Westjet 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

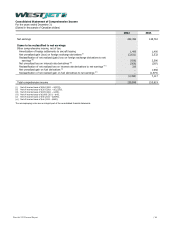

Notes to Consolidated Financial Statements

For the years ended December 31, 2012 and 2011

(Stated in thousands of Canadian dollars, except share and per share amounts)

1. Significant accounting policies (continued)

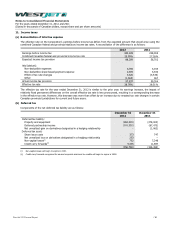

(p) Income taxes

Current tax assets and liabilities are recognized based on amounts receivable from or payable to a tax authority within the next

12 months. A current tax asset is recognized for a benefit relating to an unused tax loss or unused tax credit that can be carried

back to recover current tax of a previous period.

Deferred tax assets and liabilities are recognized for temporary differences between the tax and accounting bases of assets and

liabilities on the consolidated statement of financial position using the tax rates that are expected to apply in the period in which

the deferred tax asset or liability is expected to settle. The tax rates that are expected to be applied in future periods are based

on the enacted or substantively enacted rates known at the end of the reporting period. Deferred tax assets are only recognized

to the extent that it is probable that a taxable profit will be available when the deductible temporary differences can be utilized.

A deferred tax asset is also recognized for any unused tax losses and unused tax credits to the extent that it is pro bable that

future taxable profit will be available for use against the unused tax losses and unused tax credits. Deferred tax assets and

liabilities are not discounted.

Current and deferred tax benefit or expense is recognized in the same period as the related transaction or event is recognized in

net earnings. Current and deferred tax benefit or expense related to transactions or events in other comprehensive income or

equity are recognized directly in those accounts.

Current tax assets and liabilities are offset on the consolidated statement of financial position to the extent the Corporation has

a legally enforceable right to offset and the amounts are levied by the same taxation authority or when the Corporation has t he

right to offset and intends to settle on a net basis or realize the asset and settle the liability simultaneously. Deferred tax assets

and liabilities are classified as long-term.

(q) Share-based payment plans

Equity-settled share-based payments to employees are measured at the fair value of the equity instrument granted. An option

valuation model is used to fair value stock options issued to employees on the date of grant. The market value of the

Corporation’s voting shares on the date of the grant is used to determine the fair value of the equity-based share units issued to

employees on the date of grant.

The cost of the equity-settled share-based payments is recognized as compensation expense with a corresponding increase in

equity reserves over the related service period provided to the Corporation. The service period may commence prior to the grant

date with compensation expense recognition being subject to specific vesting conditions and the best estimate of equity

instruments expected to vest. Estimates related to vesting conditions are reviewed regularly with any adjustments recorded to

compensation expense. On the vesting date, the Corporation revises, if necessary, the estimate to equal the number of equity

instruments ultimately vested and adjusts the corresponding compensation expense and equity reserves accordingly.

Market conditions attached to certain equity-settled share-based payments are taken into account when estimating the fair value

of the equity instruments granted.

Upon exercise or settlement of equity-based instruments, consideration received, if any, together with amounts previously

recorded in the equity reserves, are recorded as an increase in share capital.

Cash-settled share-based payments are measured based on the fair value of the cash liability. The amount determined is

recorded as compensation expense and recognized over the service period. The liability is remeasured each period with a

corresponding adjustment to the related compensation expense until the date of settlement.

(r) Earnings per share

Basic earnings per share is calculated by dividing net earnings attributable to equity holders by the weighted average number of

voting shares outstanding during the period, accounting for any changes to the number of voting shares outstanding without a

corresponding change in resources.

Diluted earnings per share is calculated by dividing net earnings attributable to equity holders by the weighted average number

of voting shares outstanding adjusted for the effects of all potential dilutive voting shares. Potential dilutive voting shares are

only those shares that would result in a decrease to earnings per share or increase to loss per share. The calculation of potential

dilutive voting shares assumes the exercise of all dilutive instruments at the average market price during the period with the

proceeds received from exercise assumed to reduce the number of dilutive voting shares otherwise issued.

WestJet 2012 Annual Report

/ 71