Westjet 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WestJet 2012 Annual Report / 55

A

g

R

s

L

m

Y

r

R

C

C

U

N

T

A

O

b

a

A

i

s

A

d

E

g

i

n

C

s

b

t

o

a

R

c

i

m

l

e

F

a

F

O

A

vailable sea

t

g

uest use in an

R

evenue pas

s

s

tage length.

L

oad factor:

A

m

iles.

Y

ield (revenu

r

evenue passe

n

R

evenue per

a

C

ost per avai

l

C

ycle: One flig

U

tilization: O

p

N

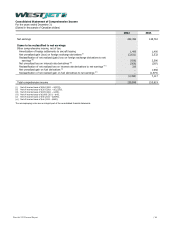

ON-GAAP

A

T

he following

n

A

djusted deb

t

O

ur practice, c

o

b

y 7.5 to deri

v

a

djusted net d

e

A

djusted equ

s

used in the c

A

djusted net

d

ebt to EBITD

A

E

BITDAR: Ea

r

g

ains and loss

e

n

dustry to eva

l

C

ASM, exclu

d

s

hare expense

b

ecause fuel p

ensions, refin

e

o

n a compara

b

a

nd excluding

t

R

eturn on in

v

c

apital to gene

m

plied interes

t

e

ase obligatio

n

F

ree cash fl

o

a

vailable that c

F

ree cash flo

w

O

perating ca

s

t

miles (ASM

aircraft by st

a

s

enger miles

A

measure of

e per reven

u

n

ger mile.

a

vailable sea

l

able seat mi

l

ht, counted b

y

p

erating hours

A

ND ADDIT

I

n

on-GAAP and

a

t

: The sum of

o

nsistent with

v

e a present

v

e

bt to EBITDA

R

ity: The sum

o

alculation of a

d

debt: Adjust

e

A

R, as defined

b

r

nings before

n

e

s on derivativ

l

uate results b

y

d

ing fuel and

to assess the

p

rices are affe

c

e

ry capacity, a

n

b

le basis. Empl

o

t

his expense al

v

ested capita

r

ate returns.

R

t

on our off-b

a

n

s, average sh

a

o

w: Operating

a

n be used to

w

per share:

F

s

h flow per s

h

): A measure

o

a

ge length.

(RPM): A me

total capacity

e passenger

t mile (RAS

M

l

e (CASM): O

p

y

the aircraft le

a

per day per o

p

I

ONAL GAA

P

a

dditional GAA

long-term de

b

common airlin

e

v

alue debt eq

u

R

, as defined b

e

o

f share capit

a

d

justed debt-t

o

e

d debt less c

a

b

elow.

n

et finance co

s

es, and foreig

n

y

excluding dif

f

employee p

r

operating pe

r

c

ted by a hos

t

n

d global dem

a

oyee profit sh

a

l

ows for great

e

l: ROIC is a m

e

R

eturn is calcul

a

a

lance-sheet a

a

reholders’ eq

u

cash flow le

s

pursue other

o

F

ree cash flow

h

are: Cash flo

w

o

f total guest

c

asure of gues

t

utilization, cal

c

mile): A mea

s

M

):

T

otal reven

p

erating expe

n

aving the grou

p

erating aircra

f

P

MEASURE

S

P measures ar

e

b

t, obligations

u

e

industry pra

c

u

ivalent. This

m

e

low.

a

l, equity reser

o

-equity.

a

sh and cash

e

s

ts, taxes, dep

n

exchange g

a

f

erences in the

r

ofit share:

W

r

formance of

o

t

of factors o

u

a

nd and suppl

y

a

re expense is

e

r comparabilit

y

easure comm

o

a

ted based on

ircraft leases.

u

ity and off-bal

a

s

s capital exp

e

o

pportunities a

f

divided by th

e

w

from operati

c

apacity, calcu

t

traffic, calcul

a

c

ulated by divi

s

ure of unit re

v

ue divided by

a

n

ses divided by

nd and landin

g

f

t.

S

e

used to mon

i

u

nder finance l

c

tice, is to mul

t

m

easure is us

ves and retain

e

quivalents. T

h

reciation, airc

r

a

ins or losses.

method by w

h

W

e exclude th

e

o

ur business.

F

u

tside our con

y

. Excluding t

h

excluded fro

m

y

.

o

nly used to as

our earnings

Invested capi

t

a

nce-sheet air

c

e

nditures. Thi

s

f

ter maintainin

g

e

diluted weigh

t

ons divided b

y

s

lated by multi

p

a

ted by multip

l

i

ding revenue

v

enue, calcula

t

a

vailable seat

m

available seat

g

.

i

tor our financi

l

eases and off

-

t

iply the trailin

g

ed in the calc

n

ed earnings,

e

h

is measure is

r

aft rent and

o

EBITDAR is a

h

ich an airline

f

e

effects of air

Fuel expense

trol, such as

s

h

is expense all

o

m

our operatin

g

sess the effici

e

before tax, ex

c

t

al includes av

c

raft operating

s

measure is

u

g

and expandi

n

t

ed average n

u

y

diluted weigh

t

s

p

lying the nu

m

lying the num

b

passenger mil

e

t

ed as the gro

s

m

iles.

miles.

al performanc

e

-

balance-sheet

g

12 months

o

c

ulation of adj

u

e

xcluding hedg

used in the c

a

o

ther items, su

measure com

f

inances its air

c

r

craft fuel exp

e

is excluded fr

o

s

ignificant we

a

o

ws us to ana

l

g

results beca

u

e

ncy with whic

c

luding special

v

erage long-te

r

leases.

u

sed to calcul

n

g the asset b

a

u

mber of shar

e

t

ed average s

h

s

m

ber of seats a

v

b

er of segmen

t

e

s by total av

a

s

s revenue ge

n

e

:

aircraft opera

t

o

f aircraft leasi

n

u

sted debt-to

-

e reserves. Th

a

lculation of a

d

ch as asset i

m

monly used in

c

raft.

e

nse and empl

o

m our opera

t

a

ther events,

g

l

yze our opera

t

u

se of its vari

a

h a company

a

items, financ

e

r

m debt, aver

a

ate the amou

a

se.

e

s outstanding.

h

ares outstandi

│

v

ailable for

t

guests by

a

ilable seat

n

erated per

t

ing leases.

n

g expense

-

equity and

is measure

d

justed net

m

pairments,

the airline

oyee profit

t

ing results

g

eopolitical

t

ing results

a

ble nature

a

llocates its

e

costs and

a

ge finance

nt of cash

ng.