AT&T Wireless 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 AT&T Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT&T Inc. 75

•Wefailtopaywhendueotherdebtof$400ormorethat

results in acceleration of that debt (commonly referred

to as “cross-acceleration”) or a creditor commences

enforcement proceedings within a specified period after

a money judgment of $400 or more has become final,

•Apersonacquiresbeneficialownershipofmorethan

50% of AT&T common shares or more than a majority of

AT&T’s directors changes in any 24-month period other

than as elected by the remaining directors (commonly

referred to as a “change in control”),

•Materialbreachesofrepresentationsorwarrantiesinthe

agreement,

•Wefailtocomplywiththenegativepledgeordebt-to-

EBITDA ratio covenants described above,

•Wefailtocomplywithothercovenantsunderthe

Agreement for a specified period after notice,

•Wefailtomakecertainminimumfundingpayments

under Employee Retirement Income Security Act of 1974,

as amended (ERISA), and

•Ourbankruptcyorinsolvency.

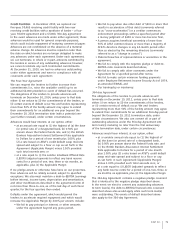

364-day Agreement

The obligations of the lenders to provide advances will

terminate on December 19, 2011, unless prior to that date

either: (i) we reduce to $0 the commitments of the lenders,

or (ii) certain events of default occur. We and lenders

representing more than 50% of the facility amount may agree

to extend their commitments for an additional 364-day period

beyond the December 19, 2011 termination date, under

certain circumstances. We also can convert all or part of

outstanding advances under the 364-day Agreement into

term loan(s) maturing no later than the first anniversary

of the termination date, under certain circumstances.

Advances would bear interest, at our option, either:

•atavariableannualrateequalto(1)thehighestof

(a) the base (or prime) rate of a designated bank,

(b) 0.50% per annum above the Federal funds rate, and

(c) the British Bankers Association Interest Settlement

Rate applicable to Dollars for a period of one month

plus 1.00%, plus (2) a rate based on AT&T’s credit default

swap mid-rate spread and subject to a floor or cap

as set forth in such Agreement (Applicable Margin)

minus 1.00% provided such total exceeds zero; or

•atarateequalto:(i)LIBOR(adjustedupwardstoreflect

any bank reserve costs) for a period of one, two, three or

six months, as applicable, plus (ii) the Applicable Margin.

The 364-day Agreement contains a negative pledge covenant

that is identical to the negative pledge described above.

In the event we elect to convert any outstanding advances

to term loan(s), the debt-to-EBITDA financial ratio covenant

described above also would apply while such term loan(s)

were outstanding. The events of default described above

also apply to the 364-day Agreement.

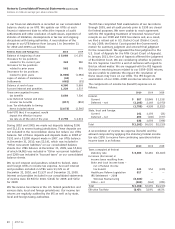

Credit Facilities In December 2010, we replaced our

five-year, $9,465 revolving credit facility with two new

revolving credit facilities with a syndicate of banks – a four-

year, $5,000 agreement and a $3,000, 364-day agreement.

In the event advances are made under either agreement, those

advances would be used for general corporate purposes,

which could include repayment of maturing commercial paper.

Advances are not conditioned on the absence of a material

adverse change. All advances must be repaid no later than

the date on which lenders are no longer obligated to make

any advances under each agreement. Under each agreement,

we can terminate, in whole or in part, amounts committed by

the lenders in excess of any outstanding advances; however,

we cannot reinstate any such terminated commitments.

At December 31, 2010, we had no advances outstanding

under either agreement and were in compliance with all

covenants under each agreement.

The Four-Year Agreement

We can request the lenders to further increase their

commitments (i.e., raise the available credit) up to an

additional $2,000 provided no event of default has occurred.

The obligations of the lenders to provide advances will

terminate on December 20, 2014, unless prior to that date

either: (i) we reduce to $0 the commitments of the lenders, or

(ii) certain events of default occur. We and lenders representing

more than 50% of the facility amount may agree to extend

their commitments for an additional one year beyond the

December 20, 2014 termination date (with a potential one-

year further renewal), under certain circumstances.

Advances would bear interest, at our option, either:

•atanannualrateequalto(1)thehighestof(a)thebase

(or prime) rate of a designated bank, (b) 0.50% per

annum above the Federal funds rate, and (c) the British

Bankers Association Interest Settlement Rate applicable

to Dollars for a period of one month plus 1.00%, plus

(2) a rate based on AT&T’s credit default swap mid-rate

spread and subject to a floor or cap as set forth in the

Agreement (Applicable Margin) minus 1.00% provided

such total exceeds zero; or

•atarateequalto:(i)theLondonInterBankOfferedRate

(LIBOR) (adjusted upwards to reflect any bank reserve

costs) for a period of one, two, three or six months, as

applicable, plus (ii) the Applicable Margin.

If we pledge assets or otherwise have liens on our properties,

then advances will be ratably secured, subject to specified

exceptions. We also must maintain a debt-to-EBITDA (earnings

before interest, income taxes, depreciation and amortization,

and other modifications described in the agreement) ratio of

not more than three-to-one, as of the last day of each fiscal

quarter, for the four quarters then ended.

Defaults under the agreement, which would permit the

lenders to accelerate required repayment and which would

increase the Applicable Margin by 2.00% per annum, include:

•Wefailtopayprincipalorinterest,orotheramounts

under the agreement beyond any grace period,