Westjet 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 70

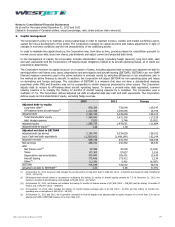

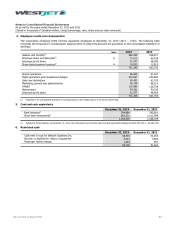

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2013 and 2012

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

1. Statement of significant accounting policies

The annual consolidated financial statements of WestJet Airlines Ltd. (the Corporation) for the years ended December 31, 2013

and 2012, were authorized for issue by the Board of Directors on February 3, 2014. The Corporation is a public company

incorporated and domiciled in Canada. The Corporation provides airline service and travel packages. The Corporation’s shares

are publicly traded on the Toronto Stock Exchange under the symbols WJA and WJA.A. The principal business address is 22

Aerial Place N.E., Calgary, Alberta, T2E 3J1 and the registered office is Suite 2400, 525 - 8 Avenue SW, Calgary, Alberta, T2P

1G1.

(a) Basis of presentation

These annual consolidated financial statements and the notes hereto have been prepared in accordance with International

Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

These annual consolidated financial statements have been prepared on an historical cost basis except for certain financial assets

and liabilities, including derivative financial instruments that are measured at fair value. Where applicable, these differences have

been described in the notes hereto.

Amounts presented in these annual consolidated financial statements and the notes hereto are in Canadian dollars, the

Corporation’s reporting currency, unless otherwise stated. The Corporation’s functional currency is the Canadian dollar.

Effective January 1, 2013, the Corporation adopted IFRS 10 – Consolidated Financial Statements, IFRS 11 – Joint Arrangements,

IFRS 12 – Disclosure of Interests in Other Entities and IFRS 13 – Fair Value Measurement. The adoption of these new standards

had no recognition or measurement impacts on the Corporation’s accounts. The new disclosure requirements relating to IFRS 12

are provided in note 18. The new disclosure requirements under IFRS 13 have been provided in note 16. There were no

retroactive restatements of prior periods applicable to the Corporation from the adoption of these new accounting standards.

(b) Principles of consolidation

The accompanying consolidated financial statements include the accounts of the Corporation and its subsidiaries. Subsidiaries

consist of entities over which the Corporation is exposed to, or has rights to, variable returns as well as the ability to affect those

returns through the power to direct the relevant activities of the entity. A description of the Corporation’s subsidiaries is provided

in note 18. All intercompany balances and transactions between the Corporation and its subsidiaries have been eliminated.

(c) Seasonality

The airline industry is sensitive to general economic conditions and the seasonal nature of air travel. The Corporation

experiences increased domestic travel in the summer months and more demand for transborder and international travel over the

winter months, thus reducing the effects of seasonality on net earnings.

(d) Revenue recognition

(i) Guest

Guest revenue, including the air component of vacation packages, are recognized when air transportation is provided. Tickets

sold but not yet used are reported in the consolidated statement of financial position as advance ticket sales.

(ii) Other

Other revenue includes items such as net revenue from the sale of the land component of vacation packages, ancillary fees as

well as cargo and charter revenue.

Revenue for the land component of vacation packages is generated from providing agency services equal to the amount paid by

the guest for products and services, less payment to the travel supplier, and is reported at the net amount received. Revenue

from the land component is deferred as advance ticket sales and recognized in earnings on completion of the vacation.

Ancillary revenue is recognized when the services and products are provided to the guest. Ancillary revenues include items such

as fees associated with guest itinerary changes or cancellations, baggage fees, buy-on-board sales, pre-reserved seating fees

and ancillary revenues from the WestJet Rewards Program.

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )