Westjet 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 86

Notes to Consolidated Financial Statements

As at and for the years ended December 31, 2013 and 2012

(Stated in thousands of Canadian dollars, except percentage, ratio, share and per share amounts)

12. Share capital (continued)

(a) Authorized (continued)

Unlimited number of non-voting shares and unlimited number of non-voting first, second and third preferred

shares

The non-voting shares and non-voting preferred shares may be issued, from time to time in one or more series, each series

consisting of such number of non-voting shares and non-voting preferred shares as determined by the Corporation’s Board of

Directors who may also fix the designations, rights, privileges, restrictions and conditions attached to the shares of each series

of non-voting shares and non-voting preferred shares. There are no non-voting shares or non-voting preferred shares issued

and outstanding.

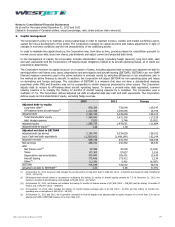

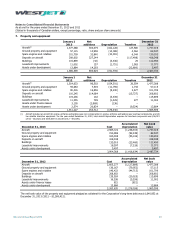

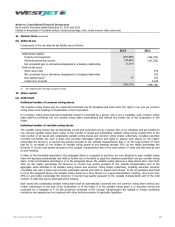

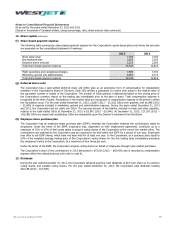

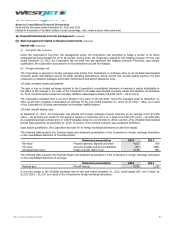

(b) Issued and outstanding

2013 2012

Number

Amount

Number

Amount

Common and variable voting shares:

Balance, beginning of year

132,256,794

614,899

Issuance of shares pursuant to compensation plans 1,086,336 11,027 890,556 16,251

Shares repurchased (4,717,710) (22,065)

Balance, end of year 128,625,420 603,861

At December 31, 2013, the number of common voting shares outstanding was 107,062,008 (2012 – 123,947,500) and the

number of variable voting shares was 21,563,412 (2012 – 8,309,294).

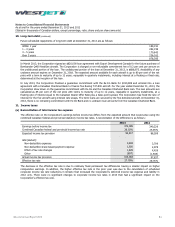

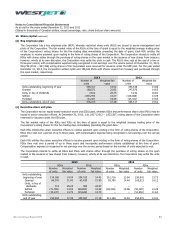

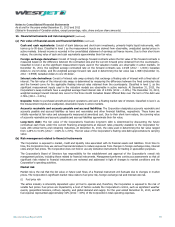

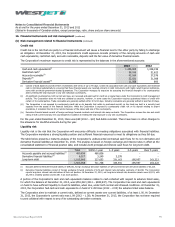

On February 14, 2013, the Corporation filed a notice with the TSX to make a normal course issuer bid to purchase outstanding

shares on the open market. As approved by the TSX, the Corporation is authorized to purchase up to 6,616,543 common voting

shares and variable voting shares (representing approximately five per cent of the Corporation’s issued and outstanding shares

at the time of the bid) during the period February 19, 2013, to February 18, 2014, or until such time as the bid is completed or

terminated at the Corporation’s option. Any shares purchased under this bid are purchased on the open market through the

facilities of the TSX at the prevailing market price at the time of the transaction. Common voting shares and variable voting

shares acquired under this bid are cancelled.

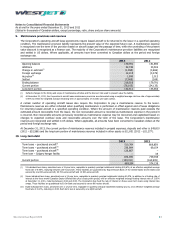

During the year ended December 31, 2013, the Corporation purchased and cancelled 4,717,710 shares under its normal course

issuer bid for total consideration of $112,362. The average book value of the shares repurchased was $4.68 per share and was

charged to share capital. The excess of the market price over the average book value, including transaction costs, was $90,297

and was charged to retained earnings.

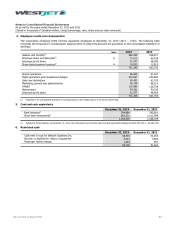

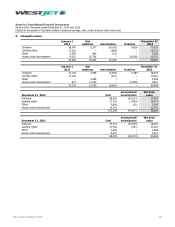

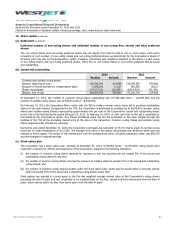

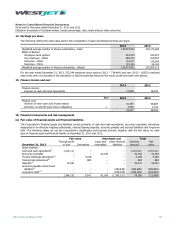

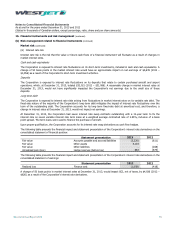

(c) Stock option plan

The Corporation has a stock option plan, whereby at December 31, 2013, 9,749,555 (2012 – 10,797,269) voting shares were

reserved for issuance to officers and employees of the Corporation, subject to the following limitations:

(i) the number of common voting shares reserved for issuance to any one optionee will not exceed 5% of the issued and

outstanding voting shares at any time;

(ii) the number of common voting shares reserved for issuance to insiders shall not exceed 10% of the issued and outstanding

voting shares; and

(iii) the number of common voting shares issuable under the stock option plan, which may be issued within a one-year period,

shall not exceed 10% of the issued and outstanding voting shares at any time.

Stock options are granted at a price equal to the five day weighted average market value of the Corporation’s voting shares

preceding the date of grant and vest completely or on a graded basis on the first, second and third anniversary from the date of

grant. Stock options expire no later than seven years from the date of grant.

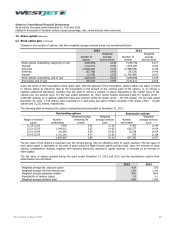

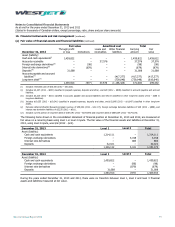

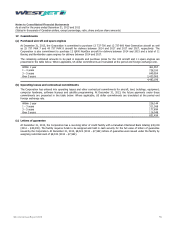

85 9 6

7 0 3)

4 1 73

46 0 6

22 0 2

5 5)

3 1 12

5 0 5

0 6 84

s

47 4 7)

2 8 )

60 1 )

47 4 7)

2) 6) 6)

0) 1) 9)

5) 7 )

2 8 )

) 3 )