Westjet 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 41

OUTLOOK

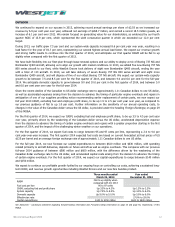

We continued to expand on our success in 2013, achieving record annual earnings per share of $2.03 as we increased our

revenue by 6.9 per cent year over year, achieved net earnings of $268.7 million, and carried a record 18.5 million guests, an

increase of 6.1 per cent over 2012. We remain focused on generating value for our shareholders, as evidenced by our fourth

quarter ROIC of 13.9 per cent, which represented the sixth consecutive quarter in which we exceeded our 12.0 per cent

target.

During 2013, our traffic grew 7.3 per cent and our system-wide capacity increased 8.6 per cent year over year, resulting in a

load factor for the year of 81.7 per cent, representing our second highest annual load factor. We expect our revenue growth

and strong traffic results to continue into the first quarter of 2014, and anticipate our first quarter RASM will be flat to up

slightly when compared with the first quarter of 2013.

We have built flexibility into our fleet plan through lease renewal options and our ability to deploy a mix of Boeing 737 NG and

Bombardier Q400 aircraft, allowing us to align our growth with market conditions. In 2013, we added five new Boeing 737 NG

800 series aircraft to our fleet, while WestJet Encore took delivery of eight new Bombardier Q400 aircraft, ending the year

with a total of 113 aircraft. In 2014, we will take delivery of seven Boeing 737 NG 800 series aircraft and eight more

Bombardier Q400 aircraft, and will dispose of five of our oldest Boeing 737 NG aircraft. We expect our system-wide capacity

growth to be between 7.5 and 8.5 per cent for the first quarter of 2014, and between 4.0 and 6.0 per cent for the full-year

2014. We anticipate domestic capacity to grow between 9.0 and 10.0 per cent in the first quarter of 2014, and between 5.0

and 6.0 per cent year over year for the full-year 2014.

Given the recent decline of the Canadian to US dollar exchange rate to approximately 1.11 Canadian dollars to one US dollar,

as well as accelerated expenses arising from the decision to advance the timing of particular engine overhauls and repairs in

anticipation of one of our suppliers providing notice recommending earlier replacement of certain parts, we now expect our

full year 2014 CASM, excluding fuel and employee profit share, to be up 1.5 to 2.5 per cent year over year, as compared to

our previous guidance of flat to up 1.0 per cent. Further information on the sensitivity of our annual operating costs, to

changes in the value of the Canadian dollar versus the US dollar, is provided under the heading

Foreign Exchange

, on page 29

of this MD&A.

For the first quarter of 2014, we expect our CASM, excluding fuel and employee profit share, to be up 3.5 to 4.5 per cent year

over year, primarily driven by the weakening of the Canadian dollar versus the US dollar, accelerated depreciation expense

from the decision to advance the timing of certain engine overhauls and repairs with a greater proportion starting in the first

quarter of 2014, and the impact of the challenging winter weather on our operations.

For the first quarter of 2014, we expect fuel costs to range between 95 and 97 cents per litre, representing a 2.0 to 4.0 per

cent year-over-year increase. The first quarter 2014 expected fuel costs are based on current forecasted jet fuel prices of US

$125 per barrel and an average foreign exchange rate of approximately 1.11 Canadian dollars to one US dollar.

For the full-year 2014, we now forecast our capital expenditures to between $610 million and $630 million, with spending

related primarily to aircraft deliveries, deposits on future aircraft as well as engine overhauls. This compares with our previous

full-year 2014 guidance of between $580 million and $600 million, with the difference driven by the weakening of the

Canadian dollar exchange rate to the US dollar, and accelerated capital costs arising from the decision to advance the timing

of certain engine overhauls. For the first quarter of 2014, we expect our capital expenditures to range between $140 million

and $150 million.

We expect to continue our profitable growth fuelled by our ongoing focus on controlling our costs, achieving a sustained long-

term ROIC, and revenue growth opportunities including WestJet Encore and our new fare bundles product.

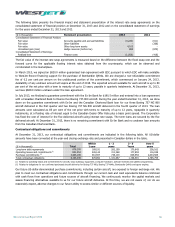

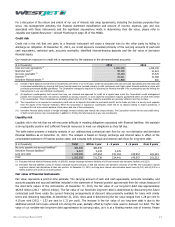

Three months ended

March 31, 2014

Year ended

December 31, 2014

RASM Flat to up slightly when

compared with Q1 2013

Fuel cost per litre

95 to 97 cents

CASM, excluding fuel and profit share Up 3.5% to 4.5% Up 1.5% to 2.5%

System capacity Up 7.5% to 8.5% Up 4.0% to 6.0%

Domestic capacity Up 9.0% to 10.0% Up 5.0% to 6.0%

Effective tax rate 27.0% to 29.0%

Capital expenditures

$140 to $150 million

$610 to $630 million

See

Advisories – Cautionary statement regarding forward-looking information

and

Forward-Looking Information

on page 20 and page 56, respectively, of this

MD&A.