AT&T Wireless 2010 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 35

We offer a large variety of handsets, including at least 18

smartphones (including Apple iPhones, our most popular

models) with advanced operating systems from eight

manufacturers. As technology evolves, rapid changes are

occurring in the handset and device industry, with the

continual introduction of new models or significant revisions

of existing models. We believe offering a wide variety of

handsets reduces dependence on any single product as these

products evolve. From time to time, we offer and have offered

attractive handsets on an exclusive basis. As these exclusivity

arrangements end, we expect to continue to offer such

handsets (based on historical industry practice), and we

believe our service plan offerings will help to retain our

customers by providing incentives not to move to a new

carrier. As noted above, more than 80% of our postpaid

subscribers are on FamilyTalk® Plans or business discount

plans that would involve moving the whole group to a new

carrier. Moreover, the vast majority of postpaid subscribers

(including FamilyTalk® Plan users) are allowed to accumulate

unused minutes (known as rollover minutes), a feature that

is currently not offered by other major postpaid carriers in

the United States, and users would lose these minutes if

they switched carriers. As is common in the industry, most

of our phones are designed to work only with our wireless

technology, requiring customers who desire to move to a

new carrier with a different technology to purchase a new

device. In addition, many of our handsets would not work or

would lose some functionality if they were used on another

carrier’s network that also used Global System for Mobile

Communications (GSM) technology, requiring the customer to

acquire another handset. Although exclusivity arrangements

are important to us, such arrangements may not provide a

competitive advantage over time, as the industry continues to

introduce new devices and services. Also, while the expiration

of any of our current exclusivity arrangements could increase

churn and reduce postpaid customer additions, we do not

expect any such termination to have a material impact on our

Wireless segment income, consolidated operating margin or

our cash from operations.

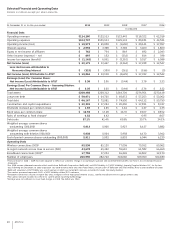

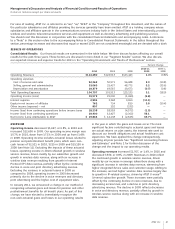

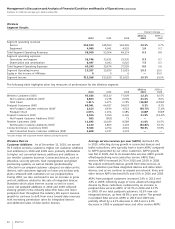

Wireless Operating Results

Our Wireless segment operating income margin was 26.1% in

2010, compared to 25.8% in 2009 after increasing from 23.6%

in 2008. The margin growth in 2010 and 2009 was primarily

due to higher data revenues generated by our customers

during those years, partially offset by the higher selling costs

associated with integrated device activations. The rate of

margin growth flattened in 2010 due to a significant number

of customers upgrading their handsets during the second half

of the year. While we subsidize the sales prices of various

integrated devices, we expect to recover that cost over time

from increased usage of the devices (especially data usage

by the customer).

Postpaid voice and other service ARPU declined due to lower

access and airtime charges, roaming revenues, and long-

distance usage. Continued growth in our family plans

(FamilyTalk® Plans) customer base, which has lower ARPU than

traditional postpaid customers, has also contributed to these

declines. We expect continued pressure on voice and other

service ARPU.

Churn The effective management of customer churn (churn

rate) is critical to our ability to maximize revenue growth and

to maintain and improve margins. Churn rate is calculated by

dividing the aggregate number of wireless customers who

cancel service during a period by the total number of wireless

customers at the beginning of that period. The churn rate for

an annual period is equal to the average of the churn rate for

each month of that period. Ongoing improvement in our total

and postpaid churn rates contributed to our net additions in

2010 and 2009. These churn rate declines reflect network

enhancements and broader coverage, more affordable rate

plans and exclusive devices, continued growth in FamilyTalk®

Plans, and free mobile-to-mobile calling among our wireless

customers. Data-centric device customers, who generally have

the lowest churn rate among our wireless customers, also

contributed to overall churn improvement due to their

increased share of net additions for 2010 and 2009.

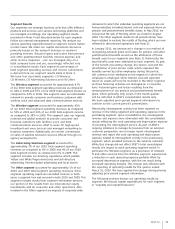

Wireless Customer Relationships

The wireless industry continues to mature. Accordingly,

we believe that future wireless growth will increasingly

depend on our ability to offer innovative services and

devices. To attract and retain customers, we offer a wide

variety of service plans in addition to offering a broad

handset line. Our postpaid customers typically sign a

two-year contract, which includes discounted handsets and

early termination fees. We also offer data plans at different

price levels, beginning as low as fifteen dollars per month,

to attract a wide variety of customers and to differentiate

us from our competitors. Many of our customers are on

FamilyTalk® Plans or business plans, which provide for

service on multiple handsets at discounted rates, and such

subscribers tend to have higher retention and lower churn

rates. As of December 31, 2010, more than 80% of our

postpaid subscribers are on FamilyTalk® Plans or business

discount plans. Such offerings are intended to encourage

existing customers to upgrade their current services and/or

add connected devices, attract customers from other

providers, and minimize customer churn. In fact, for 2010,

over 65% of our smartphone handsets were purchased by

existing AT&T customers.