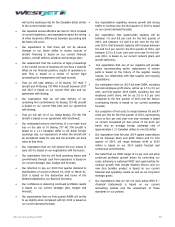

Westjet 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 68

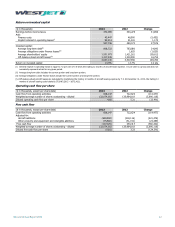

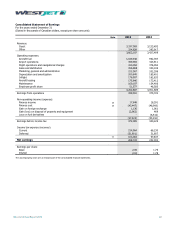

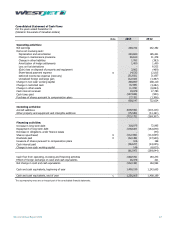

Consolidated Statement of Changes in Equity

For the years ended December 31

(Stated in thousands of Canadian dollars)

Note 2013 2012

Share capital:

Balance, beginning of year 614,899 630,408

Issuance of shares pursuant to compensation plans 11,027 16,251

Shares repurchased (22,065) (31,760)

12 603,861 614,899

Equity reserves:

Balance, beginning of year 69,856 74,184

Share-based payment expense 12 14,533 12,815

Issuance of shares pursuant to compensation plans (15,310) (17,143)

69,079 69,856

Hedge reserves:

Balance, beginning of year (5,746) (3,353)

Other comprehensive income 5,851 (2,393)

105 (5,746)

Retained earnings:

Balance, beginning of year

793,296

668,978

Dividends declared 13

(52,188)

(37,549)

Shares repurchased 12 (90,297) (80,305)

Purchase of shares pursuant to compensation plans (2,738) (220)

Net earnings 268,722 242,392

916,795 793,296

Total shareholders’ equity

1,589,840

1,472,305

The accompanying notes are an integral part of the consolidated financial statements.

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )