Westjet 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2012 Annual Report / 33

L

L

T

i

m

c

2

o

i

n

P

b

T

n

s

W

a

s

D

r

D

D

O

D

a

D

a

w

S

(

C

L

C

E

N

C

C

O

D

i

m

w

f

o

o

A

V

r

L

IQUIDITY

A

L

iquidity

T

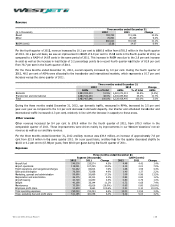

he airline ind

u

m

perative to a

c

ompleted 201

2

2

011. This incr

o

ffsetting the

$

n

terest paid, a

n

P

art of our ca

s

b

alance at Dec

e

T

ypically, we h

a

n

ormal and str

e

s

ales balance.

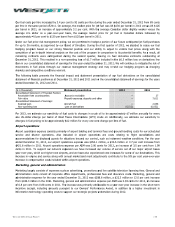

W

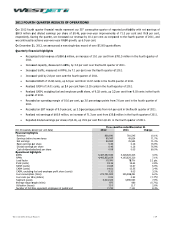

e monitor ca

p

a

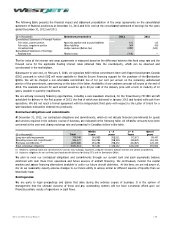

djusted debt-

t

s

heet aircraft

o

D

ecember 31,

r

esult of net

e

D

ecember 31,

D

ecember 31,

2

O

ur current ra

t

D

ecember 31,

2

a

ccounts paya

b

D

uring the thir

d

a

vailable to us

w

as secured b

y

S

elec

t

cash f

lo

(

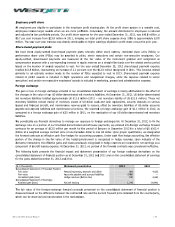

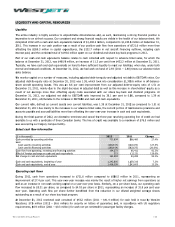

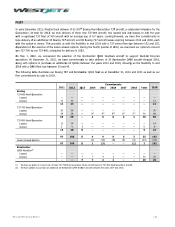

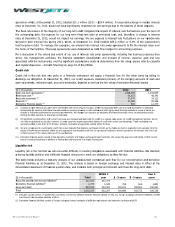

$ in thousands)

C

ash provided b

y

L

ess:

Cash used by i

Cash used by

f

C

ash flow from

o

E

ffect of forei

g

n

N

et change in ca

C

ash and cash e

q

C

ash and cash e

q

O

perating ca

s

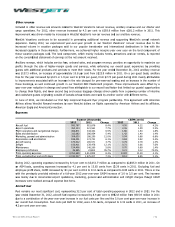

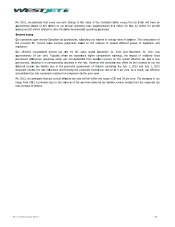

D

uring 2012,

m

provement o

w

ell as an incr

e

f

low increased

o

ver year. Op

e

o

utstanding as

A

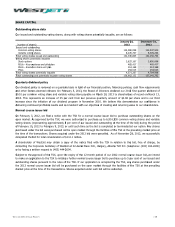

t December

3

V

acations; $7.

6

r

equirements,

$

A

ND CAPIT

A

u

stry is highly

n airline’s suc

c

2

with a cash

a

r

ease in our c

a

$

269.3 million

n

d the combin

e

s

h and cash e

q

e

mber 31, 20

1

a

ve cash and

c

e

ssed conditio

n

p

ital on a num

b

t

o-equity ratio

o

perating leas

e

2011, mainly

d

e

arnings more

2012, our ad

j

2

011, attributa

t

io, defined as

2

011 due mai

n

b

le and accrue

d

d

quarter of 2

0

with a syndic

a

y

our Calgary

C

lo

w informat

i

y

operating activ

nvesting activiti

e

f

inancin

g

activiti

e

o

perating, investi

exchan

g

e on ca

s

sh and cash eq

u

q

uivalents, begi

n

q

uivalents, end

o

s

h flo

w

s

cash from op

o

f 27.4 per ce

n

e

ase in non-ca

s

to $5.31 per

s

e

rating cash f

l

a result of our

3

1, 2012 restri

6

million (201

1

$

0.9 million (2

0

A

L RESOUR

C

sensitive to u

n

c

ess. Our consi

s

a

nd cash equi

v

a

sh position w

a

in capital ex

p

e

d total of $14

q

uivalents bal

a

1

2, was $480.

