Westjet 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 95

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2013 and 2012

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

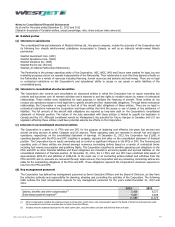

16. Financial instruments and risk management (continued)

(b) Risk management related to financial instruments (continued)

Credit risk

Credit risk is the risk that one party to a financial instrument will cause a financial loss for the other party by failing to discharge

an obligation. At December 31, 2013, the Corporation’s credit exposure consists primarily of the carrying amounts of cash and

cash equivalents, restricted cash, accounts receivable, deposits and the fair value of derivative financial assets.

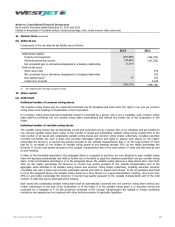

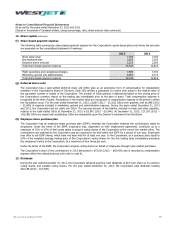

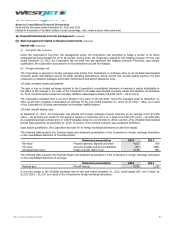

The Corporation’s maximum exposure to credit risk is represented by the balances in the aforementioned accounts:

2013 2012

Cash and cash equivalents(i)

1,256,005 1,408,199

Restricted cash(i)

58,106 51,623

Accounts receivable

(ii)

42,164 37,576

Deposits

(iii)

32,021 31,088

Derivative financial assets

(iv)

11,568 800

(i) Consist of bank balances and short-term investments with terms of up to 95 days. Credit risk associated with cash and cash equivalents and restricted

cash is minimized substantially by ensuring that these financial assets are invested primarily in debt instruments with highly rated financial institutions,

some with provincial-government-backed guarantees. The Corporation manages its exposure by assessing the financial strength of its counterparties

and by limiting the total exposure to any one individual counterparty.

(ii) All significant counterparties, both current and new, are reviewed and approved for credit on a regular basis under the Corporation’s credit management

policies. The Corporation does not hold any collateral as security, however, in some cases the Corporation requires guaranteed letters of credit with

certain of its counterparties. Trade receivables are generally settled within 30 to 60 days. Industry receivables are generally settled in less than 30 days.

(iii) The Corporation is not exposed to counterparty credit risk on its deposits that relate to purchased aircraft, as the funds are held in a security trust

separate from the assets of the financial institution. While the Corporation is exposed to counterparty credit risk on its deposit relating to airport

operations, it considers this risk to be remote because of the nature and size of the counterparty.

(iv) Derivative financial assets consist of foreign exchange forward contracts and interest rate swap contracts. The Corporation reviews the size and credit

rating of both current and any new counterparties in addition to limiting the total exposure to any one counterparty.

For the year ended December 31, 2013, there was $69 (2012 – $nil) bad debts recorded. There have been no other changes to

the allowance for doubtful accounts during the year.

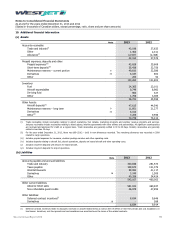

Liquidity risk

Liquidity risk is the risk that the Corporation will encounter difficulty in meeting obligations associated with financial liabilities.

The Corporation maintains a strong liquidity position and sufficient financial resources to meet its obligations as they fall due.

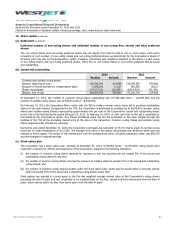

The table below presents a maturity analysis of the Corporation’s undiscounted contractual cash flows for its non -derivative and

derivative financial liabilities at December 31, 2013. The analysis is based on foreign exchange and interest rates in effect at the

consolidated statement of financial position date, and includes both principal and interest cash flows for long-term debt.

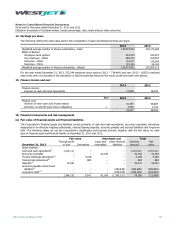

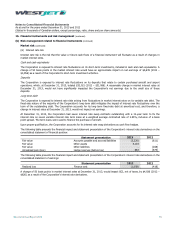

Total Within 1 year 1–3 years 3–5 years Over 5 years

Accounts payable and accrued liabilities

(i)

480,836 480,836

Derivative financial liabilities

(ii)

6,5273,2493,278

Long-term debt 1,015,995 227,653 331,163 195,957 261,222

1,503,358 711,738 334,441 195,957 261,222

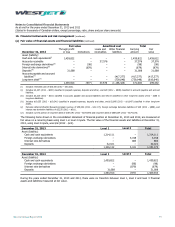

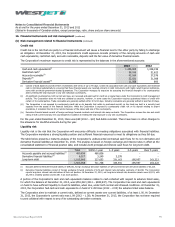

(i) Excludes deferred WestJet Rewards liability of $59,082, foreign exchange derivative liabilities of $29 and interest rate derivative liabilities of $3,220.

(ii) Derivative financial liabilities consist of foreign exchange forward contracts of $29 and interest rate derivative contracts of $6,498. The Corporation

reports long-term interest rate derivatives at their net position. At December 31, 2013, net long-term interest rate derivative assets were $4,103, with

$3,278 in a liability position and $7,381 in an asset position.

A portion of the Corporation’s cash and cash equivalents balance relates to cash collected with respect to advance ticket sales,

for which the balance at December 31, 2013, was $551,022 (2012 – $). The Corporation has cash and cash equivalents

on hand to have sufficient liquidity to meet its liabilities, when due, under both normal and stressed conditions. At December 31,

2013, the Corporation had cash and cash equivalents on hand of 2.28 times (2012 – 2.93) the advance ticket sales balance.

The Corporation aims to maintain a current ratio, defined as current assets over current liabilities, of at least 1.00. At December

31, 2013, the Corporation’s current ratio was 1.09 (2012 – ). At December 31, 2013, the Corporation has not been required

to post collateral with respect to any of its outstanding derivative contracts.

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )