Westjet 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2012 Annual Report / 41

o

r

T

t

r

l

o

t

t

F

s

a

a

C

C

d

c

(

C

R

A

D

D

(

(

(

(

L

L

a

T

f

c

(

A

D

L

T

(

(

o

perations whi

c

r

ates at Decem

T

he fixed-rate

n

he outstandin

g

r

ates at Dece

m

o

ng-term debt

otal long-term

he terms of th

e

F

or a discussio

n

s

erve; risk ma

a

ssociated wit

h

a

nd Capital Re

s

C

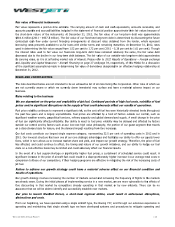

redit risk

C

redit risk is t

h

d

ischarge an o

b

c

ash equivalen

t

(

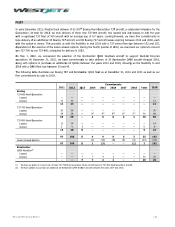

$ in thousands)

C

ash and cash e

q

R

estricted cash

(i

A

ccounts receiva

D

eposits

(iii)

D

erivative financ

i) Consists of b

a

substantially

b

directly or ind

limiting the to

ii) All si

g

nificant

not hold any

c

generally sett

l

iii) We are not e

x

assets of the

f

remote becau

iv) Derivative fin

a

and any new

c

L

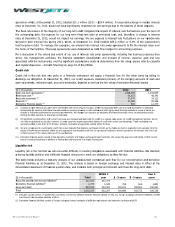

iquidity risk

L

iquidity risk is

a

strong liquidi

t

T

he table belo

w

f

inancial liabilit

c

onsolidated st

a

(

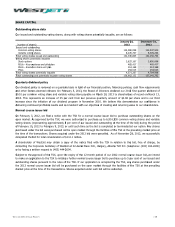

$ in thousands)

A

ccounts payabl

e

D

erivative financ

L

on

g

-term debt

T

otal

i) Excludes curre

n

and interest ra

t

ii) Derivative fina

n

c

h, at Decemb

e

ber 31, 2012,

w

n

ature of the

m

g

debt. We ac

c

ber 31, 2012,

entered into

d

debt.

T

o ma

n

e

facilities. Th

e

n

of the natur

e

nagement act

h

the instrume

n

s

ource

s

– Airc

ra

h

e risk that o

n

b

ligation. At D

e

t

s, restricted c

a

q

uivalents

(i)

)

ble

(ii)

ial assets

(iv)

a

nk balances and s

h

b

y ensuring that th

irectly

g

uaranteed

o

tal exposure to an

y

counterparties, bo

t

c

ollateral as securi

t

l

ed in less than 30

x

posed to counterp

f

inancial institution

se of the nature a

n

a

ncial assets consi

s

c

ounterparties in a

the risk that

w

t

y position and

w

presents a

m

i

es as at Dec

e

a

tement of fin

a

e

and accrued li

a

ial liabilities

(ii)

n

t portion of main

t

t

e derivative liabilit

i

n

cial liabilities cons

i

e

r 31, 2012, t

o

w

ould not hav

e

m

ajority of ou

r

c

ount for our

would not im

p

during 2012,

w

age this expo

s

e

swap agreem

e

and extent

o

ivities; the fi

n

n

ts; and the si

g

ra

ft Financing

o

n

e party to a

ecember 31,

2

a

sh, accounts

r

h

ort-term investm

e

ese financial asset

s

by provincial

g

ove

r

y

single counterpa

r

t

h current and ne

w

t

y; however, in so

m

to 60 days. Indust

arty credit risk on

o

. While we are ex

p

n

d size of the coun

t

s

t of fuel derivative

ddition to limiting

t

w

e will encoun

t

sufficient fina

n

m

aturity analys

e

mber 31, 201

a

ncial position

a

bilities

(i)

t

enance provisions

i

es of $611.

i

st of foreign exch

a

o

talled $31.1

m

e

significantly i

r

long-term de

b

long-term fixe

d

p

act net earnin

g

w

hich, at Dec

e

s

ure, we enter

e

ents were des

i

o

f our use of i

n

n

ancial statem

e

g

nificant assu

m

o

n page 34 of t

h

financial instr

2

012, our credi

r

eceivable, de

p

e

nts with terms of

u

s

are invested pri

m

r

nments. We man

a

r

ty.

