Westjet 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 98

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2013 and 2012

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

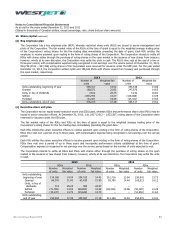

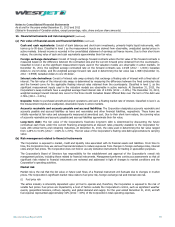

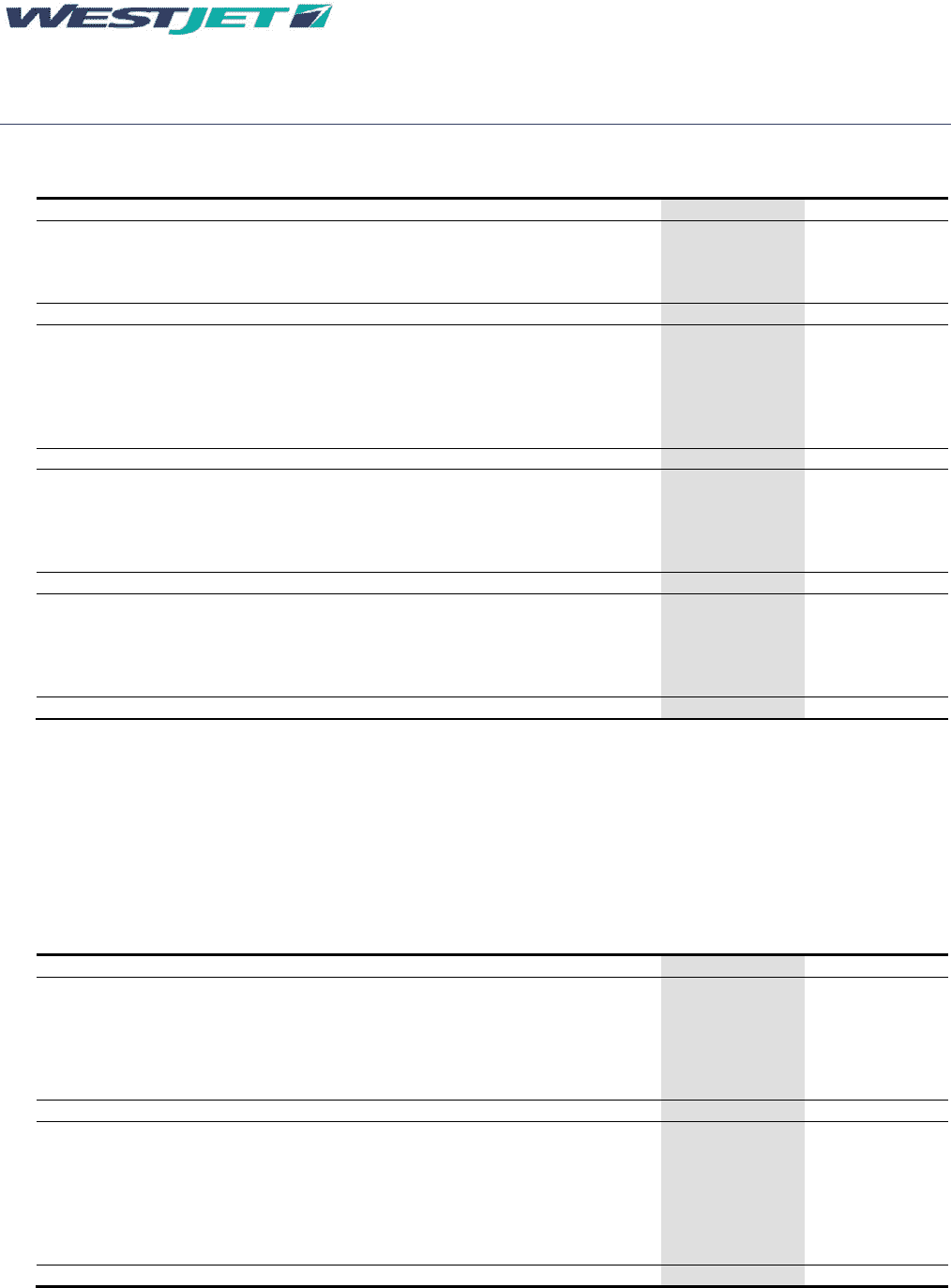

19. Additional financial information

(a) Assets

Note 2013 2012

Accounts receivable:

Trade and industry

(i)

43,198 37,633

Other 1,403 2,311

Allowance(ii)

(2,437)

(2,368)

42,164 37,576

Prepaid expenses, deposits and other:

Prepaid expenses

(iii)

43,628 35,608

Short-term deposits

(iv)

35,438 32,756

Maintenance reserves – current portion 9 49,810 32,586

Derivatives 16 4,187 800

Other 200 52

133,263 101,802

Inventory:

Fuel

24,365 23,101

Aircraft expendables 9,749 8,982

De-icing fluid 900 427

Other 1,708 3,085

36,722 35,595

Other Assets:

Aircraft deposits

(v)

47,615 44,540

Maintenance reserves – long term

9 11,851 21,277

Derivatives

16 4,103

Other(vi)

7,209 9,596

70,778 75,413

(i) Trade receivables include receivables relating to airport operations, fuel rebates, marketing programs and ancillary revenue products and services.

Industry receivables include receivables relating to travel agents, interline agreements with other airlines and partnerships. All significant counterparties

are reviewed and approved for credit on a regular basis. Trade receivables are generally settled in 30 to 60 days. Industry receivables are generally

settled in less than 30 days.

(ii) For the year ended December 31, 2013, there was $69 (2012 – $nil) in new allowances recorded. The remaining allowance was recorded in 2009

related to cargo operations.

(iii) Includes prepaid expenses for insurance, vacation package vendors and other operating costs

(iv) Includes deposits relating to aircraft fuel, airport operations, deposits on leased aircraft and other operating costs.

(v) Includes long-term deposits with lessors for leased aircraft.

(vi) Includes long-term deposits for airport operations.

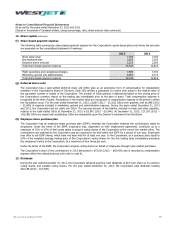

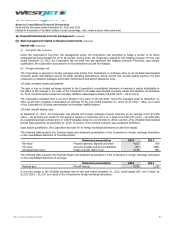

(b) Liabilities

Note 2013 2012

Accounts payable and accrued liabilities:

Trade and industry 330,836 281,574

Taxes payable 109,674 101,379

WestJet Rewards 59,082 41,117

Derivatives 16 3,249 1,509

Other 40,326 34,424

543,167 460,003

Other current liabilities:

Advance ticket sales 551,022

Non-refundable guest credits 46,975

Other liabilities:

Deferred contract incentives(i) 8,834 9,646

Derivatives 16 268

8,834 9,914

(i) Deferred contract incentives relate to discounts received on aircraft related items as well as the net effect of rent free periods and cost escalations on

land leases. Incentives, rent free periods and cost escalations are amortized over the terms of the related contracts.

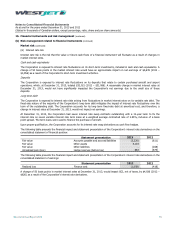

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )