Westjet 2013 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 24

Optimization of our fleet strategy. In May 2013, we entered into an agreement with Southwest Airlines to sell 10 of

our oldest Boeing 737 Next-Generation (NG) aircraft in 2014 and 2015 and we concurrently entered into an

agreement with Boeing to purchase 10 Boeing 737 NG 800 aircraft in 2014 and 2015, effectively reducing the

average age of WestJet’s fleet by approximately one year. In September 2013, we entered into an agreement with

Boeing to purchase 65 737 MAX aircraft, consisting of firm commitments to take delivery of 25 737 MAX 7 aircraft

and 40 737 MAX 8 aircraft, with deliveries scheduled between 2017 and 2027. We anticipate that the 737 MAX

aircraft, with its fuel-efficient technology and enhanced amenities, will support our continued growth and low-cost

operating model while still providing our guests with an exceptional experience.

On a go-forward basis, we expect to continue to face upward pressures on CASM. We anticipate that the cost saving initiatives

we have identified and put into action as of the date of this MD&A will help mitigate this pressure reflected in our expectation

of full year 2014 CASM (described under the heading

Outlook

, on page 41 of this MD&A). We will continue to focus on actively

identifying and putting into action new cost saving initiatives and remaining committed to working in collaboration with all

WestJetters in setting our Company up for ongoing successful low-cost operations for years to come.

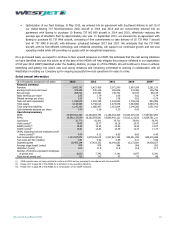

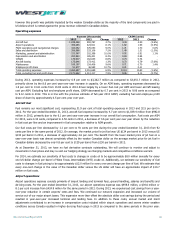

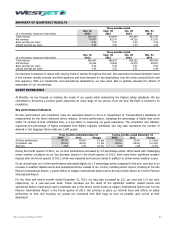

Select annual information

($ in thousands, except per unit data)

2013

2012

2011

2010

2009(i)

Financial summary

Revenue 3,662,197 3,427,409 3,071,540 2,607,294 2,281,120

Earnings before income taxes

372,085

340,229

208,006

133,465

136,796

Net earnings 268,722 242,392 148,702 90,197 98,178

Basic earnings per share 2.05 1.79 1.06 0.62 0.74

Diluted earnings per share

2.03

1.78

1.06

0.62

0.74

Cash and cash equivalents 1,256,005 1,408,199 1,243,605 1,159,316 994,989

Total assets 4,143,463 3,746,615 3,473,678 3,383,980 3,493,702

Total long-term liabilities

1,147,163

1,086,457

1,161,604

1,240,285

1,051,912

Cash dividends declared per share 0.40 0.28 0.20 0.05 ―

Operational summary

ASMs

23,970,921,260

22,063,583,754

21,186,304,409

19,535,291,313

17,587,640,902

RPMs 19,591,173,039 18,262,554,881 16,890,941,121 15,613,121,610 13,834,761,211

Load factor 81.7% 82.8% 79.7% 79.9% 78.7%

Yield (cents)(ii)

18.69

18.77

18.18

16.70

16.49

RASM (cents)(ii) 15.28 15.53 14.50 13.35 12.97

CASM (cents)

(ii)

13.61 13.83 13.29 12.37 11.77

CASM, excluding fuel and employee profit

share (cents)(iii) 9.06 9.12 8.85 8.80 8.45

Fuel consumption (litres) 1,144,937,872 1,079,108,614 1,027,821,192 950,341,292 859,115,698

Fuel costs per litre (dollars)

0.91

0.92

0.89

0.71

0.66

Segment guests 18,485,144 17,423,352 16,040,682 15,173,581 14,038,827

Average stage length (miles) 976 978 984 968 923

Utilization (hours)

12.0

11.9

11.8

11.6

11.7

Number of full-time equivalent employees

at period end 8,000 7,742 7,141 6,877 6,291

Fleet size at period end

113

100

97

91

86

(i) 2009 amounts have not been restated to conform to IFRS and are presented in accordance with Previous GAAP.

(ii) Please refer to page 59 of this MD&A for a definition of key operating indicators.

(iii) Please refer to page 59 of this MD&A for a reconciliation of non-GAAP measures.