Westjet 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2012 and 2011

(Stated in thousands of Canadian dollars, except share and per share amounts)

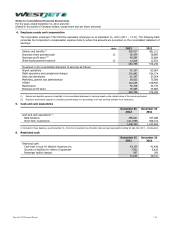

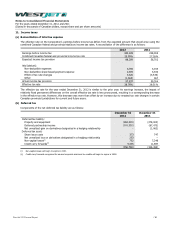

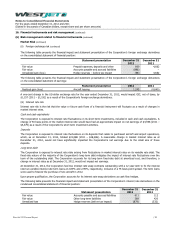

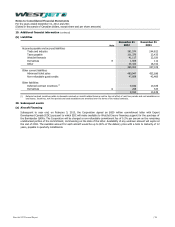

14. Earnings per share

The following reflects the share data used in the computation of basic and diluted earnings per share:

2012

2011

Weighted average number of shares outstanding – basic

Effect of dilution

Employee stock options

Key employee and pilot - Restricted share units

Executive - Restricted share units

Executive - Performance share units

Weighted average number of shares outstanding – diluted

For the year ended December 31, 2012, 734,448 employee stock options (2011 – 3,646,624) and 8,932 (2011 – nil) restricted

share units were not included in the calculation of dilutive potential shares as the result would have been anti-dilutive.

There have been no other transactions involving shares between the reporting date and the date of completion of these

statements.

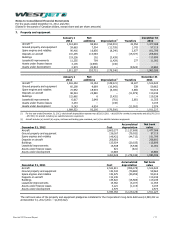

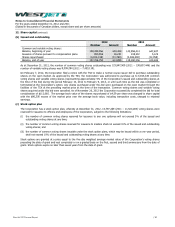

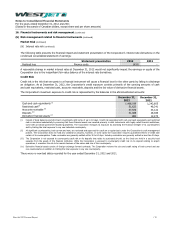

15. Finance income and cost

2012

2011

Finance income:

Interest on cash and cash equivalents

18,391

15,987

Note

2012

2011

Finance cost:

Interest on term loans and finance leases

46,887

55,833

Accretion on aircraft lease return obligations

9

2,013

5,078

48,900

60,911

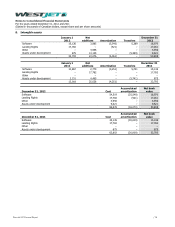

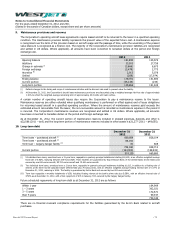

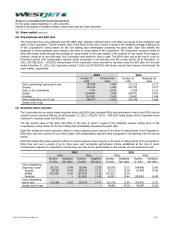

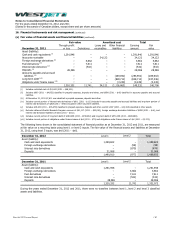

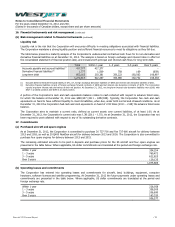

16. Financial instruments and risk management

(a) Fair value of financial assets and financial liabilities

The Corporation’s financial assets and liabilities consist primarily of cash and cash equivalents, restricted cash, accounts

receivable, derivative instruments designated and not designated in an effective hedging relationship, certain interest-bearing

deposits, accounts payable and accrued liabilities, long-term debt and obligations under finance leases. The following tables set

out the Corporation’s classification and carrying amount, together with the fair value, for each type of financial asset and

financial liability as at December 31, 2012 and 2011:

Fair value

Amortized cost

Total

December 31, 2012

Through profit

or loss

Derivatives

Loans and

receivables

Other financial

liabilities

Carrying

amount

Fair

value

Asset (liability):

Cash and cash equivalents (i)

1,459,822

–

–

–

1,459,822

1,459,822

Accounts receivable

–

–

37,576

–

37,576

37,576

Foreign exchange derivatives (ii)

–

(98)

–

–

(98)

(98)

Interest rate derivatives (iv)

–

(879)

–

–

(879)

(879)

Deposits (v)

31,088

–

–

–

31,088

31,088

Accounts payable and accrued

liabilities (vi)

–

–

–

(417,377)

(417,377)

(417,377)

Long-term debt (vii)

–

–

–

(739,048)

(739,048)

(810,640)

1,490,910

(977)

37,576

(1,156,425)

371,084

299,492

WestJet 2012 Annual Report

/ 86