9

c

ash equivalen

t

n

s. At Decemb

e

b

er of measur

e

at December

3

e

s. This was

a

d

ue to the slig

than offsetti

n

j

usted net de

b

ble to the incr

e

current asset

s

ly to the incre

a

d

liabilities mor

0

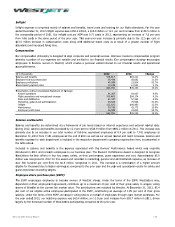

12, we electe

d

a

te of three Ca

C

ampus facility.

i

o

n

ities

e

s

e

s

ng and financin

g

s

h and cash equ

i

u

ivalents

n

ning of year

o

f year

erations incre

a

t. This year-o

v

sh working ca

p

s

hare, as com

p

l

ow per share

share buy-ba

c

cted cash con

1

– $6.6 milli

o

0

11 – $0.3 mill

C

ES

n

predictable ci

r

stent and stro

n

v

alents balanc

e

a

s a result of

o

p

enditures, th

e

9.6 million sp

e

a

nce relates to

9

million, an in

c

t

s on hand to

h

e

r 31, 2012,

w

e

s, including a

d

3

1, 2012 was

a

n 8.6 per ce

n

ht decrease i

n

n

g equity cost

s

b

t to EBITDA

R

e

ase in EBITD

A

s

over current

a

ses in our ad

v

e than offsetti

n

d

to terminate

nadian banks.

g

activities

valents

a

sed to $721

.

v

er-year incre

a

p

ital on a year

-

p

ared to $4.03

further bene

f

c

k program.

sisted of $43.

2

o

n) for securit

y

ion) for cash n

r

cumstances a

n

n

g financial re

s

e

of $1,408.2

m

o

ur positive ca

e

$132.7 milli

o

e

nt on our divi

d

cash collecte

d

crease of 11.3

h

ave sufficient

w

e had cash on

d

justed debt-t

o

1.38, which t

o

n

t improveme

n

n

adjusted deb

t

s

associated

w

R

ratio improv

A

R and cash a

n

liabilities, was

v

ance ticket sa

l

n

g the year-ov

e

and cancel th

e

The line of cr

e

.

6 million co

m

a

se was mainly

-over-year bas

per share in

2

f

itted from th

e

2 million (201

y on letters o

ot yet remitte

d

s

n

d, as such,

m

s

ults are visibl

e

m

illion, compar

a

sh flow from

o

o

n in net airc

d

end and shar

e

d

with respect

per cent fro

m

liquidity to m

e

n

hand of 2.93

o

-equity and a

d

o

ok into consid

n

t from our a

d

t

as well as t

h

w

ith our shar

e

v

ed by 38.1 p

e

n

d cash equiva

l

1.38 at Dece

m

l

es, the curren

t

e

r

-year increa

s

e three-year r

e

e

dit was avail

a

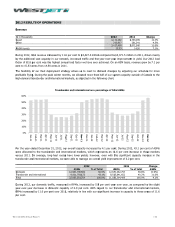

2012

721,

6

(269,3

(288,0

164,

2

3

164,

5

1,243,

6

1,408,

1

m

pared to $5

6

y

the result of

s

is. Similarly, o

n

2

011, represe

n

e

reduction in

1 – $41.4 mil

l

o

f guarantee;

a

d

for passenge

r

s

m

aintaining a s

t

e

in the health

r

ed to $1,243.

6

o

perations of

$

c

raft financing

e

buy-back pro

g

to advance ti

m

$432.2 millio

n

e

et our liabiliti

e

(2011 – 2.88)

d

justed net de

b

d

eration $1,30

0

d

justed debt-t

o

h

e increase in

e

buy-back an

d

e

r cent to 0.

8

l

ents.

m

ber 31, 201

2

t portion of m

a

s

e in cash and

e

volving opera

t

a

ble to a maxi

m

201

6

34

5

07) (1

1

54) (3

6

2

73

3

21

(

5

94

6

05 1,

1

1

99 1,

2

6

6.5 million i

n

higher net ea

r

n a per share

n

ting an incre

a

our diluted

w

l

ion) for cash

a

nd, in accor

d

r

facility charg

e

s

trong financial

of our balanc

e

6

million at De

c

$

721.6 million

outflows, incl

u

g

rams in 2012

.

cket sales, for

n at Decembe

r

e

s, when due,

times our ad

v

b

t to EBITDAR

0

.6 million in

o

o

-equity ratio

shareholders’

e

d dividend pr

o

8

6, compared

2

as compared

a

intenance pro

v

cash equivale

n

ting line of cr

e

m

um of $76.5

1 C

h

5

66,460

1

8,373)

6

2,675)

85,412

(

1,123)

84,289

1

59,316

2

43,605

n

2011, repre

s

r

nings from op

basis, our ope

a

se of 31.8 pe

r

w

eighted aver

a

held in trust

b

d

ance with US

e

s.

│

position is

e

sheet. We

c

ember 31,

more than

u

ding cash

.

r

which the

r

31, 2011.

under both

v

ance ticket

ratios. Our

o

ff-balance-

of 1.51 at

e

quity as a

o

grams. At

to 1.39 at

to 1.51 at

visions and

n

ts.

e

dit we had

million and

h

ange

27.4%

127.5%

(20.6%)

92.3%

128.6%

95.3%

7.3%

13.2%

senting an

erations as

rating cash

r

cent year

a

ge shares

b

y WestJet

regulatory