w

, are reviewed an

d

m

e cases we requir

e

ry receivables are

g

our deposits that r

e

p

osed to counterpa

r

terparty.

contracts and for

e

t

he total exposure

t

er difficulty in

n

cial resource

s

is of our undi

s

2. The analysi

date, and incl

u

of $34,135, defer

r

a

nge forward contr

a

illion (2011 –

$

mpacted our n

b

t mitigates th

e

d-rate debt at

g

s. We are ex

p

e

mber 31, 201

2

e

d into intere

s

i

gnated as cas

h

n

terest rate sw

e

nt classificati

o

m

ptions made i

n

his MD&A.

ument will ca

u

t exposure co

n

p

osits as well a

s

u

p to 92 days. Cre

d

m

arily in debt instru

m

ag

e our exposure b

d

approved for cre

d

e guaranteed lette

r

g

enerally settled

w

elate to purchased

rty credit risk on o

u

e

ign exchange for

w

to a single counter

meeting oblig

a

to meet our o

s

counted contr

a

s is based on

u

des both prin

c

Total

417,377

1,777

853,163

1,272,317

r

ed WestJet Rewar

acts of $898 and n

e

s

$

28.4 million).

n

et earnings d

u

e

impact of in

t

amortized co

s

p

osed to inter

e

2 totalled $69

s

t rate swap a

g

h

flow hedges

w

ap agreement

s

o

n and amou

n

n

determining

u

se a financia

n

sisted primari

s

the fair valu

e

d

it risk associated

w

ments with highly

b

y assessin

g

the fin

d

it on a re

g

ular ba

s

r

s of credit with ce

w

ithin 30 days.

aircraft, as the fu

n

ur

deposit relating

w

ard contracts. We

r

party.

a

tions associat

o

bligations as t

h

a

ctual cash fl

o

foreign excha

c

ipal and inter

e

Within 1

year

1

417,377

1,509

203,381

622,267

r

ds liability of $41,

et interest rate de

r

s

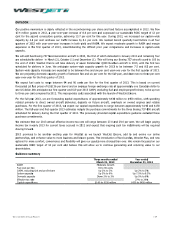

A reasonable

c

u

e to the balan

c

t

erest rate fluc

s

t, and, theref

e

st rate fluctua

t

.2 million or 9

g

reements to

f

for accounting

s

, including th

e

n

t of income,

their fair valu

e

l loss for the

ly of the carry

e

of derivative

f

2012

1,408

,

51

,

37

,

31

,

w

ith cash and cas

h

rated financial inst

i

n

ancial stren

g

th of

o

s

is under our credi

t

rtain counterpartie

n

ds are held in a s

e

to airport operatio

n

review the size an

t

ed with financ

i

h

ey fall due.

o

w for our non

-

a

nge and inter

e

e

st cash flows

f

1

- 3 years

3

―

758

350,222

350,980

117, foreign exch

a

r

ivative contracts o

s

c

hange in mar

k

c

e of these de

p

tuations over

t

f

ore, a change

t

ions on our v

a

.4% of the C

o

f

ix the interest

purposes.

e

business pu

r

expense, gai

n

e

, please refer

t

other party b

y

y

ing amounts

o

f

inancial asset

s

2

0

,

199

,

623

,

576

,

088

800

h

equivalents is mi

n

i

tutions, some of

w

o

ur counterparties

t

mana

g

ement poli

e

s. Trade receivabl

e

e

curity trust separ

a

n

s, we consider thi

d credit rating of

b

ial liabilities.

W

-

derivative an

d

e

st rates in e

f

f

or long-term

d

3

- 5 years

―

169

192,563

192,732

a

nge derivative lia

b

o

f $879.

│

k

et interest

p

osits.

t

he term of

in interest

a

riable-rate

o

rporation’s

rates over

r

poses they

n

and loss

to

Liquidity

y

failing to

o

f cash and

s

.

0

11

1,243,605

48,341

34,122

28,386

12,273

n

imized

w

hich are

and by

cies. We do

e

s are

a

te from the

i

s risk to be

b

oth current

W

e maintain

d

derivative

f

fect at the

d

ebt.

Over 5

years

―

(659)

106,997

106,338

b

ilities of $898