Westjet 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 60

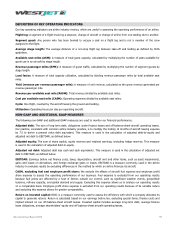

Free cash flow: Operating cash flow less capital expenditures. This measure is used to calculate the amount of cash

available that can be used to pursue other opportunities after maintaining and expanding the asset base.

Free cash flow per share: Free cash flow divided by the diluted weighted average number of shares outstanding.

Operating cash flow per share: Cash flow from operations divided by diluted weighted average shares outstanding.

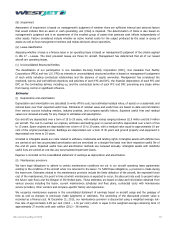

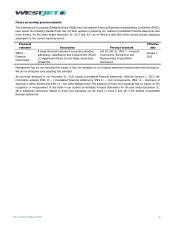

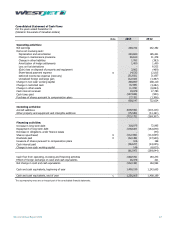

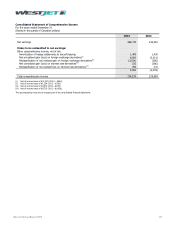

Reconciliation of non-GAAP and additional GAAP measures

The following provides a reconciliation of non-GAAP and additional GAAP measures to the nearest measure under GAAP for

items presented throughout this MD&A.

CASM, excluding fuel and employee profit share

Three months ended December 31

Twelve months ended December 31

($ in thousands) 2013 2012 Change 2013 2012 Change

Operating expenses 824,742 769,040 55,702 3,262,687 3,051,689 210,998

Aircraft fuel expense (260,528) (246,216) (14,312) (1,039,448) (992,787) (46,661)

Employee profit share expense

(12,463)

(11,639)

(824)

(51,577)

(46,585)

(4,992)

Operating expenses, adjusted

551,751

511,185

40,566

2,171,662

2,012,317

159,345

ASMs 5,942,032,692 5,487,467,646 8.3% 23,970,921,260 22,063,583,754 8.6%

CASM, excluding above items (cents) 9.29 9.32 (0.3%) 9.06 9.12 (0.7%)

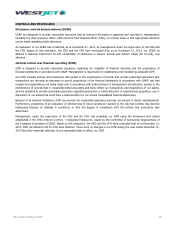

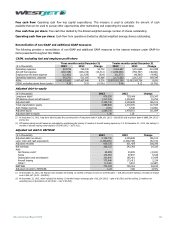

Adjusted debt-to-equity

($ in thousands)

2013

2012

Change

Long-term debt

(i)

878,395

739,048

139,347

Off-balance-sheet aircraft leases

(ii)

1,317,345

1,300,590

16,755

Adjusted debt

2,195,740

2,039,638

156,102

Total shareholders’ equity

1,589,840

1,472,305

117,535

Add: Hedge reserves

(105)

5,746

(5,851)

Adjusted equity

1,589,735

1,478,051

111,684

Adjusted debt-to-equity

1.38

1.38

–

(i) At December 31, 2013, long-term debt includes the current portion of long-term debt of $189,191 (2012 – $164,909) and long-term debt of $689,204 (2012 –

$574,139).

(ii) Off-balance-sheet aircraft leases are calculated by multiplying the trailing 12 months of aircraft leasing expense by 7.5. At December 31, 2013, the trailing 12

months of aircraft leasing costs totaled $175,646 (2012 – $173,412).

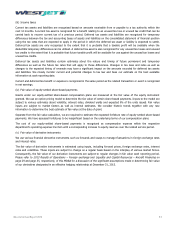

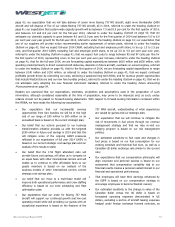

Adjusted net debt to EBITDAR

($ in thousands)

2013

2012

Change

Adjusted debt (as above) 2,195,740 2,039,638 156,102

Less: Cash and cash equivalents (1,256,005) (1,408,199) 152,194

Adjusted net debt 939,735 631,439 308,296

Net earnings 268,722 242,392 26,330

Add:

Net finance costs

(i)

25,599

30,509

(4,910)

Taxes 103,363 97,837 5,526

Depreciation and amortization 200,840 185,401 15,439

Aircraft leasing

175,646

173,412

2,234

Other(ii) (1,136) 5,451 (6,587)

EBITDAR 773,034 735,002 38,032

Adjusted net debt to EBITDAR

1.22

0.86

41.9%

(i) At December 31, 2013, net finance costs includes the trailing 12 months of finance income of $17,848 (2012 – $18,391) and the trailing 12 months of finance

cost of $43,447 (2012 – $48,900).

(ii) At December 31, 2013, other includes the trailing 12 months foreign exchange gain of $1,136 (2012 – gain of $1,061) and the trailing 12 months non-

operating loss on derivatives of $nil (2012 – loss of $6,512).