Westjet 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet Annual Report 2013 37

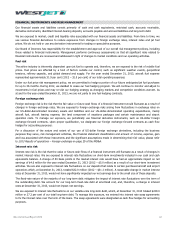

Contingencies

We are party to legal proceedings and claims that arise during the ordinary course of business. It is the opinion of

management that the ultimate outcome of these and any outstanding matters will not have a material effect upon our

financial position, results of operations or cash flows.

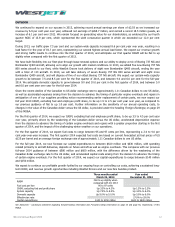

FLEET

During 2013, we took delivery of eight Bombardier Q400 aircraft and five Boeing 737 NG 800 aircraft to end the year with a

registered total fleet of 113 aircraft, with an average age of 6.8 years.

In May 2013, we announced the sale of 10 of our oldest Boeing 737 NG aircraft to take place between 2014 and 2015 to

Southwest Airlines. Due to the weakening Canadian dollar, we have revised our previously disclosed non-cash book loss range

of $60 million to $70 million, calculated using an exchange rate of 1.03, down to $50 million to $60 million calculated using an

exchange rate of 1.11 Canadian dollars to one US dollar. This non-cash book loss will be recognized closer to each aircraft’s

anticipated delivery date, in accordance with accounting guidelines. A significant portion of the book loss is driven by the

strengthening of the Canadian dollar since the aircraft were originally purchased in 2002 and 2003, thus the final book loss

will depend on the prevailing US dollar exchange rate at that time.

In September 2013, we entered into an agreement with Boeing to purchase 65 737 MAX aircraft (the MAX Transaction). This

transaction consists of firm commitments to take delivery of 25 737 MAX 7 aircraft and 40 737 MAX 8 aircraft, with deliveries

scheduled between 2017 and 2027. We also have substitution rights between these aircraft and for 737 MAX 9 aircraft. Of

these 65 aircraft, 15 represent substitutions of our then existing Boeing 737 NG aircraft orders that were scheduled to be

delivered between December 2014 and 2018, for a net increase of 50 committed deliveries to our fleet plan. We also have

options to purchase an additional 10 737 MAX aircraft between the years 2020 and 2021.

As at December 31, 2013, in addition to the above MAX Transaction, we have firm commitments to take delivery of 25 Boeing

737 NG aircraft and 12 Bombardier Q400s. We have 44 Boeing 737 NG aircraft leases expiring between 2014 and 2023, each

with the option to renew. Subsequent to December 31, 2013, we extended one of the three leases previously scheduled to be

returned in 2014. We expect to extend the other two in early 2014. The combination of our firm commitments, our sale to

Southwest and the lease renewal options provides us with the flexibility to optimize our fleet size and age.