Westjet 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2012 and 2011

(Stated in thousands of Canadian dollars, except share and per share amounts)

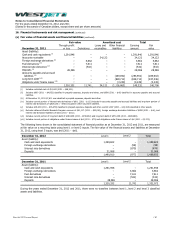

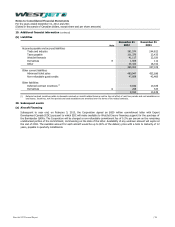

19. Additional financial information (continued)

(b) Liabilities

Note

December 31

2012

December 31

2011

Accounts payable and accrued liabilities:

Trade and industry

281,574

244,822

Taxes payable

101,379

23,433

WestJet Rewards

41,117

22,020

Derivatives

16

1,509

112

Other

34,424

16,722

460,003

307,109

Other current liabilities:

Advanced ticket sales

Non-refundable guest credits

Other liabilities:

Deferred contract incentives (i)

9,646

10,029

Derivatives

16

268

420

9,914

10,449

(i) Deferred contract incentives relate to discounts received on aircraft related items as well as the net effect of rent free periods and cost escalations on

land leases. Incentives, rent free periods and costs escalations are amortized over the terms of the related contracts.

20. Subsequent events

(a) Aircraft Financing

Subsequent to year end, on February 5, 2013, the Corporation signed an $820 million commitment letter with Export

Development Canada (EDC) pursuant to which EDC will make available to WestJet Encore financing support for the purchase of

the Bombardier Q400s. The Corporation will be charged a non-refundable commitment fee of 0.2% per annum on the remaining

undisbursed portion of the commitment, commencing on the date of the letter. Availability of any undrawn amount will expire at

the end of 2018. The available amount for each aircraft would be up to 80% of the delivery price with a term to maturity of 12

years, payable in quarterly installments.

WestJet 2012 Annual Report

/ 95