AT&T Wireless 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

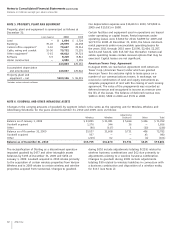

Notes to Consolidated Financial Statements (continued)

Dollars in millions except per share amounts

78 AT&T Inc.

settle or take delivery on our designated foreign exchange

contracts are amortized into income over the next few months

as the hedged funds are spent by our foreign subsidiaries,

except where a material amount is deemed to be ineffective,

which would be immediately reclassified to income. In the

year ended December 31, 2010, no ineffectiveness was

measured. No transactions were designated in the year ended

December 31, 2009.

Collateral and Credit-Risk Contingency We have entered

into agreements with most of our derivative counterparties,

establishing collateral thresholds based on respective credit

ratings and netting agreements. Collateral is exchanged on a

weekly basis. At December 31, 2010, we had posted collateral

of $82 (a deposit asset) and held collateral of $26 (a receipt

liability). Under the agreements, if our credit rating had been

downgraded one rating level by Moody’s and Fitch before

the final collateral exchange in December, we would

have been required to post additional collateral of $115.

At December 31, 2009, we held $222 of counterparty

collateral. We do not offset the fair value of collateral,

whether the right to reclaim cash collateral (a receivable)

or the obligation to return cash collateral (a payable),

against the fair value of the derivative instruments.

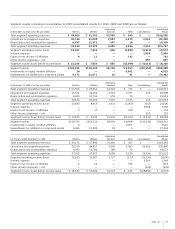

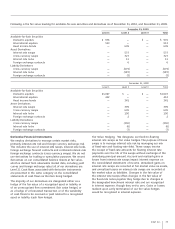

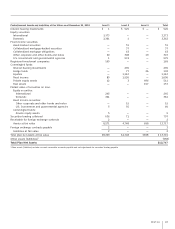

Following is the notional amount of our outstanding derivative

positions at December 31:

2010 2009

Interest rate swaps $11,050 $ 9,000

Cross-currency swaps 7,502 7,502

Interest rate locks 3,400 3,600

Foreign exchange contracts 221 293

Total $22,173 $20,395

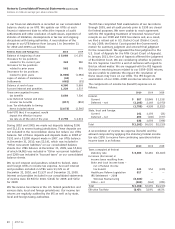

Following are our derivative instruments and their related

hedged items affecting our financial position and performance:

Fair Value of Derivatives on the Consolidated Balance Sheets

Derivatives designated as hedging instruments are reflected

as other assets, other liabilities and, for a portion of interest

rate swaps, accounts receivable at December 31.

Asset Derivatives 2010 2009

Interest rate swaps $ 537 $ 399

Cross-currency swaps 327 635

Interest rate locks 11 150

Foreign exchange contracts 6 2

Total $ 881 $1,186

Liability Derivatives 2010 2009

Cross-currency swaps $(675) $ (390)

Interest rate locks (187) (6)

Foreign exchange contracts (2) (7)

Total $(864) $ (403)

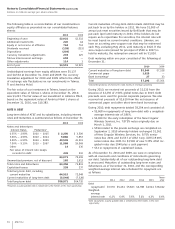

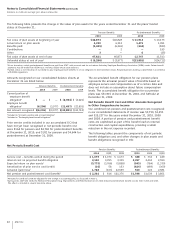

Cash Flow Hedging Unrealized gains on derivatives

designated as cash flow hedges are recorded at fair value

as assets, and unrealized losses on derivatives designated

as cash flow hedges are recorded at fair value as liabilities,

both for the period they are outstanding. For derivative

instruments designated as cash flow hedges, the effective

portion is reported as a component of accumulated OCI

until reclassified into interest expense in the same period

the hedged transaction affects earnings. The gain or loss

on the ineffective portion is recognized in other income

(expense) – net in each period.

We designate our cross-currency swaps as cash flow hedges.

We have entered into multiple cross-currency swaps to hedge

our exposure to variability in expected future cash flows that

are attributable to foreign currency risk generated from the

issuance of our Euro and British pound sterling denominated

debt. These agreements include initial and final exchanges

of principal from fixed foreign denominations to fixed U.S.

denominated amounts, to be exchanged at a specified rate,

which was determined by the market spot rate upon issuance.

They also include an interest rate swap of a fixed foreign-

denominated rate to a fixed U.S. denominated interest rate.

We evaluate the effectiveness of our cross-currency swaps

each quarter. In the years ended December 31, 2010, and

December 31, 2009, no ineffectiveness was measured.

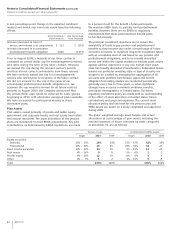

Periodically, we enter into and designate interest rate locks

to partially hedge the risk of changes in interest payments

attributable to increases in the benchmark interest rate during

the period leading up to the probable issuance of fixed-rate

debt. We designate our interest rate locks as cash flow

hedges. Gains and losses when we settle our interest rate

locks are amortized into income over the life of the related

debt, except where a material amount is deemed to be

ineffective, which would be immediately reclassified to

income. In the second quarter of 2010, we settled $200 of

notional rate locks without utilizing them in a debt issuance.

The total impact to interest expense was $(5). We are

confident our remaining rate locks will be utilized given

our probable refinancing needs over the next two years.

No other ineffectiveness was measured in the year ended

December 31, 2010. Over the next 12 months, we expect to

reclassify $15 from accumulated OCI to interest expense due

to the amortization of net losses on historical interest rate

locks. Our unutilized interest rate locks carry mandatory

early terminations, the latest occurring in April 2012.

We hedge a large portion of the exchange risk involved in

anticipation of highly probable foreign currency-denominated

transactions. In anticipation of these transactions, we often

enter into foreign exchange contracts to provide currency at

a fixed rate. Some of these instruments are designated as

cash flow hedges while others remain non-designated, largely

based on size and duration. Gains and losses at the time we