Westjet 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 88

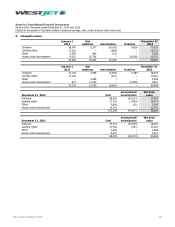

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2013 and 2012

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

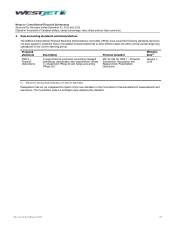

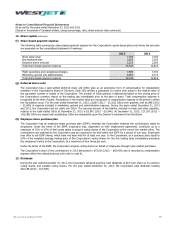

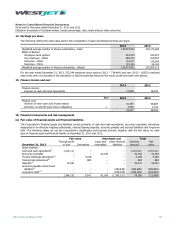

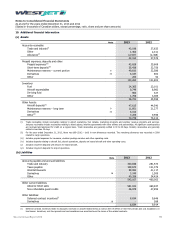

12. Share capital (continued)

(d) Key employee plan

The Corporation has a key employee plan (KEP), whereby restricted share units (RSU) are issued to senior management and

pilots of the Corporation. The fair market value of the RSUs at the time of grant is equal to the weighted average trading price

of the Corporation’s voting shares for the five trading days immediately preceding the date of grant. Each RSU entitles the

employee to receive payment upon vesting in the form of voting shares of the Corporation. The Corporation intends to settle all

RSUs with shares either through the purchase of voting shares on the open market or the issuance of new shares from treasury;

however, wholly at its own discretion, the Corporation may settle the units in cash. The RSU’s time vest at the end of a two or

three-year period, with compensation expense being recognized in net earnings over the service period. At December 31, 2013,

944,738 (2012 – 947,398) voting shares of the Corporation were reserved for issuance under the KEP plan. For the year ended

December 31, 2013, the Corporation settled 2,660 and 156,610 RSUs with shares issued from treasury and purchased through

the open market, respectively.

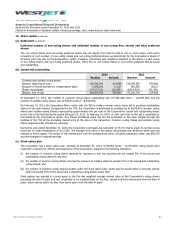

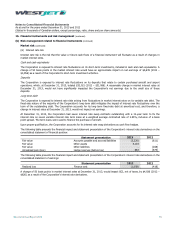

2013 2012

Number of

units

Weighted fair

value

Number of

units

Weighted fair

value

Units outstanding, beginning of year

465,417

14.52

Granted 168,571 21.92

Units, in lieu of dividends 7,612 24.75

Settled (159,270) 14.27

Forfeited (6,227) 14.49

Units outstanding, end of year

476,103

17.39

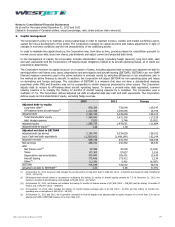

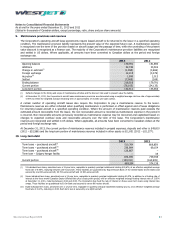

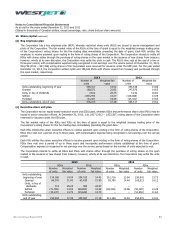

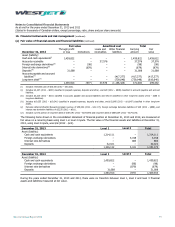

(e) Executive share unit plan

The Corporation has an equity-based executive share unit (ESU) plan, whereby RSUs and performance share units (PSU) may be

issued to senior executive officers. At December 31, 2013, 1,011,927 (2012 – 1,023,507) voting shares of the Corporation were

reserved for issuance under the ESU plan.

The fair market value of the RSUs and PSUs at the time of grant is equal to the weighted average trading price of the

Corporation’s voting shares for the five trading days immediately preceding the grant date.

Each RSU entitles the senior executive officers to receive payment upon vesting in the form of voting shares of the Corporation.

RSUs time vest over a period of up to three years, with compensation expense being recognized in net earnings over the service

period.

Each PSU entitles the senior executive officers to receive payment upon vesting in the form of voting shares of the Corporation.

PSUs time vest over a period of up to three years and incorporate performance criteria established at the time of grant.

Compensation expense is recognized in net earnings over the service period based on the number of units expected to vest.

The Corporation intends to settle all RSUs and PSUs with shares either through the purchase of voting shares on the open

market or the issuance of new shares from treasury; however, wholly at its own discretion, the Corporation may settle the units

in cash.

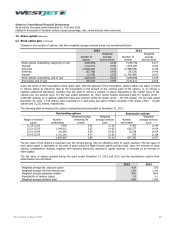

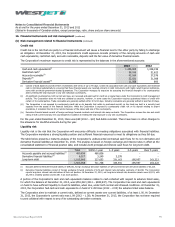

2013 2012

RSUs PSUs RSUs PSUs

Number

of units

Weighted

fair value

Number

of units

Weighted

fair value

Number

of units

Weighted

fair value

Number

of units

Weighted

fair value

Units outstanding,

beginning of year 214,168 14.54 254,515 14.41

Granted

68,205

21.82

82,635

21.89

Units, in lieu of

dividends 713 25.24 959 24.97 ––––

Settled

(71,765)

14.00

(68,893)

13.64

(50,087)

13.28

Forfeited (19,237) 14.70 (25,649) 14.70 – –

Units outstanding,

end of year 192,084 17.35 243,567 17.18

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )