AT&T Wireless 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 81

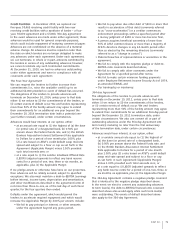

results over the average future service period of the active

employees of these plans, to the extent such gains and losses

were outside of a corridor. We have elected to immediately

recognize actuarial gains and losses in our operating results,

noting that it is generally preferable to accelerate the

recognition of deferred gains and losses into income rather

than to delay such recognition. This change will improve

transparency in our operating results by more quickly

recognizing the effects of economic and interest rate

conditions on plan obligations, investments and assumptions.

Generally, these gains and losses are measured annually as

of December 31 and accordingly will be recorded during the

fourth quarter. Additionally, for purposes of calculating the

expected return on plan assets, we will no longer use a

permitted averaging technique for the market-related value

of plan assets but instead will use actual fair value of plan

assets. We have applied these changes retrospectively,

adjusting all prior periods (see Note 1).

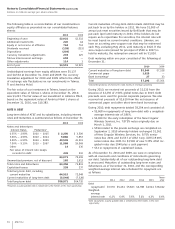

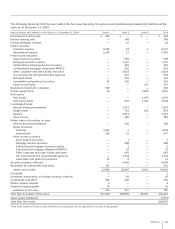

Obligations and Funded Status

For defined benefit pension plans, the benefit obligation is

the “projected benefit obligation,” the actuarial present value,

as of our December 31 measurement date, of all benefits

attributed by the pension benefit formula to employee service

rendered to that date. The amount of benefit to be paid

depends on a number of future events incorporated into the

pension benefit formula, including estimates of the average

life of employees/survivors and average years of service

rendered. It is measured based on assumptions concerning

future interest rates and future employee compensation levels.

For postretirement benefit plans, the benefit obligation is the

“accumulated postretirement benefit obligation,” the actuarial

present value as of a date of all future benefits attributed

under the terms of the postretirement benefit plan to

employee service rendered to the valuation date.

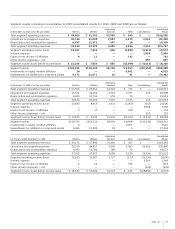

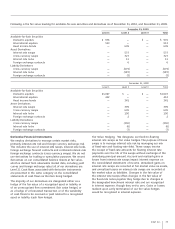

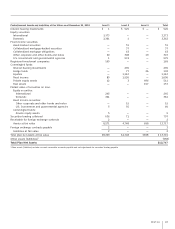

The following table presents this reconciliation and shows the

change in the projected benefit obligation for the years ended

December 31:

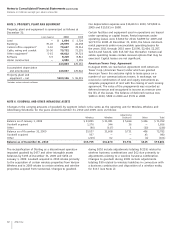

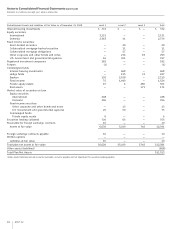

NOTE 11. PENSION AND POSTRETIREMENT BENEFITS

Pension Benefits and Postretirement Benefits

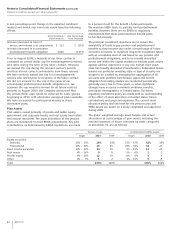

Substantially all of our U.S. employees are covered by one

of our noncontributory pension and death benefit plans.

Many of our management employees participate in pension

plans that have a traditional pension formula (i.e., a stated

percentage of employees’ adjusted career income) and a

frozen cash balance or defined lump sum formula. In 2005,

the management pension plan for those employees was

amended to freeze benefit accruals previously earned under a

cash balance formula. Each employee’s existing cash balance

continues to earn interest at a variable annual rate. After this

change, those management employees, at retirement, may

elect to receive the portion of their pension benefit derived

under the cash balance or defined lump sum as a lump sum

or an annuity. The remaining pension benefit, if any, will be

paid as an annuity if its value exceeds a stated monthly

amount. Management employees of former ATTC, BellSouth,

AT&T Mobility LLC and new hires after 2006 participate in cash

balance pension plans. Nonmanagement employees’ pension

benefits are generally calculated using one of two formulas:

benefits are based on a flat dollar amount per year according

to job classification or are calculated under a cash balance

plan that is based on an initial cash balance amount and

a negotiated annual pension band and interest credits.

Most nonmanagement employees can elect to receive their

pension benefits in either a lump sum payment or an annuity.

We also provide a variety of medical, dental and life insurance

benefits to certain retired employees under various plans and

accrue actuarially determined postretirement benefit costs as

active employees earn these benefits.

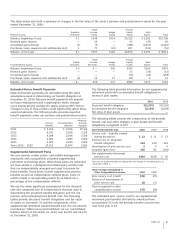

In January 2011, we announced a change in our method of

recognizing actuarial gains and losses for pension and other

postretirement benefits for all benefit plans. Historically,

we recognized the actuarial gains and losses as a component

of Stockholders’ Equity on our consolidated balance sheets

on an annual basis and amortized them into our operating

Pension Benefits Postretirement Benefits

2010 2009 2010 2009

Benefit obligation at beginning of year $50,850 $50,822 $36,225 $37,531

Service cost – benefits earned during the period 1,075 1,070 348 334

Interest cost on projected benefit obligation 3,150 3,355 2,257 2,434

Amendments 2 (685) (742) (3,115)

Actuarial loss 4,224 2,439 1,046 1,402

Special termination benefits 101 118 7 9

Benefits paid (5,485) (6,269) (2,536) (2,370)

Other — — 33 —

Benefit obligation at end of year $53,917 $50,850 $36,638 $36,225