AT&T Wireless 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 41

OPERATING ENVIRONMENT OVERVIEW

AT&T subsidiaries operating within the U.S. are subject to

federal and state regulatory authorities. AT&T subsidiaries

operating outside the U.S. are subject to the jurisdiction

of national and supranational regulatory authorities in the

markets where service is provided, and regulation is generally

limited to operational licensing authority for the provision of

services to enterprise customers.

In the Telecommunications Act of 1996 (Telecom Act),

Congress established a national policy framework intended to

bring the benefits of competition and investment in advanced

telecommunications facilities and services to all Americans

by opening all telecommunications markets to competition

and reducing or eliminating regulatory burdens that harm

consumer welfare. However, since the Telecom Act was

passed, the Federal Communications Commission (FCC) and

some state regulatory commissions have maintained certain

regulatory requirements that were imposed decades ago

on our traditional wireline subsidiaries when they operated

as legal monopolies. Where appropriate, we are pursuing

additional legislative and regulatory measures to reduce

regulatory burdens that inhibit our ability to compete more

effectively and offer services wanted and needed by our

customers. With the advent of the Obama Administration,

the composition of the FCC has changed, and the new

Commission appears to be more open than the prior

Commission to maintaining or expanding regulatory

requirements on entities subject to its jurisdiction. In addition,

Congress, the President and the FCC all have declared a

national policy objective of ensuring that all Americans have

access to broadband technologies and services. To that end,

the FCC delivered a National Broadband Plan to Congress in

2010. The FCC has issued dozens of notices seeking comment

on whether and how it should modify its rules and policies on

a host of issues, which would affect all segments of the

communications industry, to achieve universal access to

broadband. These issues include rules and policies relating

to universal service support, intercarrier compensation and

regulation of special access services, as well as a variety of

others that could have an impact on AT&T’s operations and

revenues. However, at this stage, it is too early to assess what,

if any, impact such changes could have on us.

In addition, states representing a majority of our local service

access lines have adopted legislation that enables new video

entrants to acquire a single statewide or state-approved

franchise (as opposed to the need to acquire hundreds or

even thousands of municipal-approved franchises) to offer

competitive video services. We also are supporting efforts

to update and improve regulatory treatment for retail

services. Passage of legislation is uncertain and depends

on many factors.

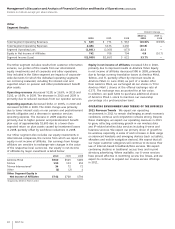

2011 Expense Trends We will continue to focus sharply

on cost-control measures, including areas such as simplifying

product offerings. We will continue our ongoing initiatives

to improve customer service and billing so we can realize

our strategy of bundling services and providing a simple

customer experience. We expect our 2011 operating income

margin to improve, as our revenues improve. Expenses related

to growth areas of our business, especially in the wireless,

U-verse and strategic business services areas, will apply

some pressure to our operating income margin. In addition,

as we complete readying our Long-Term Evolution (LTE)

technology for its intended use, we will no longer capitalize

interest on this spectrum.

Market Conditions During 2010, the securities and fixed

income markets and the banking system in general continued

to stabilize, although bank lending and the housing industry

remained weak. The ongoing weakness in the general

economy has also affected our customer and supplier bases.

We saw lower demand from our residential customers as well

as our business customers at all organizational sizes. Some of

our suppliers continue to experience increased financial and

operating costs. These negative economic trends were offset

by continued growth in our wireless data and IP-related

services. While the economy appears to have stabilized,

we do not expect a quick return to growth during 2011.

Should the economy instead deteriorate further, we likely

will experience further pressure on pricing and margins as we

compete for both wireline and wireless customers who have

less discretionary income. We also may experience difficulty

purchasing equipment in a timely manner or maintaining

and replacing warranteed equipment from our suppliers.

Included on our consolidated balance sheets are assets held

by benefit plans for the payment of future benefits. We are

not required to make significant funding contributions to our

pension plans in 2011. However, because our pension

plans are subject to funding requirements of the Employee

Retirement Income Security Act of 1974, as amended (ERISA),

a continued weakness in the equity, fixed income and real

asset markets could require us to make contributions to

the pension plans in order to maintain minimum funding

requirements as established by ERISA in future periods.

Investment returns on these assets depend largely on

trends in the U.S. securities markets and the U.S. economy.

In addition, our policy of recognizing actuarial gains and

losses related to our pension and other postretirement plans

in the period in which they arise, subjects us to earnings

volatility caused by changes in market conditions. Changes

in our discount rate, which are tied to changes in the bond

market and in the performance of equity markets, may have

significant impacts on the fair value of pension and other

postretirement plans at the end of 2011 (see “Significant

Accounting Policies and Estimates”).