Westjet 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 84

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2013 and 2012

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

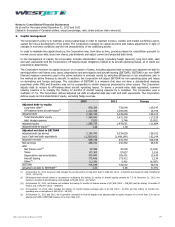

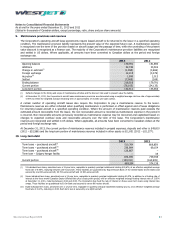

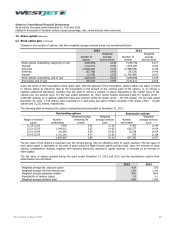

10. Long-term debt (continued)

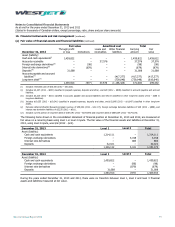

Future scheduled repayments of long-term debt at December 31, 2013 are as follows:

Within 1 year 189,191

1 – 3 years

282,199

3 – 5 years 170,843

Over 5 years 236,162

878,395

In March 2013, the Corporation signed an $820,000 loan agreement with Export Development Canada for the future purchase of

Bombardier Q400 NextGen aircraft. The Corporation is charged a non-refundable commitment fee of 0.2 per cent per annum on

the undisbursed portion of the loan. The undisbursed portion of the loan at December 31, 2013, is $688,973. Availability of any

undrawn amount expires on December 31, 2018. The expected amount available for each aircraft is up to 80 per cent of the net

price with a term to maturity of up to 12 years, repayable in quarterly instalments, including interest at a floating or fixed rate,

determined at the inception of the loan.

In July 2013, the Corporation finalized a guarantee commitment with the Ex-Im Bank for $190,489 and entered into a loan

agreement with a Canadian Chartered Bank to finance five Boeing 737-800 aircraft. For the year ended December 31, 2013, the

Corporation drew down on the guarantee commitment with Ex-Im and the Canadian Chartered Bank loan. The loan amounts are

calculated as 85 per cent of the net price with terms to maturity of up to 12 years, repayable in quarterly instalments, at a

floating rate of interest equal to the Canadian Dealer Offer Rate plus a basis point spread. The Corporation has fixed the rate of

interest for the five aircraft using interest rate swaps. The term loans are secured by the five delivered aircraft. At December 31,

2013, there is no remaining commitment with Ex-Im Bank and no undrawn loan amounts from the Canadian Chartered Bank.

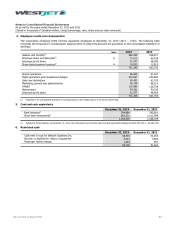

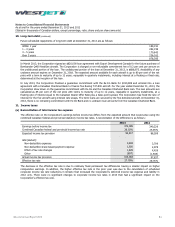

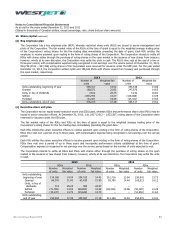

11. Income taxes

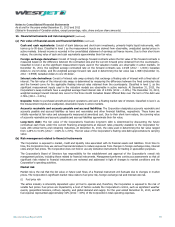

(a) Reconciliation of total income tax expense

The effective rate on the Corporation’s earnings before income tax differs from the expected amount that would arise using the

combined Canadian federal and provincial statutory income tax rates. A reconciliation of the difference is as follows:

2013

2012

Earnings before income tax 372,085 340,229

Combined Canadian federal and provincial income tax rate 26.02% 25.95%

Expected income tax provision 96,817 88,289

Add (deduct):

Non-deductible expenses 3,694 3,709

Non-deductible share-based payment expense 1,920 2,978

Effect of tax rate changes

1,829

4,426

Other

(897)

(1,565)

Actual income tax provision 103,363 97,837

Effective tax rate 27.78% 28.76%

The decrease in the effective tax rate is due to relatively fixed permanent tax differences having a smaller impact on higher

comparative earnings. In addition, the higher effective tax rate in the prior year was due to the cancellation of scheduled

corporate income tax rate reductions in Ontario that increased the Corporation’s deferred income tax expense and liability in

2012 only. There were no significant changes to corporate income tax rates in 2013 that had a significant impact on the

Corporation’s effective tax rate.

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )