Westjet 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2012 and 2011

(Stated in thousands of Canadian dollars, except share and per share amounts)

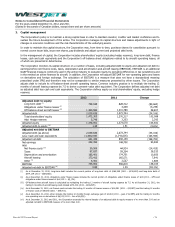

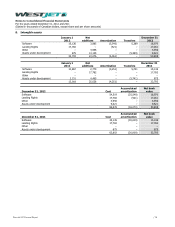

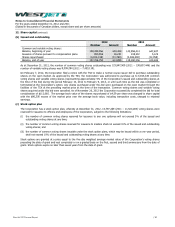

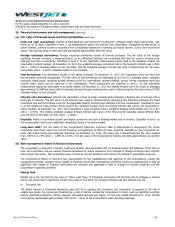

9. Maintenance provisions and reserves

The Corporation’s operating aircraft lease agreements require leased aircraft to be returned to the lessor in a specified operating

condition. The maintenance provision liability represents the present value of the expected future cost. A maintenance expense

is recognized over the term of the provision based on aircraft usage and the passage of time, while the unwinding of the present

value discount is recognized as a finance cost. The majority of the Corporation’s maintenance provision liabilities are recognized

and settled in US dollars. Where applicable, all amounts have been converted to Canadian dollars at the period end foreign

exchange rate.

2012

2011

Opening balance

151,890

125,578

Additions

33,502

27,758

Change in estimate (i)

(3,866)

8,675

Foreign exchange

(3,479)

2,775

Accretion (ii)

2,013

5,078

Settled

(269)

(17,974)

Ending balance

179,791

151,890

Current portion

(34,135)

(245)

Long-term portion

145,656

151,645

(i) Reflects changes to the timing and scope of maintenance activities and the discount rate used to present value the liability.

(ii) At December 31, 2012, the Corporation’s aircraft lease maintenance provisions are discounted using a weighted average risk-free rate of approximately

1.16% to reflect the weighted average remaining term of approximately 38 months until cash outflow.

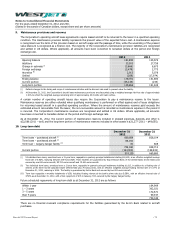

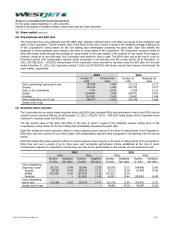

A certain number of operating aircraft leases also require the Corporation to pay a maintenance reserve to the lessor.

Maintenance reserves are either refunded when qualifying maintenance is performed or offset against end of lease obligations

for returning leased aircraft in a specified operating condition. Where the amount of maintenance reserves paid exceeds the

estimated amount recoverable from the lessor, the non-recoverable amount is recorded as maintenance expense in the period it

is incurred. The Corporation’s maintenance reserves are recognized and settled in US dollars. Where applicable, all amounts

have been converted to Canadian dollars at the period end foreign exchange rate.

As at December 31, 2012, the current portion of maintenance reserves included in prepaid expenses, deposits and other is

$32,586 (2011 – $nil) and the long-term portion of maintenance reserves included in other assets is $21,277 (2011 – $49,655).

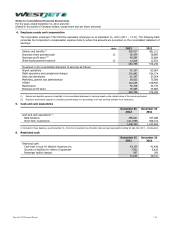

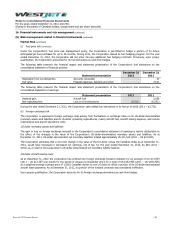

10. Long-term debt

December 31

2012

December 31

2011

Term loans – purchased aircraft (i)

669,859

828,104

Term loans – purchased aircraft (ii)

69,154

Term loan – Calgary hangar facility (iii)

35

608

739,048

828,712

Current portion

(164,909)

(158,832)

574,139

669,880

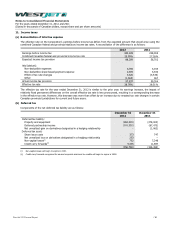

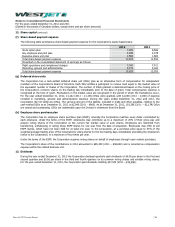

(i) 52 individual term loans, amortized over a 12-year term, repayable in quarterly principal instalments totalling $40,676, at an effective weighted average

fixed rate of %, maturing between and . These facilities are guaranteed by Export-Import Bank of the United States (Ex-Im Bank) and

secured by one 800-series aircraft, 700-series aircraft and 600-series aircraft.

(ii) Two individual term loans, amortized over a 12-year term, repayable in quarterly principal instalments totalling $1,613, in addition to a floating rate of

interest at the three month Canadian Dealer Offered Rate plus 75 basis points, with an effective weighted average floating interest rate of 3.17% at

December 31, 2012, maturing in 2024. The facility is guaranteed by Ex-Im Bank and secured by two 800-series aircraft.

(iii) Term loan repayable in monthly instalments of $ , including floating interest at the bank’s prime rate plus %, with an effective interest rate of

% as at December 31, 2012, with a final repayment of $35 in January 013, secured by the Calgary hangar facility.

Future scheduled repayments of long-term debt as at December 31, 2012 are as follows:

Within 1 year

164,909

1 – 3 years

302,021

3 – 5 years

172,671

Over 5 years

99,447

739,048

There are no financial covenant compliance requirements for the facilities guaranteed by the Ex-Im Bank related to aircraft

purchases.

WestJet 2012 Annual Report

/ 79