Westjet 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Westjet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

For the years ended December 31, 2012 and 2011

(Stated in thousands of Canadian dollars, except share and per share amounts)

16. Financial instruments and risk management (continued)

(b) Risk management related to financial instruments (continued)

Market Risk (continued)

(ii) Foreign exchange risk (continued)

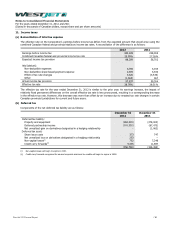

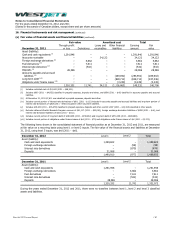

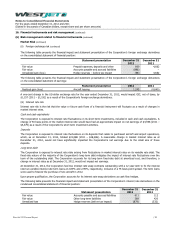

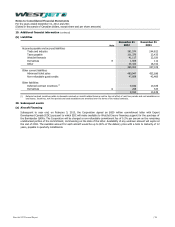

The following table presents the financial impact and statement presentation of the Corporation’s foreign exchange derivatives

on the consolidated statement of financial position:

Statement presentation

December 31

2012

December 31

2011

Fair value

Prepaid expenses, deposits and other

800

4,662

Fair value

Accounts payable and accrued liabilities

(898)

−

Unrealized gain (loss)

Hedge reserves – before tax impact

(98)

4,662

The following table presents the financial impact and statement presentation of the Corporation’s foreign exchange derivatives

on the consolidated statement of earnings:

Statement presentation

2012

2011

Realized gain (loss)

Aircraft leasing

1,245

(4,840)

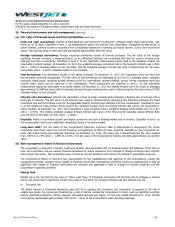

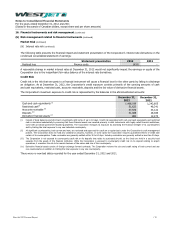

A one-cent change in the US-dollar exchange rate for the year ended December 31, 2012, would impact OCI, net of taxes, by

$1,157 (2011 – $1,192) as a result of the Corporation’s foreign exchange derivatives.

(iii) Interest rate risk

Interest rate risk is the risk that the value or future cash flows of a financial instrument will fluctuate as a result of changes in

market interest rates.

Cash and cash equivalents

The Corporation is exposed to interest rate fluctuations on its short-term investments, included in cash and cash equivalents. A

change of 50 basis points in the market interest rate would have had an approximate impact on net earnings of $4,956 (2011 –

$) as a result of the Corporation’s short-term investment activities.

Deposits

The Corporation is exposed to interest rate fluctuations on its deposits that relate to purchased aircraft and airport operat ions,

which, as at December 31, 2012, totaled $ (2011 – $ ). A reasonable change in market interest rates as at

December 31, 2012, would not have significantly impacted the Corporation’s net earnings due to the small size of these

deposits.

Long-term debt

The Corporation is exposed to interest rate risks arising from fluctuations in market interest rates on its variable rate debt. The

fixed-rate nature of the majority of the Corporation’s long-term debt mitigates the impact of interest rate fluctuations over the

term of the outstanding debt. The Corporation accounts for its long-term fixed-rate debt at amortized cost, and therefore, a

change in interest rates as at December 31, 2012, would not impact net earnings.

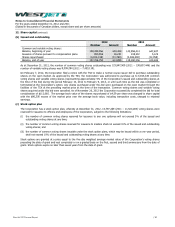

At December 31, 2012, the Corporation had two interest rate swap contracts outstanding with a 12 year term to fix the interest

rate two variable interest rate term loans at 2.89% and 2.99%, respectively, inclusive of a 75 basis point spread. The term loans

were used to finance the purchase of two aircraft in 2012.

Upon proper qualification, the Corporation accounts for its interest rate swap derivatives as cash flow hedges.

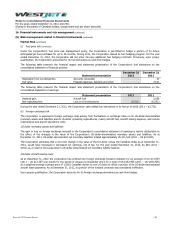

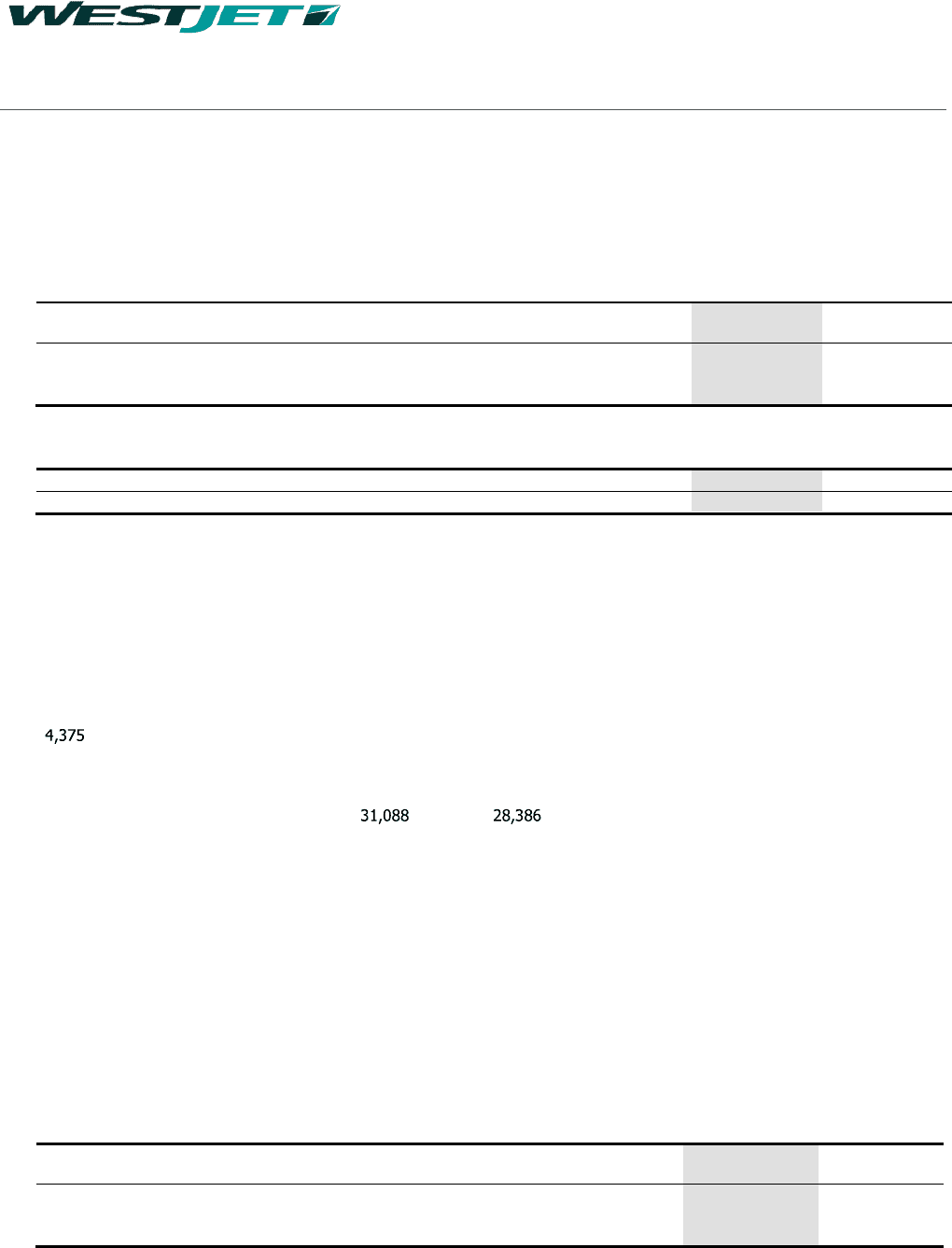

The following table presents the financial impact and statement presentation of the Corporation’s interest rate derivatives on the

condensed consolidated statement of financial position:

Statement presentation

December 31

2012

December 31

2011

Fair value

Accounts payable and accrued liabilities

611

112

Fair value

Other long-term liabilities

268

420

Unrealized loss

Hedge reserves (before tax impact)

(879)

(532)

WestJet 2012 Annual Report

/ 90