Westjet 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2012 Annual Report / 57

R

(

E

A

I

R

(

(

(

(

O

(

C

W

D

F

(

C

A

W

D

R

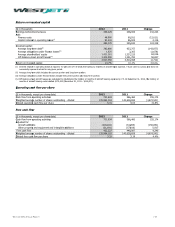

eturn on in

v

(

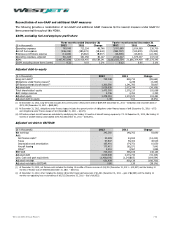

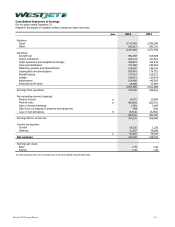

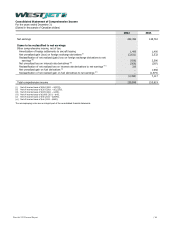

$ in thousands)

E

arnings before

i

A

dd:

Finance costs

Implicit intere

s

I

nvested capital:

Average long-t

Avera

g

e obli

ga

Average share

h

Off-balance-sh

R

eturn on invest

e

i) Interest implici

t

necessarily rep

r

ii) Average long-t

e

iii) Average obli

g

a

t

iv) Off-balance-sh

e

months of airc

r

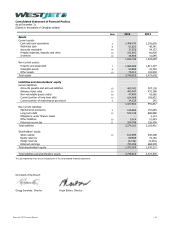

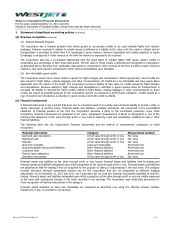

O

perating ca

s

(

$ in thousands,

C

ash flow from

o

W

eighted avera

g

D

iluted operatin

g

F

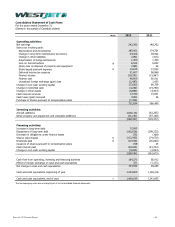

ree cash flo

w

(

$ in thousands,

C

ash flow from

o

A

djusted for:

Aircraft additi

o

Other propert

y

Free cash flow

W

eighted avera

g

D

iluted free cas

h

v

ested capita

l

i

ncome taxes

s

t in operating le

a

t

erm debt

(ii)

a

tions under fina

n

h

olders' equity

eet aircraft leas

e

e

d capital

t

in operating leas

e

r

esent actual for a

n

e

rm debt includes

t

t

ions under financ

e

e

et aircraft leases

a

r

aft leasin

g

costs t

o

s

h flow per s

h

except per shar

e

o

peratin

g

activiti

e

g

e number of sh

a

g

cash flow per s

w

except per shar

e

o

perating activiti

e

o

ns

y

and equipment

g

e number of sh

a

h

flow per share

l

ases

(i)

n

ce leases

(iii)

e

s

(i

v

)

e

s is equal to 7.0 p

e

n

y given period.

t

he current portion

e

leases include th

e

a

re calculated by

m

o

talled $173,412 (

D

h

ar

e

e

data)

e

s

a

res outstanding

s

hare

e

data)

e

s

and intangible

a

a

res outstanding

e

r cent of 7.5 time

s

and long-term po

r

e

current portion a

n

m

ultiplying the traili

n

D

ecember 31, 2011

- diluted

a

dditions

- diluted

s the trailing 12 m

o

r

tion.

n

d lon

g

-term porti

o

ng 12 months of ai

– $165,571).

s

2012

340,229

48,900

91,041

480,170

783,880

1,625

1,421,261

1,300,590

3,507,356

13.7%

o

nths of aircraft le

a

o

n.

i

rcraft leasing exp

e

2012

721,634

135,964,118

5.31

2012

721,634

(218,116)

(51,191)

452,327

135,964,118

3.33

s

2011

208

,

60

,

86

,

355

,

927

,

3

,

1,337

,

1,241

,

3,510

,

10

a

se expense. 7.0 p

e

e

nse by 7.5. At De

c

2011

566

,

140,638

,

4

2011

566

,

(61,

2

(57,

1

448

,

140,638

,

3

s

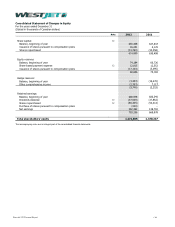

Ch

a

,

006

,

911

,

925

,

842

,

757

,

303

,

225

,

783

,

068

.1%

er cent is a proxy

a

c

ember 31, 2012, t

h

Ch

a

,

460

,

659 (

4

.03

Ch

a

,

460

2

65)

1

08)

,

087

,

659 (

3

.19

│

a

nge

132,223

(12,011)

4,116

124,328

(143,877)

(1,678)

84,036

58,807

(2,712)

3.6 pts.

a

nd does not

he trailing 12

a

nge

155,174

4,674,541)

31.8%

a

nge

155,174

(156,851)

5,917

4,240

4,674,541)

4.4%