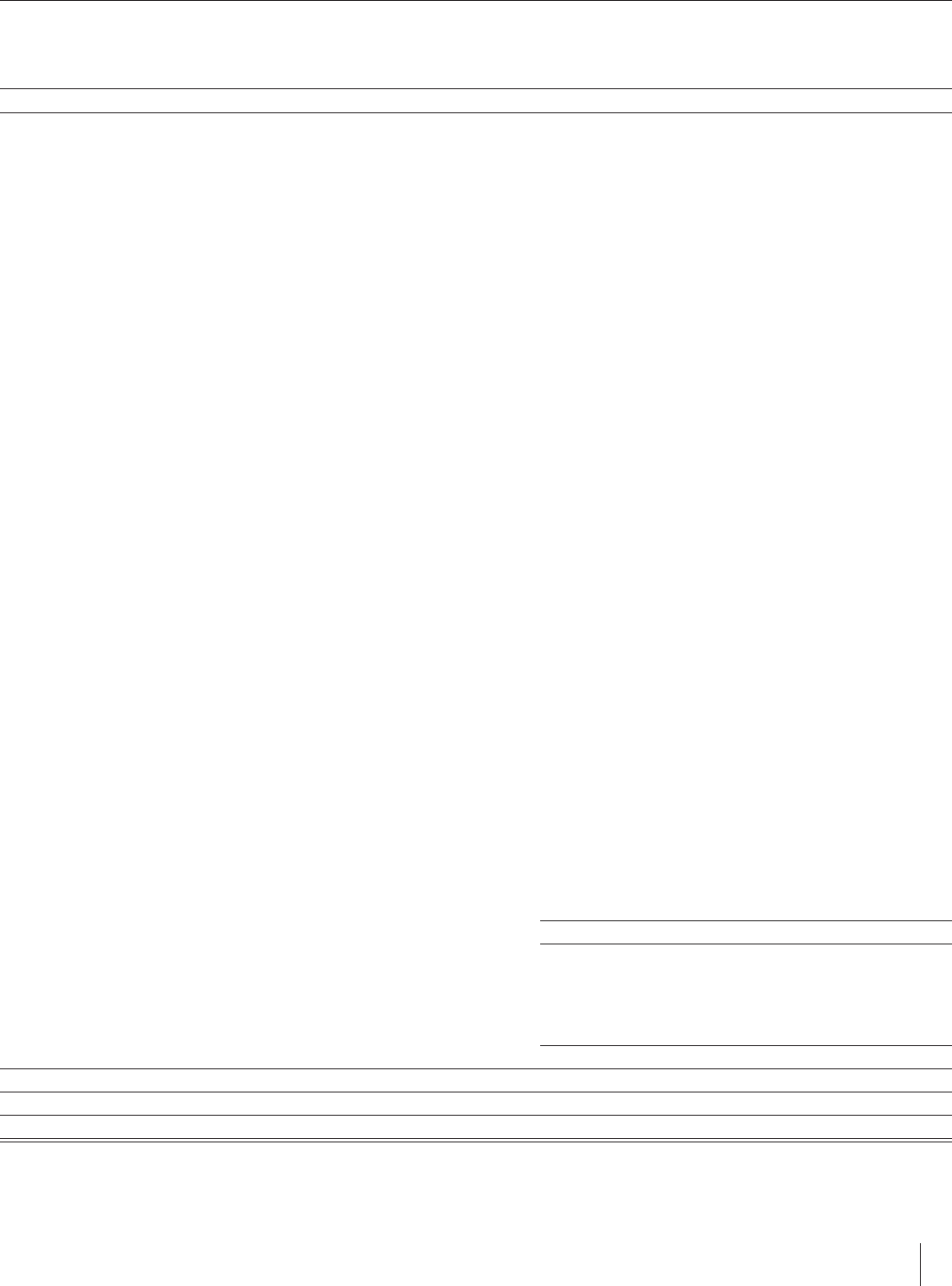

The following tables set forth by level, within the fair value hierarchy, the pension and postretirement assets and liabilities at fair

value as of December 31, 2009:

Pension Assets and Liabilities at Fair Value as of December 31, 2009 Level 1 Level 2 Level 3 Total

Non-interest bearing cash $ 464 $ — $ — $ 464

Interest bearing cash — 248 — 248

Foreign exchange contract — 22 — 22

Equity securities:

Domestic equities 8,704 22 1 8,727

International equities 5,367 13 — 5,380

Fixed income securities:

Asset-backed securities — 999 — 999

Mortgage-backed securities — 1,727 — 1,727

Collateralized mortgage-backed securities — 499 — 499

Collateralized mortgage obligations/REMICS — 925 — 925

Other corporate and other bonds and notes — 4,618 — 4,618

U.S. Government and governmental agencies — 953 — 953

Municipal bonds — 119 — 119

Convertible and preferred securities 91 200 — 291

Fixed income funds — — 337 337

Registered investment companies 509 — — 509

Private equity funds 36 — 4,874 4,910

Real assets:

Real assets — — 1,955 1,955

Real estate funds — 352 1,342 1,694

Commingled funds:

Interest bearing investments — 2,212 — 2,212

Hedge funds — 751 102 853

Equities — 3,213 — 3,213

Fixed income — 985 — 985

Market value of securities on loan:

Interest bearing investments — 300 — 300

Equity securities:

Domestic 1,943 1 — 1,944

International 562 15 — 577

Fixed income securities:

Asset-backed securities — 7 — 7

Mortgage-backed securities — 588 — 588

Collateralized mortgage-backed securities — 3 — 3

Collateralized mortgage obligations/REMICS — 32 — 32

Other corporate and other bonds and notes — 687 — 687

U.S. Government and governmental agencies — 2,304 — 2,304

Convertible and preferred securities 23 8 — 31

Securities lending collateral — 6,606 — 6,606

Receivable for investments sold short 191 — — 191

Assets at fair value 17,890 28,409 8,611 54,910

Overdrafts 1 — — 1

Unrealized depreciation on foreign currency contracts — 20 — 20

Investments sold short 435 290 — 725

Written options payable 4 — — 4

Variation margin payable 30 — — 30

Liabilities at fair value 470 310 — 780

Total plan net assets at fair value $17,420 $28,099 $8,611 $54,130

Other assets (liabilities)1 (7,257)

Total Plan Net Assets $46,873

1Other assets (liabilities) include accounts receivable, accounts payable and net adjustment for securities lending payable.