Westjet 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 42

FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

Our financial assets and liabilities consist primarily of cash and cash equivalents, restricted cash, accounts receivable,

derivative instruments, identified interest-bearing deposits, accounts payable and accrued liabilities and long-term debt.

We are exposed to market, credit and liquidity risks associated with our financial assets and liabilities. From time to time, we

use various financial derivatives to reduce exposures from changes in foreign exchange rates, interest rates and jet fuel

prices. We do not hold or use any derivative instruments for trading or speculative purposes.

Our Board of Directors has responsibility for the establishment and approval of our overall risk management policies, including

those related to financial instruments. Management performs continuous assessments so that all significant risks related to

financial instruments are reviewed and addressed in light of changes to market conditions and our operating activities.

Fuel risk

The airline industry is inherently dependent upon jet fuel to operate and, therefore, we are exposed to the risk of volatile fuel

prices. Fuel prices are affected by a host of factors outside our control, such as significant weather events, geopolitical

tensions, refinery capacity, and global demand and supply. For the year ended December 31, 2013, aircraft fuel expense

represented approximately 31.9 per cent (2012 – 32.5 per cent) of our total operating expenses.

Under our fuel price risk management policy, we are permitted to hedge a portion of our future anticipated jet fuel purchases

for up to 36 months. During 2012, we decided to cease our fuel hedging program. We will continue to monitor and adjust to

movements in fuel prices and may re-visit our hedging strategy as changing markets and competitive conditions warrant. As

at and for the year ended December 31, 2013, we are not party to any fuel hedging contracts.

Foreign exchange risk

Foreign exchange risk is the risk that the fair value or future cash flows of a financial instrument would fluctuate as a result of

changes in foreign exchange rates. We are exposed to foreign exchange risks arising from fluctuations in exchange rates on

our US-dollar-denominated monetary assets and liabilities and our US-dollar-denominated operating expenditures, mainly

aircraft fuel, aircraft leasing expense, the land component of vacations packages and certain maintenance and airport

operation costs. To manage our exposure, we periodically use financial derivative instruments, such as US-dollar foreign

exchange forward contracts. Upon proper qualification, we designate our foreign exchange forward contracts as cash flow

hedges for accounting purposes.

For a discussion of the nature and extent of our use of US-dollar foreign exchange derivatives, including the business

purposes they serve, risk management activities, the financial statement classification and amount of income, expense, gain

and loss associated with these instruments and the significant assumptions made in determining their fair value, please refer

to

2013 Results of operations – Foreign exchange

on page 29 of this MD&A.

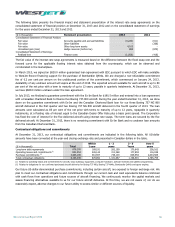

Interest rate risk

Interest rate risk is the risk that the value or future cash flows of a financial instrument will fluctuate as a result of changes in

market interest rates. We are exposed to interest rate fluctuations on short-term investments included in our cash and cash

equivalents balance. A change of 50 basis points in the market interest rate would have had an approximate impact on net

earnings of $4.6 million for the year ended December 31, 2013 (2012 – $5.0 million) as a result of our short-term investment

activities. We are also exposed to interest rate fluctuations on our deposits that relate to certain purchased aircraft and airport

operations which, at December 31, 2013, totaled $32.0 million (2012 – $31.1 million). A reasonable change in market interest

rates at December 31, 2013, would not have significantly impacted our net earnings due to the small size of these deposits.

The fixed-rate nature of the majority of our long-term debt mitigates the impact of interest rate fluctuations over the term of

the outstanding debt. We account for our long-term fixed-rate debt at amortized cost, and, therefore, a change in interest

rates at December 31, 2013, would not impact net earnings.

We are exposed to interest rate fluctuations on our variable-rate long-term debt, which, at December 31, 2013 totaled $239.0

million or 27.2 per cent of our total long-term debt. To manage this exposure, we entered into interest rate swap agreements

to fix the interest rates over the term of the loans. The swap agreements were designated as cash flow hedges for accounting

purposes.