Westjet 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 35

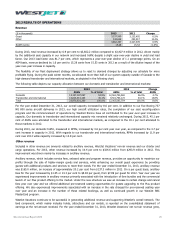

Investing cash flows

For the year ended December 31, 2013, cash flow used for investing activities totaled $715.2 million as compared to $269.3

million in the prior year. This significant year-over-year increase is mainly due to the delivery of five 737-800 aircraft, eight

Q400 aircraft, future aircraft deposits for 10 Boeing 737 NG aircraft as part of the Southwest transaction, future aircraft

deposits for 65 of Boeing’s new 737 MAX aircraft, costs incurred for owned aircraft overhauls and additional rotable parts and

spare engine acquisitions.

Financing cash flows

For the year ended December 31, 2013, our financing cash outflow of $61.5 million consisted mainly of cash inflows of $318.1

million related to the financing of five Boeing 737 NG 800 series aircraft and eight Q400 aircraft, offset by cash outflows

related to long-term debt repayments of $178.6 million, cash interest paid of $36.7 million, dividends paid of $52.2 million and

shares repurchased pursuant to our normal course issuer bid of $112.4 million. In the prior year, financing cash outflow of

$289.0 million was mainly attributable to cash inflow of $73.0 million related to the financing of two 737-800 series aircraft

and cash outflow related to long-term debt repayments of $162.7 million, cash interest paid of $43.1 million, dividends paid of

$37.5 million and share repurchases of $112.1 million.

Free cash flow

Free cash flow is a measure that represents the cash that a company is able to generate after meeting its requirements to

maintain or expand its asset base. It is a calculation of operating cash flow, less the amount of cash used in investing

activities related to property and equipment. Our free cash flow for the year ended December 31, 2013, was a negative

$107.0 million, as compared to a positive $453.3 million in the prior year. This decrease is due to the significant cash outflows

made in the current year related to five Boeing 737 NG 800 aircraft deliveries, eight Q400 aircraft deliveries, aircraft deposits

related to the Southwest transaction and Boeing MAX aircraft purchase agreement, costs incurred for owned aircraft overhauls

and additional rotable parts and spare engine acquisitions.

On a per share basis, for the year ended December 31, 2013, our free cash flow decreased 124.3 per cent to negative $0.81

per share compared to $3.33 per share in 2012.

Please refer to page 59 of this MD&A for a reconciliation of non-GAAP and additional GAAP measures.

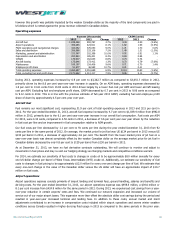

Aircraft financing

We have grown through acquisitions of Boeing 737 NG and Bombardier Q400 aircraft. Our Boeing 737 NG aircraft deliveries in

2013 were financed by secured term loans with Canadian chartered banks and guaranteed by the Export-Import Bank of the

United States (Ex-Im Bank) for approximately 85 per cent of the purchase price of the aircraft. Our Q400 aircraft deliveries in

2013 were financed by secured term loans with Export Development Canada (EDC) for approximately 80 per cent of the

purchase price of the aircraft. Our aircraft debt in 2013 was financed in Canadian dollars, eliminating the foreign exchange

exposure on any US-dollar denominated debt. At December 31, 2013, we had 59 Boeing 737 NG aircraft and eight Q400

aircraft financed with a remaining debt balance of $878.4 million, net of transaction costs. There are no financial covenant

requirements associated with our debt.

To mitigate the earnings impact of changing interest rates on our variable rate loans, we have entered into interest rate swap

agreements to fix the interest rates over the term of the loans. Upon proper qualification, we designated the interest rate

swap contracts as effective cash flow hedges for accounting purposes. At December 31, 2013, no portion of the interest rate

swap agreements was considered ineffective.