Westjet 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 91

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2013 and 2012

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

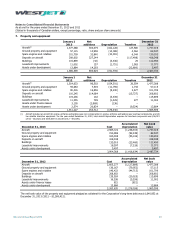

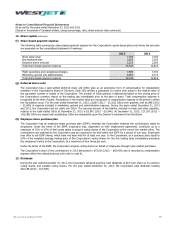

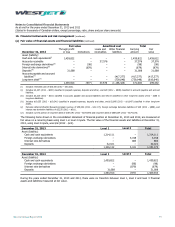

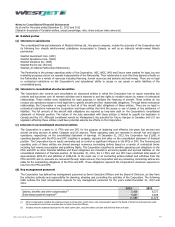

16. Financial instruments and risk management (continued)

(a) Fair value of financial assets and financial liabilities (continued)

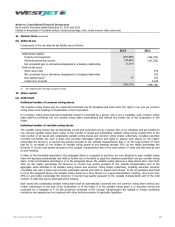

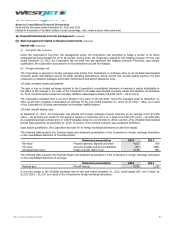

Fair value Amortized cost Total

December 31, 2012

Through profit

or loss Derivatives

Loans and

receivables

Other financial

liabilities

Carrying

amount

Fair

value

Asset (liability):

Cash and cash equivalents(i) 1,459,822 – – – 1,459,822 1,459,822

Accounts receivable – – 37,576 – 37,576 37,576

Foreign exchange derivatives

(ii)

– (98) – – (98) (98)

Interest rate derivatives

(iii)

–(879)––(879)(879)

Deposits

(iv)

31,088 – – – 31,088 31,088

Accounts payable and accrued

liabilities(v) – – – (417,377) (417,377) (417,377)

Long-term debt

(vi)

– – – (739,048) (739,048) (810,640)

1,490,910 (977) 37,576 (1,156,425) 371,084 299,492

(i) Includes restricted cash of $58,106 (2012 – $51,623).

(ii) Includes $4,187 (2012 – $800) classified in prepaid expenses, deposits and other, and $29 (2012 – $898) classified in accounts payable and accrued

liabilities.

(iii) Includes $3,220 (2012 – $611) classifed in accounts payable and accrued liabilities and $4,103 classified in other long-term assets (2012 – $268 in

long-term liabilities).

(iv) Includes $19,355 (2012 – $19,241) classified in prepaid expenses, deposits and other, and $12,666 (2012 – $11,847) classified in other long-term

assets.

(v) Excludes deferred WestJet Rewards program revenue of $59,082 (2012 – $41,117), foreign exchange derivative liabilities of $29 (2012 – $898), and

interest rate derivative liabilities of $3,220 (2012 – $611).

(vi) Includes current portion of long-term debt of $189,191 (2012 – $164,909) and long-term debt of $689,204 (2012 – $574,139).

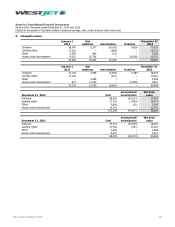

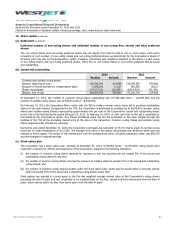

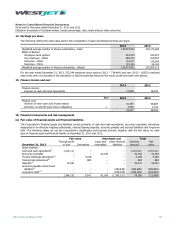

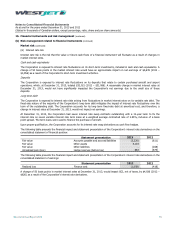

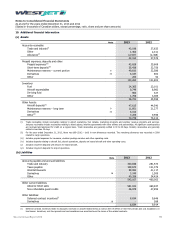

The following items shown in the consolidated statement of financial position at December 31, 2013 and 2012, are measured at

fair value on a recurring basis using level 1 or level 2 inputs. The fair value of the financial assets and liabilities at December 31,

2013, using level 3 inputs, was $nil (2012 $nil).

December 31, 2013

Level 1

Level 2

Total

Asset (liability):

Cash and cash equivalents 1,314,111 − 1,314,111

Foreign exchange derivatives − 4,158 4,158

Interest rate derivatives −883 883

Deposits 32,021 − 32,021

1,346,132 5,041 1,351,173

December 31, 2012

Level 1

Level 2

Total

Asset (liability):

Cash and cash equivalents 1,459,822 − 1,459,822

Foreign exchange derivatives − (98) (98)

Interest rate derivatives −(879) (879)

Deposits 31,088 − 31,088

1,490,910 (977) 1,489,933

During the years ended December 31, 2013 and 2012, there were no transfers between level 1, level 2 and level 3 financial

assets and liabilities measured at fair value.

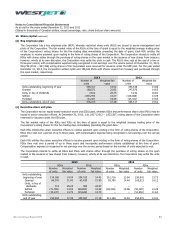

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )