AT&T Wireless 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

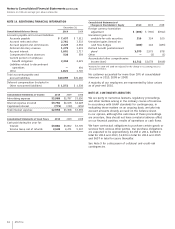

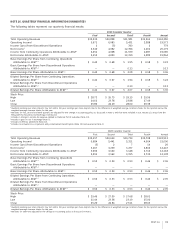

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

90 AT&T Inc.

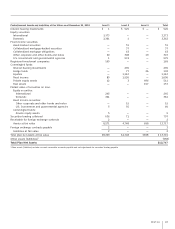

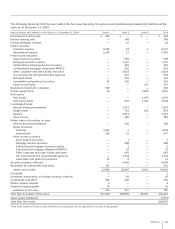

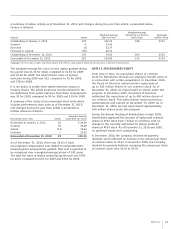

Postretirement Assets and Liabilities at Fair Value as of December 31, 2009 Level 1 Level 2 Level 3 Total

Interest bearing investments $ 372 $ — $ — $ 372

Equity securities:

International 2,121 — — 2,121

Domestic 2,363 11 — 2,374

Fixed income securities:

Asset-backed securities — 49 — 49

Collateralized mortgage-backed securities — 11 — 11

Collateralized mortgage obligations — 57 — 57

Other corporate and other bonds and notes — 276 19 295

U.S. Government and governmental agencies 16 301 — 317

Registered investment companies 182 — — 182

Futures (1) — — (1)

Commingled funds:

Interest bearing investments — 468 — 468

Hedge funds — 155 72 227

Equities 102 2,108 — 2,210

Fixed income 75 1,449 — 1,524

Private equity assets 15 6 480 501

Real assets — — 171 171

Market value of securities on loan:

Equity securities:

International 248 — — 248

Domestic 396 — — 396

Fixed income securities:

Other corporate and other bonds and notes — 13 — 13

U.S. Government and governmental agencies 25 50 — 75

Commingled funds:

Private equity assets 6 — — 6

Securities lending collateral 700 65 — 765

Receivable for foreign exchange contracts 10 — — 10

Assets at fair value 6,630 5,019 742 12,391

Foreign exchange contracts payable 10 — — 10

Written options — — — —

Liabilities at fair value 10 — — 10

Total plan net assets at fair value $6,620 $5,019 $742 $12,381

Other assets (liabilities)1 (868)

Total Plan Net Assets $11,513

1Other assets (liabilities) include accounts receivable, accounts payable and net adjustment for securities lending payable.