AT&T Wireless 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 77

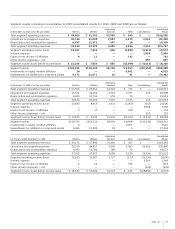

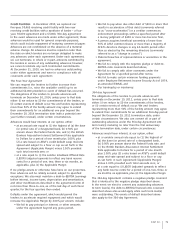

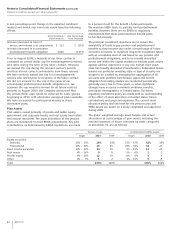

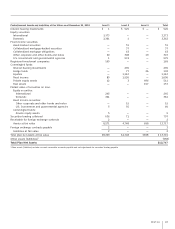

Following is the fair value leveling for available-for-sale securities and derivatives as of December 31, 2010, and December 31, 2009.

December 31, 2010

Level 1 Level 2 Level 3 Total

Available-for-Sale Securities

Domestic equities $ 976 — $ — $ 976

International equities 513 — — 513

Fixed income bonds — 639 — 639

Asset Derivatives

Interest rate swaps — 537 — 537

Cross-currency swaps — 327 — 327

Interest rate locks — 11 — 11

Foreign exchange contracts — 6 — 6

Liability Derivatives

Cross-currency swaps — (675) — (675)

Interest rate locks — (187) — (187)

Foreign exchange contracts — (2) — (2)

December 31, 2009

Level 1 Level 2 Level 3 Total

Available-for-Sale Securities

Domestic equities $1,047 $ — $ — $1,047

International equities 412 — — 412

Fixed income bonds — 341 — 341

Asset Derivatives

Interest rate swaps — 399 — 399

Cross-currency swaps — 635 — 635

Interest rate locks — 150 — 150

Foreign exchange contracts — 2 — 2

Liability Derivatives

Cross-currency swaps — (390) — (390)

Interest rate locks — (6) — (6)

Foreign exchange contracts — (7) — (7)

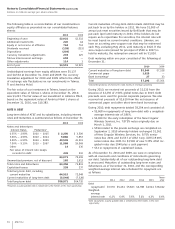

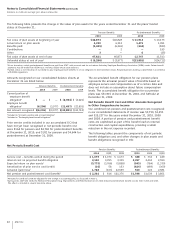

Fair Value Hedging We designate our fixed-to-floating

interest rate swaps as fair value hedges. The purpose of these

swaps is to manage interest rate risk by managing our mix

of fixed-rate and floating-rate debt. These swaps involve

the receipt of fixed-rate amounts for floating interest rate

payments over the life of the swaps without exchange of the

underlying principal amount. Accrued and realized gains or

losses from interest rate swaps impact interest expense on

the consolidated statements of income. Unrealized gains on

interest rate swaps are recorded at fair market value as assets,

and unrealized losses on interest rate swaps are recorded at

fair market value as liabilities. Changes in the fair value of

the interest rate swaps offset changes in the fair value of

the fixed-rate notes payable they hedge due to changes in

the designated benchmark interest rate and are recognized

in interest expense, though they net to zero. Gains or losses

realized upon early termination of our fair value hedges

would be recognized in interest expense.

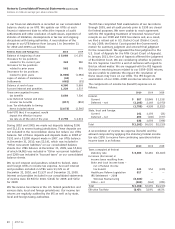

Derivative Financial Instruments

We employ derivatives to manage certain market risks,

primarily interest rate risk and foreign currency exchange risk.

This includes the use of interest rate swaps, interest rate locks,

foreign exchange forward contracts and combined interest rate

foreign exchange contracts (cross-currency swaps). We do not

use derivatives for trading or speculative purposes. We record

derivatives on our consolidated balance sheets at fair value,

which is derived from observable market data, including yield

curves and foreign exchange rates (all of our derivatives are

Level 2). Cash flows associated with derivative instruments

are presented in the same category on the consolidated

statements of cash flows as the item being hedged.

The majority of our derivatives are designated either as a

hedge of the fair value of a recognized asset or liability or

of an unrecognized firm commitment (fair value hedge), or

as a hedge of a forecasted transaction or of the variability

of cash flows to be received or paid related to a recognized

asset or liability (cash flow hedge).