Westjet 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 83

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2013 and 2012

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

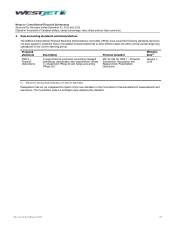

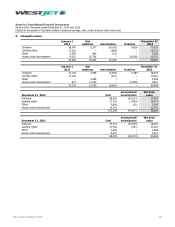

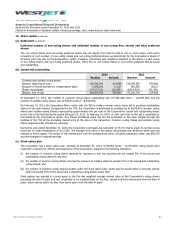

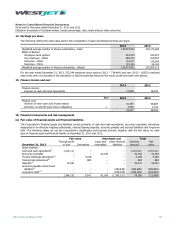

9. Maintenance provisions and reserves

The Corporation’s operating aircraft lease agreements require leased aircraft to be returned to the lessor in a specified operating

condition. The maintenance provision liability represents the present value of the expected future cost. A maintenance expense

is recognized over the term of the provision based on aircraft usage and the passage of time, while the unwinding of the present

value discount is recognized as a finance cost. The majority of the Corporation’s maintenance provision liabilities are recognized

and settled in US dollars. Where applicable, all amounts have been converted to Canadian dollars at the period end foreign

exchange rate.

2013 2012

Opening balance

179,791

151,890

Additions 32,740 33,502

Change in estimate

(i)

(1,055) (3,866)

Foreign exchange 12,115 (3,479)

Accretion

(ii)

1,990 2,013

Settled

(7,065)

(269)

Ending balance 218,516 179,791

Current portion

(76,105)

(34,135)

Long-term portion 142,411 145,656

(i) Reflects changes to the timing and scope of maintenance activities and the discount rate used to present value the liability.

(ii) At December 31, 2013, the Corporation’s aircraft lease maintenance provisions are discounted using a weighted average risk-free rate of approximately

0.99% to reflect the weighted average remaining term of approximately 27 months until cash outflow.

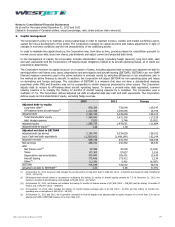

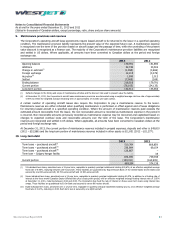

A certain number of operating aircraft leases also require the Corporation to pay a maintenance reserve to the lessor.

Maintenance reserves are either refunded when qualifying maintenance is performed or offset against end of lease obligations

for returning leased aircraft in a specified operating condition. Where the amount of maintenance reserves paid exceeds the

estimated amount recoverable from the lessor, the non-recoverable amount is recorded as maintenance expense in the period it

is incurred. Non-recoverable amounts previously recorded as maintenance expense may be recovered and capitalized based on

changes to expected overhaul costs and recoverable amounts over the term of the lease. The Corporation’s maintenance

reserves are recognized and settled in US dollars. Where applicable, all amounts have been converted to Canadian dollars at the

period end foreign exchange rate.

At December 31, 2013, the current portion of maintenance reserves included in prepaid expenses, deposits and other is $49,810

(2012 – $32,586) and the long-term portion of maintenance reserves included in other assets is $11,851 (2012 – $21,277).

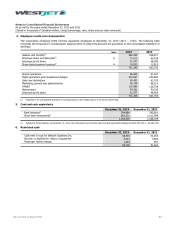

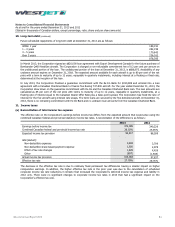

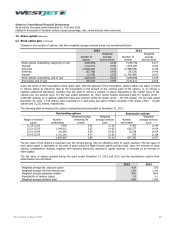

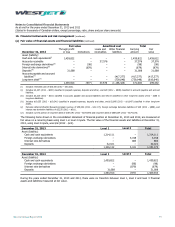

10. Long-term debt

2013 2012

Term loans – purchased aircraft

(i)

510,764 669,859

Term loans – purchased aircraft

(ii)

238,96469,154

Term loans – purchased aircraft(iii)

128,667–

Term loan – Calgary hangar facility – 35

878,395 739,048

Current portion (189,191) (164,909)

689,204 574,139

(i) 52 individual term loans, amortized over a 12-year term, repayable in quarterly principal instalments totaling $40,676, at an effective weighted average

fixed rate of 5.95%, maturing between and . These facilities are guaranteed by Export-Import Bank of the United States (Ex-Im Bank) and

secured by one 800-series aircraft, 700-series aircraft and 600-series aircraft.

(ii) Seven individual term loans, amortized over a 12-year term, repayable in quarterly principal instalments totaling $5,576, in addition to a floating rate of

interest at the three month Canadian Dealer Offered Rate plus a basis point spread, with an effective weighted average floating interest rate of 2.85%

at December 31, 2013, maturing between 2024 and 2025. The Corporation has fixed the rate of interest on these seven term loans using interest rate

swaps. These facilities are guaranteed by Ex-Im Bank and secured by seven 800-series aircraft.

(iii) Eight individual term loans, amortized over a 12-year term, repayable in quarterly principal instalments totaling $2,231, at an effective weighted average

fixed rate of 4.02%, maturing in 2025. Each term loan is secured by one Q400 aircraft.

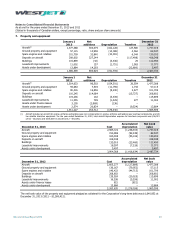

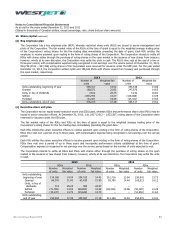

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )