AT&T Wireless 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (continued)

Dollars in millions except per share amounts

42 AT&T Inc.

As the wireless industry continues to mature, we believe that

future wireless growth will increasingly depend on our ability

to offer innovative services that will encourage existing

customers to upgrade their services, either by adding new

types of services, such as data enhancements, or through

increased use of existing services, such as through equipment

upgrades. These innovative services should attract customers

from other providers, as well as minimize customer churn.

We intend to accomplish these goals by continuing to expand

our network coverage, improve our network quality and offer

a broad array of products and services, including free mobile-

to-mobile calling among our wireless customers. Minimizing

customer churn is critical to our ability to maximize revenue

growth and to maintain and improve our operating margins.

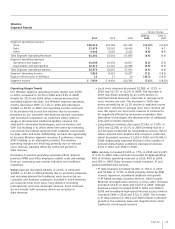

U-verse Services We are continuing to expand our

deployment of U-verse High Speed Internet and TV services.

As of December 31, 2010, we have passed 27.3 million living

units (constructed housing units as well as platted housing

lots) and are marketing the services to 77% of those units.

Our rate of expansion will be slowed if we cannot obtain all

required local building permits in a timely fashion. We also

continue to work with our vendors on improving, in a timely

manner, the requisite hardware and software technology.

Our deployment plans could be delayed if we do not receive

required equipment and software on schedule.

We believe that our U-verse TV service is subject to federal

oversight as a “video service” under the Federal

Communications Act. However, some cable providers and

municipalities have claimed that certain IP services should

be treated as a traditional cable service and therefore subject

to the applicable state and local cable regulation. Certain

municipalities have delayed our request or have refused us

permission to use our existing right-of-ways to deploy or

activate our U-verse-related services and products, resulting

in litigation. Pending negotiations and current or threatened

litigation involving municipalities could delay our deployment

plans in those areas. Petitions have been filed at the FCC

alleging that the manner in which we provision “public,

educational and governmental” (PEG) programming over our

U-verse TV service conflicts with federal law, and a lawsuit has

been filed in a California state superior court raising similar

allegations under California law. If courts having jurisdiction

where we have significant deployments of our U-verse

services were to decide that federal, state and/or local cable

regulation were applicable to our U-verse services, or if the

FCC, state agencies or the courts were to rule that we must

deliver PEG programming in a manner substantially different

from the way we do today or in ways that are inconsistent

with our current network architecture, it could have a

material adverse effect on the cost, timing and extent

of our deployment plans.

Our wireless operations operate in robust competitive markets

but are likewise subject to substantial governmental

regulation. Wireless communications providers must be

licensed by the FCC to provide communications services at

specified spectrum frequencies within specified geographic

areas and must comply with the rules and policies governing

the use of the spectrum as adopted by the FCC. The FCC has

recognized the importance of providing carriers with access to

adequate spectrum to permit continued wireless growth and

has begun investigating how to develop policies to promote

that goal. While wireless communications providers’ prices

and service offerings are generally not subject to state

regulation, an increasing number of states are attempting

to regulate or legislate various aspects of wireless services,

such as in the area of consumer protection.

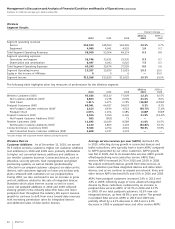

Expected Growth Areas

We expect our wireless services and data wireline products to

remain the most significant portion of our business and have

also discussed trends affecting the segments in which we

report results for these products (see “Wireless Segment

Results” and “Wireline Segment Results”). Over the next few

years, we expect an increasing percentage of our growth to

come from: (1) our wireless service and (2) data/broadband,

through existing and new services. We expect that our

previous acquisitions will enable us to strengthen the reach

and sophistication of our network facilities, increase our

large-business customer base and enhance the opportunity

to market wireless services to that customer base. Whether,

or the extent to which, growth in these areas will offset

declines in other areas of our business is not known.

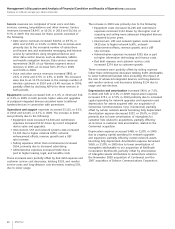

Wireless Wireless is our fastest-growing revenue stream and

we expect to deliver continued revenue growth in the coming

years. We believe that we are in a growth period of wireless

data usage and that there are substantial opportunities

available for next-generation converged services that combine

wireless, broadband, voice and video.

We cover most major metropolitan areas of the U.S. with our

Universal Mobile Telecommunications System/High-Speed

Downlink Packet Access (HSPA) and HSPA+ network

technology, with HSPA+ providing 4G speeds when combined

with our upgraded backhaul. Our network provides superior

speeds for data and video services, as well as operating

efficiencies using the same spectrum and infrastructure for

voice and data on an IP-based platform. Our wireless network

also relies on digital transmission technologies known as

GSM, General Packet Radio Services and Enhanced Data

Rates for GSM Evolution for data communications. As of

December 31, 2010, we served 95.5 million customers.

We have also begun transitioning our network to more

advanced LTE technology. We continue to expand the

number of locations, including airports and cafés, where

customers can access broadband Internet connections

using wireless fidelity (local radio frequency commonly

referred to as Wi-Fi) wireless technology.